Buy HDFC AMC Ltd for the Target Rs. 6,800 by Motilal Oswal Financial Services Ltd

Lower tax provisions lead to PAT beat

* HDFC AMC’s operating revenue grew 16% YoY/6% QoQ to INR10.3b (in line) in 2QFY26. Yields came in at 46.6bp vs. 46.8bp in 2QFY25 and 46.7bp in 1QFY26. For 1HFY26, revenue grew 20% YoY to INR20b.

* Total opex rose 23% YoY/16% QoQ to INR2.3b, driven by 29% YoY growth in employee costs and 16% YoY growth in other expenses.

* EBIDTA came in at INR8b, up 14% YoY. EBIDTA margin was 78% vs. 79% in 2QFY25 and 80% in 1QFY26. For 1HFY26, EBITDA came in at INR15.7b, up 21% YoY

* PAT was up 25% YoY/down 4% QoQ at INR7.2b (9% beat mainly driven by the reversal of INR468m in income tax provisions of earlier years); excluding this one-off benefit, PAT would have been INR6.7b. For 1HFY26, PAT came in at INR14.7b, up 24% YoY.

* HDFC AMC will continue to focus on expanding its product suite, strengthening its distribution network, leveraging technology, and diversifying beyond mutual funds into PMS, AIFs, and products targeted at global institutions investing in India.

* We have raised our earnings estimates by 2%/3%/3% for FY26/FY27/FY28, led by higher growth assumption in Equity AUM. We maintain our BUY rating on the stock with a TP of INR6,800 (premised on 41x Sep’27E EPS).

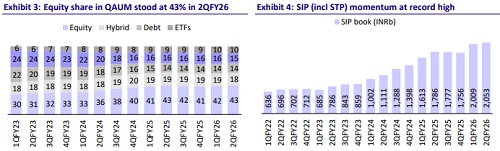

Equity mix rises sequentially in QAAUM

* QAAUM grew 16% YoY and 6% QoQ to INR8.8t, driven by 17%/12%/20%/ 10%/68%/20% YoY growth in equity/hybrid/debt/ liquid/ ETFs/index funds.

* On a QAAUM basis, the Equity mix stood at 64.9% in 2QFY26 vs. 65.7% in 2QFY25 and 64.2% in 1QFY26. Closing AUM as of 2QFY26 stood at INR8.7t, up 14% YoY and 2% QoQ.

* On closing AUM basis, the company’s overall market share in total AUM remained stable YoY at 11.5%; excluding ETFs, the market share declined to 12.8% from 12.9% in Sep’24. Actively managed equity/debt/ liquid AUM market share stood at 12.9%/13.3%/11.8% as of Sep’25.

* Individual Monthly AAUM grew 12% YoY to INR6.2t (~69.8% of total AUM), with a market share of 13.1%, making HDFC AMC one of the most preferred choices of individual investors.

* SIP AUM as of Sep’25 was up 15% YoY/2% QoQ at INR2.1t, backed by growth in the number of transactions to 13.1m. The average ticket size rose sequentially to INR3.4k from INR3.3k in 1QFY26.

* Based on total AUM, the direct channel accounted for the largest share at 43%, followed by IFAs and national distributors at 25% and 22%, respectively. Within equity AUM, IFAs led the distribution with a 32% share, while direct/national distributor channels contributed 29%/26%.

* Unique investors for HDFC AMC were 14.5m (vs. 11.8m in 2QFY25), reflecting 25% penetration in the mutual fund industry. Live accounts grew 26% YoY to 26m.

* Employee costs grew 29% YoY to INR1.2b on account of hirings in the alternatives and international side and recording of the ESOP costs. Other expenses grew 16% YoY to INR1b on account of business promotions and CSR expenditures. As bps of AUM, opex was at 10.3bp vs. 9.7bp in 2QFY25 and 9.4bp in 1QFY26.

* Other income declined 44% YoY and 59% QoQ in the quarter due to adverse MTM changes.

* Total investments as of Sep’25 stood at INR79b, with 89%/6%/5% being segregated into MFs/tax-free bonds/others

Key takeaways from the management commentary

* On the alternatives side, the platform continues to gain traction with a team in place and new AI-led initiatives—closed a Category II AIF fund of funds of INR12b last year and launched a Performing Credit Fund that is witnessing strong investor interest. Simultaneously, on the PMS side, it is expanding across discretionary and non-discretionary offerings.

* Under the GIFT City platform, HDFC AMC currently has five active funds, one of which was launched last quarter. Work is underway for the launch of inbound funds and outbound strategies. On the SIF front, approvals are in place, and the company is evaluating options and products best suited for the client segment, with updates expected soon.

* UBS Asset Management (Singapore) has entered into an Investment Advisory agreement with HDFC AMC to jointly offer an India equity strategy. This agreement has gone live.

Valuation and view

* HDFC AMC remains a strong player in the mutual fund industry, backed by robust financial performance, steady AUM growth, cost efficiency and a strong retail presence. Despite short-term market volatilities, the company’s long-term fundamentals remain solid.

* With an improved market position, a diversified product portfolio across permitted segments by SEBI, multi diversification business streams beyond MFs into Alternatives, AIFs & PMS and digital expansion efforts, HDFC AMC is wellpositioned to sustain growth and deliver value to its stakeholders.

* We have raised our earnings estimates by 2%/3%/3% for FY26/FY27/FY28, led by a higher growth assumption in Equity AUM. We maintain our BUY rating on the stock with a TP of INR6,800 (premised on 41x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412