Buy Galaxy Surfactants Ltd for the Target Rs. 2,650 by Motilal Oswal Financial Services Ltd

Margin above est. with strong RoW growth; demand mixed

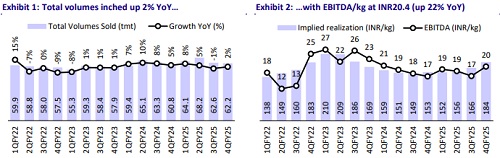

* Galaxy Surfactants (GALSURF) reported an EBITDA/kg of INR20.4 (est. INR11.5), up 22% YoY, in 4QFY25. Total volume inched up ~2% YoY to 62.2tmt (our est. 59.9tmt), with strong YoY performance in the RoW region. Subsequently, EBITDA stood at INR1.3b (up 25% YoY), while PAT came in at INR759m (down 2% YoY, our est. INR352m).

* The business environment remained dynamic and complex throughout FY25, with persistent supply-side volatility, though it stabilized toward year-end. Fatty alcohol prices remained elevated due to plant shutdowns in Southeast Asia and are expected to remain firm for another quarter, while international freight costs have eased a bit but are still at elevated levels. However, geopolitical uncertainties continue to warrant caution.

* Demand trends were mixed. India and AMET saw flat performance in FY25, with domestic volumes down 1% YoY in 4QFY25 due to the lingering impact of higher fatty alcohol prices. Despite this, the company remains optimistic about a recovery in domestic demand in the coming quarters. Meanwhile, the RoW region posted strong double-digit growth, supported by favorable markets, portfolio expansion, and a 9% YoY volume increase in 4QFY25—demonstrating the company’s growing global footprint.

* GALSURF remains resilient, focused on long-term goals despite inflationary headwinds. A significant portion of input cost increases has already been passed on, albeit with a lag. Volume growth guidance for FY26 is at the lower end of the 6–8% range, with long-term volume expectations unchanged. EBITDA/kg, including other income, is guided at INR20.5–21.5 for FY26. The India-Turkey exposure is minimal, posing no immediate risk to GALSURF.

* Given the beat in 4Q, we raise our EBITDA/PAT estimates by 8%/9% for FY26 and by 5% each for FY27. The stock currently trades at ~22x FY27E EPS of INR106 and ~13x FY27E EV/EBITDA. We value the company at 25x FY27E EPS to arrive at our TP of INR2,650. We reiterate our BUY rating on the stock.

Beat across the board; margin dips sequentially

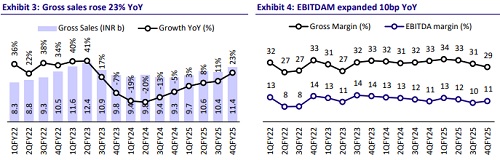

* Revenue stood at INR11.4b (+23% YoY) in 4QFY25.

* EBITDA came in at INR1.3b (est. of INR689m, +25% YoY).

* Gross margin was 29.4% (-320bp YoY), with EBITDAM at 11.1% (+10bp YoY).

* GALSURF’s PAT came in at INR759m (est. of INR352m, -2% YoY).

* In FY25, revenue stood at INR42.7b (+13% YoY), EBITDA was INR5b (+9% YoY), and PAT came in at INR3.2b (+6% YoY).

* EBITDAM was at INR11.8% (-40bp YoY).

* The Board declared a final dividend of INR4/share for FY25 (with an interim dividend of INR18/share), taking the total dividend to INR22/share.

Valuation and view

* We believe that going forward, volume growth will be driven by the company’s steady focus on R&D (with an annual expenditure of INR400-500m), increased wallet share from its existing customers, and acquisition of new customers. Margin is also likely to expand gradually with an increase in the volume of premium specialty products.

* We estimate a volume CAGR of 6% over FY25-27, with volumes picking up in the Specialty Care segment in the developed markets and a recovery in demand, albeit gradual, from the rural and urban markets in India. The stock is currently trading at ~22x FY27E EPS of INR106 and ~13x FY27E EV/EBITDA. We value the company at 25x FY27E EPS to arrive at a TP of INR2,650. We reiterate our BUY rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)