Buy Bharat Electronics Ltd For Target Rs.360 by Motilal Oswal Financial Services Ltd

Well equipped to benefit from defense ordering

* We continue to remain positive on Bharat Electronics (BEL) given 1) its market leadership in defense electronics and ability to benefit from defense indigenization as well as from the upcoming large defense platform orders (QRSAM, MRSAM, Tejas Mk1A, naval platforms, etc.), 2) a strong order book of INR746b as of 2QFY25-end, providing healthy visibility on revenue, 3) stable margins and control over working capital, and 4) healthy return ratios.

* Despite BEL’s overall FY25YTD orders of INR103b being lower than last year’s, we expect the company to gain from the further ramp-up in defense orders in the coming months. The recent DAC approvals augur well for the sector and emphasize the government’s focus on defense indigenization. The company is continuously expanding its presence across new areas via its SBUs. It is also focusing on improving the share of exports and non-defense projects in the overall order book.

* We tweak our estimates to bake in slightly lower ordering estimates and roll forward our TP to 35x Mar’27 estimates. Reiterate BUY with a TP of INR360.

Key investment thesis

Market leader in defense electronics

BEL is a market leader in the highly specialized defense electronics market with nearly 60% share. In the overall defense market, the company has consistently improved its revenue market share over the last four years, reaching 12.8% in FY24. This was led by the government’s continued focus on defense indigenization and BEL’s focus on the Ministry of Defence (MoD)’s Make-I, Make-II, and Make-III projects involving indigenous solution development, with emphasis on systems, sub-systems, and services. With various large platform orders likely to be finalized over the next 1-3 years (Ref Exhibit 3), we expect defense PSUs to garner a larger share of ordering, and within that we expect BEL to benefit from the increased scope of its offerings via indigenization. We thus expect BEL’s market share to continue growing in the coming years and anticipate that it will clock faster growth than the growth in capex in the defense market.

Recent DAC approvals augur well for the sector

Over the past 12 months, BEL has been a potential vendor for multiple AoNs granted by DAC (Ref Exhibit 4). While the share of private companies in defense orders is increasing, BEL has the potential to secure larger-sized orders by leveraging its strong domain knowledge and core competencies in defense electronics. Over the years, the company has also developed a strong vendor base and expanded its offerings. BEL has improved its procurement from Indian MSEs to 37.3% in FY24 from 32.0% in FY23.

Expect BEL to benefit from the increased scope of work across platforms

Various large platform projects by DRDO are lined up or in the process of being finalized in the next 1-3 years. As a PSU and a market leader in defense electronics, we anticipate that a major share of orders for radar systems, TR modules, EW systems, and subsystems related to these projects will be awarded to BEL. The company is actively pursuing a larger share of naval projects related to defense electronics. Similarly, for radars, BEL is qualified for Uttam AESA radar integration into Tejas MK1 and later for Tejas MK2. The company anticipates a significant influx of orders from the QRSAM system during FY26. We, thus, believe that with rising volumes and higher indigenization, BEL would be able to expand its share across platforms.

Budget expectations for the defense sector

The defense budget has seen a YoY growth in absolute terms over the years, and capital allocation usually forms a third of the total defense budget. However, in the past few years, post-Covid, budget allocation for defense as a % of GDP has declined and has been hovering around 1.5-1.6%. To achieve a target defense turnover of USD25b, it is essential to increase defense spending to 1.8-2.0% of GDP. In the Union Budget, we will keenly monitor the allocation for the defense sector and will seek a more expedited finalization of large platform orders from the MoD.

Expectation of a revival in inflows in 2HFY25

BEL had maintained its order inflow target of INR250b for FY25 at the time of its 2QFY25 results. Inflows for FY25YTD stood at INR100b, and the ask rate for 4QFY25 is high at INR150b. To achieve that target, the company expects major orders to originate from radars, the EW suite, Atulya, and Shakti EW, as these projects are in the final stages of negotiation and will be awarded in 2HFY25. Even if, due to unforeseen circumstances, these orders are pushed back to 1QFY26, our revenue estimates for FY25 should not change meaningfully given BEL’s strong order book position. Management is also expecting QRSAM order inflow to come through during FY26.

Progress on SBUs to contribute to revenue

In Jan’24, BEL increased its Strategic Business Units (SBUs) count to 29 from 24 in the previous year. EW Land Systems SBU, Hyderabad, is the biggest SBU that has now started generating revenue, and the expected revenue for FY25 is around INR15b. The remaining four SBUs that were formed in Bangalore are the Seekers SBU for RF and IR seekers, the Arms and Ammunition SBU, the Network and Cyber Security SBU, and the Unmanned Systems SBU. The target set for FY25 for all the Bangalore-based SBUs is between INR2.5b and INR3.0b. Over 2-3 years, each of these SBUs is likely to contribute INR10b+ in revenue annually for the company.

BEL’s strategic tie-ups in CY24

The company has remained focused on strategic alliances, technology tie-ups, and MoUs, as well as on in-house R&D to provide complete solutions and platforms, thereby enhancing its market access and facilitating entry into new areas. In FY24, the company filed 146 IPRs (including 82 patents) in the areas of communications, artificial intelligence, radars, antennae, embedded systems, software, and command & control system domains and was granted 161 patents in the year, taking the total count to 208.

Financial outlook

We tweak our estimates and expect a sales/EBITDA/PAT CAGR of 17%/18%/20% over FY24-27. We expect OCF/FCF to remain strong over FY25-27, led by control over working capital. Further, the company had a cash surplus of INR110b (as of FY24), providing scope for further capacity expansion. We will reevaluate our estimates if overall ordering in the defense sector remains weak over the next few quarters.

Key risks and concerns

A slowdown in order inflows from the defense and non-defense segments, intensified competition, further delays in the finalization of large tenders, a sharp rise in commodity prices, and delays in payments from the MoD can adversely impact our estimates on revenue, margins, and cash flows.

Valuation and recommendation

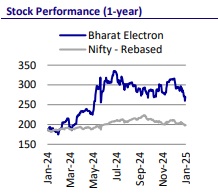

BEL is currently trading at 35.0x/29x on FY26E/FY27E EPS. We tweak our estimates to bake in slightly lower ordering estimates and roll forward our TP to 35x Mar’27E. We reiterate our BUY rating on the stock with a TP of INR360.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Neutral Hindustan Zinc Ltd for the Target Rs. 510 by Motilal Oswal Financial Services Ltd

.jpg)