Buy HPCL Ltd For Target Rs.490 by Motilal Oswal Financial Services Ltd

Strong earning momentum to continue

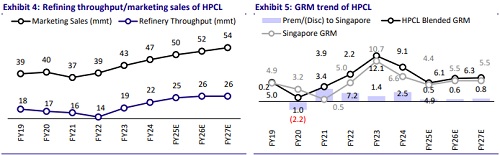

* HPCL’s reported 3QFY25 financial performance was significantly above our estimates, as weaker-than-expected marketing margin performance was overpowered by robust refining margins and marketing sale volumes. We estimate up to a USD1/bbl refining GRM impact should the Russian crude proportion in the crude oil mix decline to zero (not our base case). On a sequential basis, LPG prices have remained stable, and under-recoveries should start tapering off from 1QFY26 onwards. Further, marketing margins at ~INR9/INR5 per liter for MS/HSD remain robust and above our assumption (of INR3.3 per liter).

* LPG under-recovery compensation, the start of the bottom upgrade unit, and the commissioning of the Rajasthan refinery are key catalysts for the stock. Further, should oil prices weaken post-4QFY25 (leading to higher marketing margins), we believe there remains a strong possibility of upward earnings revision to our and street estimates.

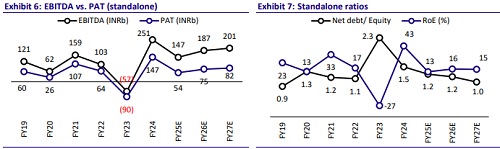

* HPCL’s capex cycle is tapering off with major projects slated to commission in CY25 and ND/E improving to 1.1x in FY26 (vs. 2.1x in FY23). HPCL is currently trading at 1.3x FY26E P/B, slightly above its one-year forward LTA of 1.2x P/B. With FY26 RoE at ~17.4%, current valuations appear attractive. Hence, we reiterate our Buy rating on the stock with a SoTP-based TP of INR490

Lower Russian crude proportion to weigh on GRM; LPG losses to be flat QoQ

* HPCL’s Russian crude utilization has been within the range of 35-40%. While all 4QFY25 cargoes have been tied up, there might be shortages in 1HFY26. If the Russian crude utilization becomes nil, the company shall encounter a USD1/bbl GRM impact, as the USD3-USD3.5 per bbl discount shall not be available elsewhere. However, management believes that the situation is transient and not a disruption. Further, RUF at Visakhapatnam Refinery (Visakh) shall help to expand their crude basket.

* In 3QFY25, LPG under-recoveries came in ~50% higher QoQ. With propane prices averaging USD635/ton in Jan’25 (similar to 3QFY25 prices), LPG under-recovery is expected to be in the similar range of ~INR10b per month. We continue to believe that the government will provide compensation to OMCs against LPG under-recovery (media article).

Projects approaching commissioning; ND/E to strengthen further

* While the 5mmtpa Chhara LNG Terminal was commissioned in Jan’24, RUF at Visakh, the 9mmtpa refinery, and the petchem complex (HRRL) entailing a capex ofINR729b are slated for commissioning in 4QFY25/CY25. Additionally, an equity contribution of INR140b (out of INR180b) has already been made by HPCL in HRRL. The management expects RUF commissioning to add USD2-3/bbl to Visakh’s GRM, further strengthening HPCL’s operating cash flow. Also, HRRL is expected to be fully functional in FY27.

* In 3Q, HPCL’s debt dipped INR116b, and the resulting ND stood at INR540b. With the capex cycle tapering off and major projects being commissioned in CY25, we estimate HPCL’s ND/E to improve from a high of 2.1x in FY23 to 1.1x/0.9x in FY26/FY27.

Other key takeaways from the conference call

* INR130b-140b p.a. capex shall be incurred going forward (INR40b/ INR60b/ INR40b on Refining/Marketing/Equity contribution in JVs).

* HPCL expects the mid-cycle SG GRM to be ~USD5-6/bbl, and its GRMs to be at some premium to SG GRM + USD2-3/bbl post-RUF unit commissioning at Visakh.

* A polymer margin of USD150-USD170 per ton shall enable HMEL to break even, while the current margin is USD70-USD80 per ton.

* Going forward, INR5-6b/INR6b interest/depreciation increase might be seen.

EBITDA/PAT beat led by robust GRM and strong marketing volumes

* HPCL’s EBITDA stood at INR59.7b in 3QFY25 (30% beat, up 181% YoY/116% QoQ).

* The beat was led by a higher-than-estimated GRM, which was 10% above our estimate at USD6/bbl (-57% YoY).

* LPG under-recovery stood at INR31b, which we believe could be reversed in due course as LPG remains a controlled product.

* Refining throughput was in line with our estimate at 6.5mmt (+21% YoY).

* Marketing volumes stood at 12.9mmt (est. 12.2mmt), up 8% YoY.

* Marketing margin (incl. inv.) stood at ~INR5.7/lit (est. INR6.1/lit), up 310% YoY.

* PAT came in 29% above our estimate at INR30.2b (5.7x YoY, 4.8x QoQ). Depreciation & other income were below our estimates, while finance costs were above our estimate. In 3Q, forex losses stood at INR4.8b vs. INR0.4b in 1HFY25.

* In 9MFY25, net sales grew 2% to INR3.2t, while EBITDA/PAT declined 47%/66% to INR108.2b/40.1b. In 4QFY25, we estimate a 31%/51% YoY decline in HPCL’s EBITDA/PAT.

* As of Dec’24, HPCL had a cumulative negative net buffer of INR76b due to the under-recovery on LPG cylinders (INR45b as of Sep’24).

Highlights of the 3QFY25 performance:

Operational performance:

* HPCL recorded its highest-ever crude throughput of 18.5mmt in 9MFY25 (6.5mmt in 3Q).

* The company reported the highest-ever quarterly sales volume of 12.9mmt and gained a market share of 0.4% during the quarter.

* Sales volumes of motor fuels/LPG/industrial products rose 6.3%/4.9%/ 25.5% YoY. Aviation/lubricants posted volume growth of 26%/11.5% YoY.

* In 3QFY25, HPCL recorded its highest-ever pipeline throughput of 6.9mmt.

* HPCL expanded its retail network with 452 new outlets in 3Q, taking the total to 22,953. Additionally, six new LPG distributorships were commissioned, increasing the total count to 6,370. It commissioned 50 retail outlets in CNG and 1,062 EV charging facilities, taking the total number to 1,851 and 5,104, respectively.

* HPCL initiated CNG sales in Darjeeling, Jalpaiguri, and Uttar Dinajpur, and commercial PNG sales in Shahjahanpur Badaun, expanding its presence in eastern India.

* The company achieved the highest-ever Ethanol blending of 16.2% during the quarter.

Update on the ongoing projects:

* The company’s 3Q capex stood at INR28.9b (INR94.8b in 9MFY25)

* HPCL successfully commissioned its 5mmtpa LNG regasification terminal.

* HPCL has started its 'Lube Modernization' project at the Mumbai Refinery for an estimated cost of INR46.8bm with a Mar’28 completion target. The project will improve LOBS and Bitumen capacity and will improve the refinery’s distillate yield by 4%.

* Mumbai Refinery has commissioned VGO hydro-treating in its DHT Unit, becoming the first in India to process VGO and diesel simultaneously in parallel reactors within a single unit and is expected to boost motor spirit (MS) yields by ~100tmt p.a.

HRRL:

* The construction of the project is in full swing, and the refinery and petrochemical complex is expected to be commissioned in CY25.

* As of Dec’24, total commitments stood at INR718.1b and capex was INR528.7b.

Other highlights

* The 3.55mmtpa residue upgradation facility at its Visakh Refinery is completed, with the commissioning expected in 4QFY25.

* The company signed MoUs with the Rajasthan and Bihar governments to develop solar and wind hybrid projects in Rajasthan and invest INR5b in seven CBG plants in Bihar.

Valuation and view

* HPCL remains our preferred pick among the three OMCs. We model a marketing margin of INR3.3/lit for both MS and HSD in FY26/27, while the current MS and HSD marketing margins are INR4.7/lit and INR9.6/lit, respectively. We view the following as key catalysts for the stock: 1) the de-merger and potential listing of the lubricant business, 2) the commissioning of its bottom upgrade unit in 4QFY25, 3) the start of its Rajasthan refinery in CY25, and 4) LPG under-recovery compensation.

* HPCL currently trades at 1.3x FY26E P/B, which we believe offers a reasonable margin of safety as we estimate FY26E RoE of 17.3%.

* Our SoTP-based TP includes:

* The standalone refining and marketing business at 6.5x Dec'26E EBITDA.

* INR38/sh as potential value unlocking from the de-merger of the lubricant business.

* HMEL at 8x P/E based on its FY24 PAT (HPCL’s share), deriving a value of INR35/share.

* Chhara Terminal at 1x P/B, and HPCL’s HRRL stake at 0.5x of HPCL’s equity investment in the project to date. MRPL’s stake is valued at MOFSL’s TP.

* All these lead to a revised TP of INR490. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412