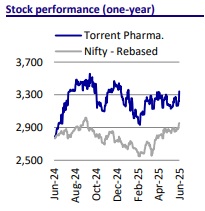

Neutral Torrent Pharma Ltd for the Target Rs. 3,430 by Motilal Oswal Financial Services Ltd

JB Chem deal enhances domestic formulation offerings

Valuation supports strategic rationale

* Torrent Pharma (TRP) is set to acquire a controlling stake in JB Chemicals and Pharmaceuticals (JBCP).

* The deal is at an equity valuation of INR256b (on a fully diluted basis).

* With this acquisition, TRP would have access to a fast-growing domestic formulation (DF) business with a healthy share of the chronic portfolio. In addition, TRP would garner the international CDMO business of JBCP.

* The valuation of JBCP would be 30.7x FY26E earnings and 27x FY27E earnings, assuming an 18% earnings CAGR over FY25-27. On an EV/EBITDA basis, it would be at 22x FY26E EBITDA and 19x FY27E EBITDA.

* Considering the strong brand franchise of JBCP with an established 2,800+ field force and lower valuation of JBCP compared to that of TRP (47x FY26 earnings/38x FY27 earnings), we believe the acquisition to be value accretive for TRP over the medium to long term.

* We await clarity on the debt/equity composition to pay cash consideration of INR126b to acquire a 46.4% stake in KKR and 2.8% of equity shares from certain JBCP employees.

Deal background

* TRP has entered into a definitive agreement to acquire a controlling stake in JBCP at an equity valuation of INR256b (on a fully diluted basis), followed by the merger of the two entities.

* The transaction will be executed in two phases. TRP will acquire a 46.39% equity stake through a share purchase agreement at a consideration of INR119b (INR1,600 per share), followed by a mandatory open offer to acquire up to 26% of JB Pharma from public shareholders at an open offer price of INR1,639. TRP has expressed its intent to acquire up to 2.8% of equity shares from certain employees of JBCP at the same price per share as KKR. To merge JBCP with TRP, every shareholder holding 100 shares of JBCP would receive 51 shares of TRP.

* The transaction is subject to shareholder and Competition Commission of India (CCI) approval. The overall process is expected to be completed within the 6-month timeframe.

JBCP: Sizable business with robust growth in the DF segment

* JBCP has delivered a 17%/24%/19% sales/EBITDA/PAT CAGR over FY22-25 to reach INR39b/INR10b/INR6.6b. Over the past three years, it has delivered a consistent RoCE of 19-20%.

* JBCP has 58% of business from the DF segment, 29% from the international formulation segment, and 11% from the CDMO segment.

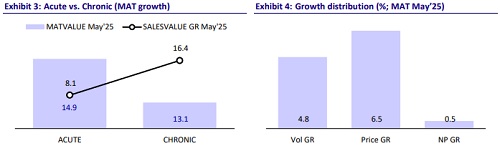

* JBCP has consistently outperformed the industry over the past five years and derives about 47% of DF revenue from the chronic portfolio.

* It has a leading global position in the lozenges CDMO opportunity, driving the international business of JBCP.

* JBCP has an INR7b cash surplus on the balance sheet.

Scope for building synergy post-integration

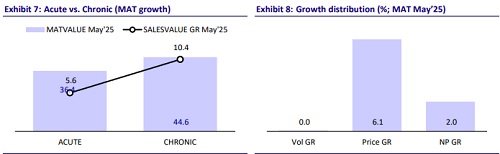

* TRP adds INR23b of domestic formulation business of JBCP to its current sales of INR64b (FY25). While cardiac is the top therapy for both companies, the focus products are different and thus can aid synergy post-acquisition.

* JBCP has a healthy mix of price/volume (4.8%/6.5%) for the past 12M vs. pricedriven growth for TRP.

* This acquisition would also enable TRP to make inroads into ophthalmology therapy.

Await clarity on funding for the cash part of the payment

* KKR (46.4% stake in JBCP) is expected to be paid cash consideration of INR119b. TRP intends to pay certain employees holding a cumulative position of 2.8% of JBCP at a similar price to that of KKR.

* TRP has a current net debt of ~INR22.5b with a net debt:EBITDA ratio of 0.6x. TRP garnered EBITDA of INR37.6b in FY25 and is expected to deliver INR43b/INR49b in FY26/FY27.

* If the entire amount is funded using debt, then it may dilute the earnings in FY27 by 10.5%. While 50% of the requirement is funded using equity raise, it would marginally dilute the earnings.

Strategically positive for TRP

* We believe acquiring JBCP to be value accretive for TRP backed by 1) diversified branded portfolio comprising multiple potential mega brands, 2) pan-India presence through a strong MR field force of 2,800, 3) manufacturing capabilities/capacities for diversified dosage forms, and d) lozenges-led CDMO business.

* Ex-JBCP, we expect TRP to deliver 12%/14%/23% revenue/EBITDA/PAT CAGR over FY25-27. We value TRP at 38x 12M forward earnings to arrive at a price target of INR3,430. While the deal is positive, we reiterate our Neutral rating on the stock due to limited upside from the current levels.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412