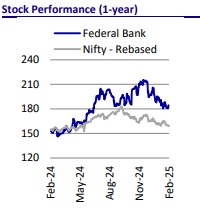

Buy Federal Bank Ltd For Target Rs.225 by Motilal Oswal Financial Services Ltd

.jpg)

Primed for the big leap!

A multipronged approach to deliver balanced growth with superior profitability

Federal Bank (FB) hosted its analyst meet, presenting a strategic vision under the leadership of MD & CEO Mr. KVS Manian to position itself among the top five private sector banks in India. With a legacy spanning over 93 years, a dominant presence in Kerala, and a refreshed focus on becoming a more comprehensive bank, FB is charting a path of sustainable growth, profitability, and technological advancement. The bank’s roadmap emphasizes scaling its operations prudently by prioritizing better-yielding loans, enhancing its liability franchise, and leveraging digital capabilities. We expect FB to deliver an earnings CAGR of 19% over FY25-27 with an RoA/RoE of 1.3%/14.6% by FY27. We reiterate our BUY rating with a TP of INR225 (premised on 1.4x Sep’26E ABV).

Focus on balanced growth vs. profitability

FB’s growth in 3QFY25 was slower as the bank had taken a conscious call on slowing down unsecured lending. The bank is sharpening its focus on segments that offer healthy yields along with stable asset quality, thereby delivering better risk-adjusted RoA. The bank is enriching its product portfolio with offerings designed to deliver superior RoA, such as used CV and CE financing, an expanding Micro-LAP, and the introduction of affordable housing finance to extract higher yields. Thus, the share of low-yielding assets will decrease to 58% in FY28 from 64% in FY25, while the share of medium-yielding assets will rise to 34% from 31%, and that of high-yielding assets will improve to 5% from 3%. Hence, better growth in these segments is likely to support NIM, which has historically trailed larger peers by a significant margin.

Reorienting strategy towards CASA deposits

FB is committed to strengthening its deposits franchise with an emphasis on CA deposits to optimize its CoF while providing support to the NIM. While FB has lagged in CA share to its peers, the bank has ramped up CA account openings in recent months, driven by innovative offerings such as Soundbox and a focus on high transaction sectors like capital markets. The bank is also reorienting its branch strategy to prioritize liability acquisition, transforming branches into hubs for deposit mobilization and customer engagement. Retaining its ~7% market share in NR deposits, FB plans to expand beyond Kerala and the GCC region by introducing targeted investment products and wealth management solutions. As a result, FB expects its overall CASA deposit share to improve to 36% in FY28 from 30% in FY25, while the share of CA as a % of overall deposits would rise to 10% from 6% currently.

NIM to improve over the medium term; near-term weakness persists

FB’s NIM is likely to exhibit a favorable bias and improve over the medium term, while near-term margins may contract as repo cuts compress yields over the short term. However, as the bank gradually pivots towards better-yielding assets such as mid-corporate loans, used CV loans, and affordable housing, along with optimizing its liability mix led by the CASA mix, the medium-term margins are likely to trend higher. The reduction of wholesale deposits by INR40b in 3QFY25, bringing their share (alongside CDs) to 18.2% of the deposit base, is expected to moderate the cost of funds over time. Thus, maintaining a strategic balance between the assets and liabilities side, the bank expects to improve its current NIM level of 3.13% and move towards the average of the top 3 private banks.

Driving growth through digital initiatives and cost efficiency

Digital initiatives are set to play a crucial role in accelerating the bank’s growth while maintaining cost efficiency, aligning with its mantra of “Digital at the Fore, Human at the Core.” The bank is revamping its mobile app, aiming to enhance revenue, acquire NTB customers, and reduce servicing costs. Organic digital sourcing is a key focus, with FB having plans to increase the share of credit card sourcing to 45% from 30%, reduce the share of personal loans to 50% from 60%, and notably increase the share of SA accounts to 25% from 2% by FY28—building on a foundation where 92% of transactions are already digital. Cost optimization is being driven through FedServ, the bank’s subsidiary, which will help to reduce the cost of operations, back-office operations, and call centers. FB is thus targeting a reduction in the C/I ratio from 53% in 3QFY25 to align with the top 3 banks’ average of ~42%. These efforts are expected to support the bank’s RoA target of aligning more closely to the bank’s aspiration of being between the best 3 banks and the next 3 banks in the industry (i.e., in the middle of the range of 1.4-2.2%).

Balancing fintech partnerships with organic expansion

FB is adopting a dual approach of fintech partnerships and organic growth to enhance its product suite and digital capabilities, reinforcing its universal banking aspirations. Collaborations with multiple fintech partners are expanding customer support for digital lending and payment solutions. The bank is prioritizing organic growth through proprietary platforms like the revamped mobile app and corporate super app, alongside increasing in-house digital sourcing for credit cards and personal loans. Despite a cautious stance on unsecured loans, commercial credit cards remain a lucrative focus within the affluent banking strategy. While open to inorganic portfolio acquisitions, management currently emphasizes organic scaling, with no immediate M&A plans on the horizon. This balanced strategy leverages external expertise for agility while building a robust internal ecosystem.

Vision on growing “Beyond Kerala Corridor” in a phased manner

Management plans to expand beyond Kerala, targeting high-growth markets by adding 400-450 branches by FY28 in states such as Karnataka, Tamil Nadu, Telangana, Maharashtra, and Gujarat, using a pincode-level approach. This aligns with the bank’s aim to boost CASA and deposits by turning branches into acquisition hubs to leverage untapped potential. Growth in Tier-2 and Tier-3 cities will support SME banking (INR10m average ticket, PSL-focused) and CV/CE financing via stronger dealer and BC ties. The bank targets mass affluent and small businesses to lift its low non-Kerala market share, despite a ~7% NR deposit hold. This phased expansion also aligns with a 1.5x systemic credit growth goal, enhancing both deposit and asset franchises.

Valuation view: Reiterate BUY with a TP of INR225

FB’s strategic vision positions it as a key player amongst mid-sized private banks, blending high-yielding asset growth, liability optimization, and digital transformation to deliver sustained profitability and growth. We believe that FB is well placed amongst the mid-sized private sector banks to deliver a healthy earnings trajectory, aided by steady business growth and gradual improvement in margins and operating leverage. The bank’s guidance of 1.5x nominal GDP growth and stable credit costs of 0.4-0.5% will contribute to the management’s vision of delivering superior RoA over the coming years. We currently estimate FB to deliver FY27E RoA/RoE of 1.3%/14.6% and remain optimistic about the execution capabilities of the bank under the new leadership. We reiterate our BUY rating with a TP of INR225 (premised on 1.4x Sep’26E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412