Buy Hindustan Unilever Ltd for the Target Rs.3,000 by Motilal Oswal Financial Services Ltd

Leadership transition – opportunity in disguise

* Hindustan Unilever (HUVR) announced that Ms. Priya Nair, current President of Beauty & Wellbeing at Unilever, will be appointed CEO and MD of the company, effective 1st Aug’25, for a period of five years. Ms. Nair will replace Mr. Rohit Jawa, who will step down on 31st Jul’25 to pursue the next chapter in his personal and professional journey, the company said.

* We are surprised by the move because Mr. Jawa is leaving HUVR after a two-year tenure with the company, the shortest and unprecedented in the company’s history (also leaving Unilever Group). He had chalked out a volume priority plan for FY26, which we considered as a mean-revision opportunity for the company.

* Ms. Nair, the first woman CEO of HUVR, brings various positive possibilities for the India business. She has 30 years of experience at Unilever, with most of it handling the company’s India portfolio. She has a successful legacy in the Home Care and B&W portfolios. Home Care in HUVR’s India portfolio has seen a massive premiumization drive under her leadership.

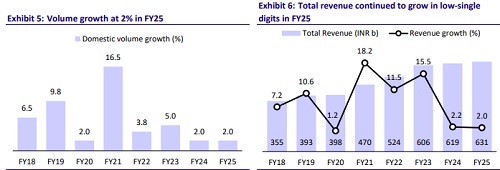

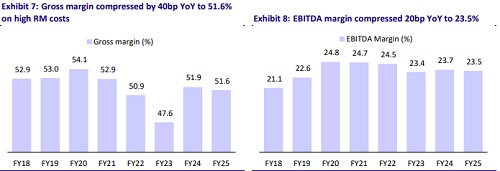

* HUVR in the 4Q earnings concall downgraded its EBITDA margin guidance to 22-23% from 23-24% to increase spending on marketing and promotion. We expect the cost impact will be front-ended and volume pickup will be gradual. We believe the new CEO can further capitalize on the volume drive with her understanding of Indian consumers and the company’s execution playbook. We have a BUY rating on the stock with a TP of INR3,000.

Will CEO transition solve HUVR’s prolonged performance issue?

It is too early to comment if this CEO transition will solve HUVR’s underperformance in business delivery and stock price. Given its large size (INR592b) and established process, finding grey areas and fixing them is not an easy task. We believe the same struggle Mr. Jawa faced too. The competitive landscape is changing much faster than anyone would have thought a few years back. And that is where many traditional companies struggle to cope with their old playbook (distribution, product relaunches, brand extensions, media campaigns). Businesses have been challenged and business moats are gradually fading away. In this backdrop, the new CEO brings a hope of recovery for HUVR, particularly as she has been part of India business for the last three decades. The company, in its 4Q earnings concall, articulated its new strategy of focusing more on boosting volume growth, even at the expense of margin compression in the interim. It has created a new P&L structure, with a higher contribution from volume. It also aims for faster customer acquisition (particularly young people who are inclined toward more appealing D2C). We hope that this strategy will remain unchanged under the new CEO and that her past experience will bring a more refreshed approach to attaining these objectives.

What does the new CEO bring to HUVR?

Ms. Nair has held several key leadership roles across Home Care, Beauty & Wellbeing, and Personal Care. During her tenure, she worked on several initiatives to drive product innovation, consumer upgrades, and better profitability metrics. She is well recognized for her key role in transforming the Home Care business during 2014-2020. In this tenure, the company had enhanced its competitive positioning to achieve much better growth and margin delivery. Home Care business had seen 800-900bp EBIT margin expansion with consistent acceleration in growth metrics.

Home Care segment focused on premiumization and future-ready portfolio under her leadership

* Ms. Nair, while leading the Home Care segment, primarily focused on premiumization in its laundry portfolio to drive upgrades. Over FY11-18, HUVR increased the share of premium products in the laundry space from 17% to 22% by building strong brand equity through effective and impactful media investments and by growing volumes of INR5/INR10 access packs.

* Home Care segment was prioritized by building future formats, especially the liquid detergents in laundry, with Surf Excel launching the first liquid detergent in the category. Ms. Nair also focused on growing the fabric conditioner market in India with a strong product portfolio and effective campaigns with a focus on creating category awareness.

* One of the key innovations to address the white space in the Indian toilet category was the launch of ‘Domex Toilet cleaning powder’ designed keeping the Indian pit toilets in mind (consumes 50% less water than other products).

* E-commerce channel was extensively leveraged to drive innovations and formats. Similarly, digital media was leveraged, along with precision marketing, to promote liquid detergents and liquid dishwash categories.

Feather from global experience

* During her tenure as President of Beauty & Wellbeing, reporting directly to Unilever’s Global CEO (currently Fernando Fernandez), Ms. Nair has delivered an exceptional performance, driving growth in her division that has consistently outpaced Unilever's overall performance (refer Exhibit-3). She emphasized that there is a strategic transformation underway: “We are making radical shifts in superior aesthetics to drive the transition from value to premium, adopting social-first marketing to scale engagement, and expanding our presence in high-growth channels such as digital commerce and specialist retail.”

Key excerpts from Ms. Nair’s media interviews:

* “As aspirations begin to change, consumers start upgrading. I see this business moving forward on the premiumization journey, but we also need to strike a balance between aspirations and reality… One of my recent launches is Comfort One Rinse, a fabric conditioner that promises to save water while washing clothes.” (15th Sep 2023).

* “I like to take risks because the world that we live in today requires you to take risks. It is changing fast, and one needs to leapfrog to stay afloat.” (19th Mar, 2023).

* “Detergents are a household’s first basic sanitation product… The opportunity is at the bottom of the pyramid. We created an innovation—smart foam technology, which uses half the amount of water and also halves the effort required for rinsing clothes, which is a very relevant need for consumers who wash clothes by hand.” (6th Aug 2018).

* “Big brands have the opportunity to create and lead conversations… Our new Wheel advertisement shows a conversation… The idea is that a brand like Wheel, which reaches millions of rural women, can make a huge difference in changing a conversation that is so important in this country—financial empowerment of women.” (6th Aug 2018).

Valuation and view

* HUVR had prioritized growth over margins as in its 4QFY25 earnings call, the company revised its EBITDA margin guidance to 22–23% (from 23-24%) to accelerate marketing/promotion budgets. We expect the cost impact will be front-ended and the volume pickup will be gradual.

* We believe new CEO can further capitalize on the volume drive with her understanding of Indian consumers and the company’s execution playbook. We have a BUY rating on the stock with a TP of INR3,000 (55x Jun’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412