Buy DLF Ltd for the Target Rs. 967 by Motilal Oswal Financial Services Ltd

‘The Dahlias’ propels DLF’s FY25 performance

FY25 pre-sales guidance exceeded; pipeline robust

* DLF reported bookings of INR20b, up 39% YoY (25% below our est.) in 4Q.

* This impressive performance was fueled by healthy sales from the superluxury project 'The Dahlias', launched in 3QFY25, which contributed a total of INR137b in FY25 (~65% of total pre-sales of INR212b in FY25). Thus, FY25 exceeded the full-year pre-sales guidance.

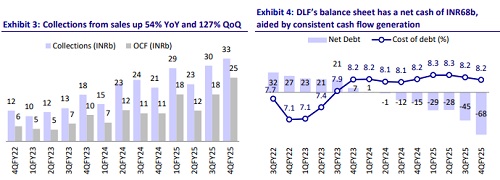

* DLF also witnessed a strong uptick in collections, which increased 51%/7% YoY/QoQ to INR33b. Consequently, OCF jumped 127%/36% YoY/QoQ to INR25b in 4QFY25. The net cash position was INR68b vs. INR45b in 3QFY25.

* The medium-term launch pipeline increased by INR35b and now stands at INR739b. Management guided >INR172b (15% of INR1.15tn) worth of launches in FY26.

* P&L performance: In 4QFY25, DLF's revenue came in at INR31.3b, up 47% YoY/2x QoQ (59% above our estimate). EBITDA jumped 30% YoY/2.5x QoQ to INR9.8b (2x above), while its margin stood at 31% (down 4pp YoY and up 5pp QoQ; 6pp above). PAT was INR12.9b, up 41% YoY/down 21% QoQ (5x above, including reversal of deferred tax liabilities (DTL)), while normalized PAT (ex-DTL) was at INR12.8b, up 39%/21% YoY/QoQ (5x above our est.).

* In FY25, revenue came in at INR80b, up 24% YoY. EBITDA was flat YoY at INR21b, striking a lower margin of 26% (7pp below FY24). PAT was INR49.6b, up 82% YoY (including reversal of DTL), while normalized PAT (ex-DTL) was INR43.7b, up 60% YoY.

DCCDL: Healthy growth; Debt-to-GAV dips 2% to 21% (down 12% from FY21)

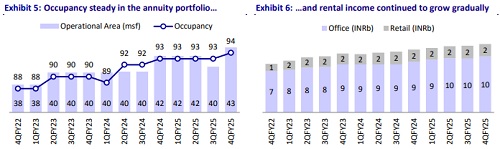

* In FY25, the rental income in DCCDL’s commercial portfolio grew 11%/4% YoY for Office/Retail to INR38.7b/INR8.8b. Total revenue was INR63.5b, up 9% YoY. EBITDA stood at INR48.5b, up 10% YoY.

* The overall occupancy in DCCDL’s office portfolio was up 1% YoY and stood at 94% (Non-SEZ: 98% /SEZ: 88%).

* Further, 12msf is under construction across its existing assets in Gurugram and Chennai.

* Net debt increased 5% to INR175b from INR167b in 3QFY25, with the net debt-to-GAV ratio at 0.21x. The cost of debt stood at 8.06%.

Key management commentary

* DLF is witnessing strong housing demand, especially in Gurgaon, driven by its reputation for quality construction and timely delivery.

* Planned residential project launches worth INR739b include Mumbai and Privana Phase 3 in 1QFY26 and Goa in late FY26.

* FY26 pre-sales are guided at INR200–220b, reflecting confidence in new launches and continued demand.

* The super-luxury project, ‘The Dahlias’, was a major success, contributing 65% to FY25 pre-sales and helping DLF exceed its annual target.

* The RERA escrow balance of ~INR82b is likely to dip as the high-rise project cycle progresses.

* Business development is focused on NCR, Tri-City, MMR, and Goa, with limited new acquisitions expected in the near term.

* Capex is guided at INR50b annually for both FY26 and FY27, with a stable effective tax rate expected.

* Office/retail vacancies remain low at 6%/2%, indicating strong leasing activity.

* In Downtown Gurugram, Block-4 (2msf) is 97% pre-leased with rent commencing from 1QFY26; construction is ongoing across 7.5msf.

* Downtown Chennai’s DT-3 (1.1msf) is 99% leased, with rents starting from May/Jun’25; DT 4&5 (3.6msf) phases are under construction.

* Atrium Place Phase-1 (2.1msf) rentals will begin in Jul’25; Phase 2 (1.1msf) is expected to be ready by 4QFY26.

* DLF’s credit rating has been upgraded: Crisil has upgraded its rating to AAA (stable), and ICRA has upgraded to AA (positive).

Valuation and view: Growth trajectory remains intact

* DLF continues to enhance its growth visibility as it replenishes its launches with its existing vast land reserves. However, our assumption of a 12-13-year monetization timeline for its remaining 160msf of land bank (including TOD potential) adequately incorporates this growth.

* DLF’s (Devco/DLF commercial) business is valued at INR1,726b, wherein land contributes INR1,304b. DCCDL is valued at INR708b. Gross NAV is at INR2,434b, which, after taking net debt of INR41b (incl. DCCDL) into consideration, stands at INR2,393b. We reiterate our BUY rating with a revised TP of INR967 (vs. INR954)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412