Neutral Britannia Industries Ltd for the Target Rs. 5,850 by Motilal Oswal Financial Services Ltd

Margins pressure persists, offset by cost efficiencies

* Britannia Industries (BRIT) posted total consolidated revenue growth of 9% YoY in 4QFY25 (in line) and volume growth of ~3% (est. 4.5%).

* GM contracted 480bp YoY to 40.1%, impacted by rising commodity prices, mainly palm oil (+54% YoY), Cocoa (+83% YoY) and Milk (+21% YoY). Employee expenses rose 1.5% YoY, while other expenses declined 11% YoY. The strategic price hikes by BRIT and cost efficiency initiatives (~2.5% in FY25) supported margins.

* EBITDA margin contracted 120bp YoY to 18.2%, EBITDA grew 2% YoY to INR8b. Management highlighted that EBITDA margin will be maintained at 17-18%. We model EBITDA margin of 18% in FY26E and 18.3% in FY27E.

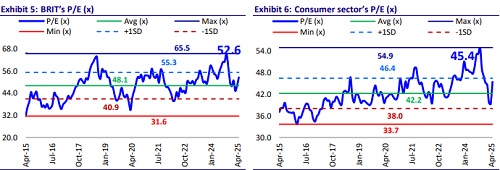

* BRIT’s focus on innovation, distribution expansion, marketing, pricing actions, RTM 2.0 and dairy capacity expansion will drive growth. However, we await a stable demand recovery in core categories amid high macro inflation and price hikes while closely monitoring margins. We reiterate our Neutral rating with a TP of INR5,850 (premised on 50x FY27E EPS).

In-line performance; volume growth at ~3%

* Volume growth at ~3%: BRIT’s consolidated net sales (excluding other operating income) rose 9% YoY to INR43.7b (est. INR42.5b) in 4Q. Other operating income grew 2% YoY to INR0.57b. Consolidated total revenue rose 9% YoY to INR44.3b (est. INR43.6b). The company delivered ~3% volume growth in 4Q (est. 4.5%, 6.5% in 3QFY25).

* Commodity pressure on margin: Consolidated gross margin contracted by 480bp YoY to 40.1% (in line) due to a rise in commodity prices. Employee expenses rose 1.5% YoY, while other expenses declined 11% YoY, leading to a 120bp YoY contraction in EBITDA margin to 18.2% (in line).

* Low-single-digit growth in profitability: EBITDA grew 2% YoY to INR8b (est. INR7.8b). APAT was up 4% YoY at INR5.6b (est. INR5.4b). ? In FY25, net sales grew 7% YoY, EBITDA was flat YoY and APAT rose 3% YoY.

Highlights from the management commentary

* Improving macro trends indicate gradual consumption recovery in FY26.

* Competition from D2C players is not a matter of concern for BRIT. However, with modern trade (MT) and quick commerce (QC) growing, BRIT will remain watchful of any developments in D2C space.

* BRIT has continued to leverage its e-com channel. In FY25, e-com revenue grew 7.4x compared to other channels. BRIT also launched e-com-only products. E-com and QC account for ~4% of BRIT sales and they are growing fast, though the overall salience is relatively low.

* In terms of new launches, BRIT focuses on the premium side. The overall premium portfolio continues to do well for BRIT.

* Cake, rusk, dairy and bread are ~INR8b each, while newer categories launched in the last 4-5 years such as croissants, milkshakes, and wafters are in the range of INR1-2.5b. The split between old and new categories is ~75:25.

* Wheat and oil are ~30% each and sugar is ~20% of total RM basket for FY25.

* Management highlighted that EBITDA margin will be maintained at 17-18%.

Valuation and view

* We largely maintain our EPS estimates for FY26/FY27.

* BRIT focuses on expanding its distribution, primarily in rural areas, innovating products, and scaling up in related categories.

* While BRIT wants to focus on sustaining margins, volatile commodity prices and competitive intensity at both regional and national levels could weigh on BRIT’s margins. The margin is likely to remain volatile in the near term. We model EBITDA margin of 18% in FY26E and 18.3% in FY27E.

* We believe urban demand will recover gradually and growth in packaged food categories will also improve. With pricing action initiated, we expect revenue growth to remain healthy, along with a gradual recovery in gross margin. We reiterate our Neutral rating with a TP of INR5,850 (premised on 50x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412