Buy Aadhar Housing Finance Ltd For the Target Rs. 605 by Mirae Asset Capital Markets

Strong Q2; growth guidance maintained

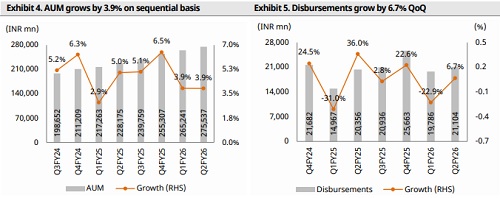

AADHARHF reported better than expected Q2 performance. While AUM growth came in-line at 21% YoY/4% QoQ, it delivered beat on margin and credit cost fronts. Spread improved by 20bps QoQ on decline in COB. PAT grew by 17% YoY/12% QoQ to INR 2.7bn (7% higher than our est.). Credit cost (on avg. AUM) reduced to 19bps (vs 41bps QoQ) on decline in delinquency. Management retainedAUM growth guidance of 20-22% for FY26.

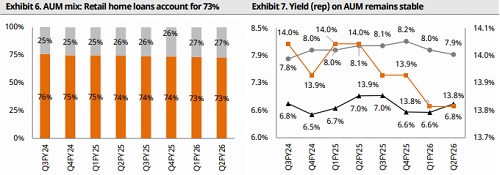

NIM improves; ROA picks up: NIM (on avg. AUM) rose 6.8% (vs 6.6% QoQ) led by 10bps reduction in COB (7.9% vs 8.0% QoQ) on repricing of MCLR borrowings book. Yield (rep) remained flat at 13.8% on QoQ basis. Management expects 10bps further reduction in COB in H2 led by repricing of MCLR borrowings book. Core PPOP/AA stood at 5.0% (vs 5.4% QoQ) as increase in opex (C/I at 36.2% vs 36.1% QoQ) weighed on core income. Meanwhile, ROA rose to 4.3% (4.0% QoQ) led by strong earnings growth.

In-line growth; guidance maintained: Disbursements grew by 3.7% YoY/6.7% QoQ to INR 21bn (vs INR20bn QoQ). Disbursement is expected to pick-up in H2. Management guided for 18% disbursement growth during FY26. AADHARHF remained optimistic on low-income housing finance sector on favorable policy reforms (PMAY 2.0, GST 2.0) and continued government’s focus.

Delinquency reduces: GS3/ loans rose to 1.5% (vs 1.4% QoQ). However, GS2/loans further reduced to 3.5% (vs 3.7% QoQ). Management said diversification in the loan portfolio (no state >15% of AUM) has proved good on assets quality front given the prevailing stress in some states like Karnataka. Stress markets Tirupur, Surat, Coimbatore collectively represent ~1.6% of AUM. Collection efficiency also stood healthy at 99% during the quarter.

Valuation: AADHARHF reported better performance for Q2FY26 across business verticals. It expects pick-up in disbursements during H2 which usually remains good for business. Margin is expected to get support from easing COB. Assets quality outlook remains stable given the declining delinquency. Management sees strong underlying demand for affordable housing. We maintained our estimates over FY26- 27E. AUM is expected to grow at a CAGR of 21% over FY25- 28E. At CMP, the stock is currently trading at IY forward P/BV 2.6x. We maintain our ‘BUY’ rating with revised TP of INR 605/sh valuing at P/BV 2.8x Sep’27E BV (vs 2.9x earlier). An increase in TP is mainly due to rolling forward of valuation to Sep’27E BV.

Above views are of the author and not of the website kindly read disclaimer