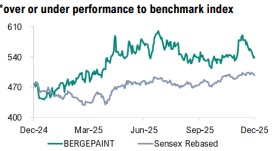

Buy Berger Paints India Ltd For Target Rs. 628 By Geojit Financial Services Ltd

Improved Demand and Volume to Drive Growth

Berger Paints India (Berger) is the second largest paint company in the domestic market, with 12 strategically located manufacturing units and a countrywide distribution network of 25,000+ dealers.

* In Q2FY26, consolidated revenue grew a marginal 1.9% YoY to Rs. 2,827cr due to a heavy monsoon and sustained competitive intensity.

* Despite inclement weather, Berger achieved 8.8% YoY volume growth in Q2FY26, while value grew 1.1% YoY owing to higher contribution from tile adhesives.

* EBITDA declined 18.9% YoY to Rs. 352cr due to higher cost of sales and other expenses. Accordingly, EBITDA margin contracted 310bps YoY to 12.5%.

* Management reiterated its confidence in a stronger H2, citing demand recovery as a key driver.

* Gross margin is expected to improve, aided by benign raw material prices and an improving product mix.

Outlook & Valuation

During the quarter, Berger's revenue growth was impacted by the prolonged monsoon season, resulting in a modest increase in revenue. The company's margin and profitability were also affected by higher costs and expenses. However, the company continued to expand its retail presence, adding new stores and increasing its overall footprint. The sector’s competitive landscape has stabilised, and demand is expected to pick up in the coming months, driven by improved weather conditions and the release of pent-up demand. This is expected to contribute to the company's overall revenue growth, margin and profitability. Therefore, we upgrade our rating on the stock to 'BUY', with a revised target price of Rs. 628, based on 55x FY27E adjusted EPS.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345