Buy Trent Ltd for the Target Rs. 6,900 by Motilal Oswal Financial Services Ltd

.jpg)

SSSG moderates further; lower costs drive 11% EBITDA beat

* Trent’s 4QFY25 revenue growth moderated to ~29% YoY (vs. 37% YoY in 3Q), as SSSG came down to a mid-single digit in 4Q (vs. high-single digit in 3Q and double digits in 2Q).

* However, store additions remained robust, with net store additions of 13/130 in WestSide/Zudio (up ~29% YoY).

* Gross margin contracted ~265bp YoY, likely due to higher discounts and rising salience of Zudio in the revenue mix.

* Despite weaker gross margin, Trent delivered ~11% EBITDA beat, driven by superior cost controls (employee/occupancy costs up 3%/7% YoY). ? Star growth also moderated with a modest ~2% LFL.

* Our FY26-27 estimates are broadly unchanged. We build in FY25-27E CAGR of ~25-26% in standalone revenue/EBITDA/PAT, driven by continuation of robust area additions in Zudio.

* We assign 55x Mar’27E EV/EBITDA to the standalone business (Westside and Zudio; a premium over our Retail Universe, given TRENT’s superlative growth), 2.5x FY27E EV/sales to Star JV, and ~7x EV/EBITDA to Zara JV to arrive at our TP of INR6,900. Adjusting the value of Star and Zara, the stock is trading at 73x FY27E PE for the standalone business (vs. ~90x LT average 1-year forward PE). We reiterate our BUY rating.

Standalone EBITDA beat driven by lower employee/rental costs

* Standalone revenue at INR41b grew 29% YoY, driven largely by ~29% YoY net store additions and mid-single digit LFL (vs. high-single digit in 3Q).

* Gross profit grew 21% YoY to INR17.5b, 6% below our est. as gross margin contracted ~265bp YoY to 42.6%, possibly on higher discounts.

* Employee costs inched up ~3% YoY (13% below), possibly on account of lower incentive provisions (which are linked to stock price performance).

* SG&A and other costs increased ~18% YoY (13% below), with occupancy cost rising ~7% YoY, despite robust store additions.

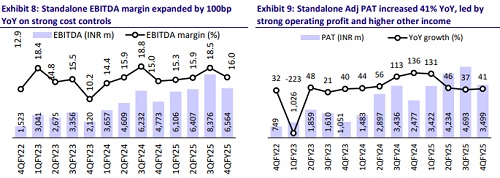

* EBITDA grew 38% YoY to INR6.6b (11% beat) as lower gross margin was offset by superior cost control.

* Reported EBITDA margins expanded 100bp YoY to 16% (~150bp ahead),

* As per Trent, standalone Pre-Ind AS EBIT margin stood at 9.3% (up 100bp YoY).

* Adjusted PAT grew 41% YoY to INR3.5b (31% beat), driven by higher EBITDA, other income (+58% YoY) and a lower tax rate.

* In FY25, Trent’s revenue/EBITDA/adj. PAT grew 40%/43%/54% YoY, driven by 29% YoY net store additions and double digits SSSG.

* WC days declined to 37 in FY25 from ~40 in FY24 as inventory days came down to 44 (from 48 YoY).

* OCF (after interest and leases) increased 29% YoY to INR10b, led by ~43% YoY growth in EBITDA. However, Trent had FCF outflow of ~INR2.2b in FY25 (vs. INR600m FCF generation in FY25), due to higher capex of ~INR12.2b (vs. INR7.2b YoY).

* Trent’s net cash stood at ~INR3.4b in FY25 (vs. ~INR4.1b in FY24).

Strong store additions continue in Zudio; should aid growth in FY26

* Trent added 136 net stores QoQ across its fashion concepts, though the bulk of the store additions were back-ended.

* Trent added 13 Westside stores and consolidated three stores, taking the total count to 248 stores (up ~7% YoY). We note that Trent has been opening bigger Westside stores in the past few quarters.

* Trent added 130 (open 132; consolidated two) Zudio stores, taking the total count to 765 stores (up 40% YoY), including two in the UAE.

* Trent also consolidated four other format stores, taking their store count to 30 stores.

* In FY25, Trent added 16/220 Westside/Zudio stores on net basis to cross 1k stores across its fashion formats (+29% YoY).

Star: Growth moderates in 4Q; LFL declines to 2% from 10% in 3Q

* Star’s 4Q revenue grew 17% YoY (vs. 25% YoY in 3Q) as LFL growth moderated to ~2% (from ~10% in 3Q).

* The company opened net four stores in 4Q, taking the count to 78 stores (12 net store additions in FY25).

* Calculated annualized revenue per sqft declined ~7% YoY to INR27.4k (vs. likely +3% YoY for DMart at INR35k) and annualized revenue per store was up only ~2% YoY to INR451m (vs. +3% YoY for DMart at INR1.44b).

* The share of own-brand offerings now contributes 72%+ to Star’s revenue (vs. 69% YoY).

Valuation and view

* TRENT’s growth rate continues to moderate, though still robust, amid a weak discretionary demand environment.

* Back-ended strong store additions in Zudio should aid growth in FY26. However, recovery in SSSG across fashion and Star formats would be a key near-term monitorable.

* We continue to like Trent for its robust footprint additions, strong double-digit growth, long runway for growth in Star (presence in just 10 cities) and potential scale-up of new categories (Beauty, and Lab-grown diamonds).

* Our FY26-27 estimates are broadly unchanged. We build in FY25-27E CAGR of ~25-26% in standalone revenue/EBITDA/PAT CAGR, driven by continuation of robust area additions in Zudio.

* We assign 55x Mar’27E EV/EBITDA to the standalone business (Westside and Zudio; a premium over our Retail Universe, given TRENT’s superlative growth), 2.5x FY27E EV/sales to Star JV, and ~7x EV/EBITDA to Zara JV to arrive at our TP of INR6,900. Adjusting the value of Star and Zara, the stock is trading at 73x FY27E PE for the standalone business (vs. ~90x LT average 1-year forward PE). We reiterate our BUY rating.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Ltd.jpg)