Buy HCL Technologies Ltd for the Target Rs.2,000 by Motilal Oswal Financial Services Ltd

Continues to impress despite margin hiccup

Tightens guidance as growth visibility improves

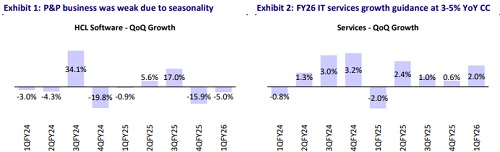

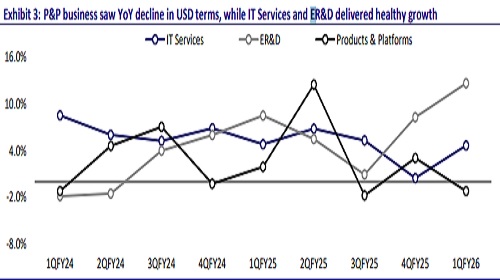

* HCL Technologies (HCLT) reported 1QFY26 revenue of USD3.5b, down 0.8% QoQ CC vs. our estimate of 1.2% QoQ CC decline. EBIT margins came in at 16.3% vs. our estimate of 17.5%. New deal TCV stood at USD1.8b (down 8% YoY) in 1QFY26. For FY26, revenue growth guidance was increased to 3%-5% YoY CC (from 2%-5% earlier), implying a CQGR range of 1.4%-2.7% for the next three quarters. EBIT margin guidance was lowered to 17%-18% for FY26 (from 18%-19% earlier).

* For 1QFY26, revenue/EBIT grew 8.2%/3.0% and PAT declined 10% YoY in INR terms. We expect revenue/EBIT/PAT to grow by 9.4%/2.1%/5.3% YoY in 2QFY26. HCLT remains the fastest-growing large-cap IT services company, and we like its all-weather portfolio. We reiterate our BUY rating on HCLT with a TP of INR2,000, implying a 23% potential upside.

Our view: HCLT holds growth fort

* Revenue beat estimates, and HCLT upgraded the bottom end of its revenue guidance. The guidance implies total revenue CQGR of 2.7% at the top end of the guidance range, whereas, for services, it implies a CQGR of 2.0%. HCLT is on track to be the fastest-growing company among the top 4 names.

* Margins missed estimates, however, impacted by higher GenAI and SG&A investments (30bps), but primarily due to lower utilization (80bps), as employees released from select projects (on productivity gains) couldn’t be re-deployed in time. We expect both these factors to spill over to 2Q, but expect margins to normalize post that.

* TCV optically appears tepid, but pipeline remains healthy: New deal TCV stood at USD1.8b, down 8% YoY. However, this is not reflective of demand weakness – two large deals initially expected in 1Q were deferred to 2Q (unrelated to macro concerns) and a sizeable vendor consolidation deal in financial services (not included in 1Q) will start contributing to revenue from 2QFY26 onward.

* Discretionary demand in financial services and hi-tech improves: HCLT called out a recovery in discretionary spends in financial services and hitech, while weakness continued in manufacturing, life sciences, and retail.

* We cut FY26 estimates by 3-4% to account for higher investments, whereas we keep FY27 estimates largely unchanged. We believe FY27 margins can again get back to normalized levels of 18-18.5%.

Beat on revenue and miss on margins; upgrades lower end of guidance

* Revenue was down 0.8% QoQ in CC vs. our estimate of 1.2% decline.

* New deal TCV stood at USD1.8b (down 40% QoQ/8% YoY).

* IT business was flat QoQ CC, while ER&D/P&P were down 0.5%/7.1% QoQ cc.

* EBIT margin was 16.3% – below our estimate of 17.5%.

* For FY26, revenue growth guidance was increased to 3%-5% YoY CC from 2%-5% earlier. EBIT margin guidance was lowered to 17%-18% for FY26 (from 18%-19% earlier).

* In 1QFY26, PAT was down 10.8% QoQ/9.7% YoY at INR38b vs. our est. of INR43b.

* LTM attrition was down 20bp QoQ at 12.8%. Net employee headcount increase was flat in 1QFY26. Net employee headcount stood at 223,151 as of 1QFY26 end. HCLT added 1,984 freshers in this quarter.

* LTM FCF to net income stood at 121%.

* Management declared an interim dividend of INR12/share for 1QFY26.

Key highlights from the management commentary

* The environment remained stable with some variations across verticals. It did not deteriorate as feared.

* Discretionary spending trends vary by vertical.

* Discretionary spending in Financial Services and Technology has not worsened as earlier anticipated.

* Revenue declined by 0.8% QoQ in CC. Growth was seen in the Tech Services vertical, especially around conversational AI and contact center management, which ramped up in Mar’25 and revenue realized in 1Q.

* Two large deals expected to close in 1Q have moved to 2Q. The delays are unrelated to macro factors, and management remains optimistic about conversions.

* Revenue growth guidance for FY26 was raised to 3-5% YoY in CC (from 2–5%) due to better-than-expected 1Q performance and an improved outlook.

* EBIT margin guidance was reduced to 17-18% (from 18–19%) due to lower utilization and restructuring efforts. One-time restructuring costs are factored into the guidance.

* GenAI and GTM investments are expected to normalize as growth improves by FY27.

* Agentic AI gaining traction in operational efficiency and application modernization.

Valuation and view

* We expect HCLT to deliver a CAGR of 7.0%/8.8% in USD revenue/INR PAT over FY25-27E. HCLT remains the fastest-growing large-cap IT services company, and we like its all-weather portfolio. We reduce our FY26 estimates by 3-4% to account for higher investments, whereas we keep FY27 estimates largely unchanged. Reiterate BUY with a TP of INR2,000 (based on 26x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412