Sell Fine Organic Industries Ltd for the Target Rs. 3,920 by Motilal Oswal Financial Services Ltd

Earnings under pressure amid persistent margin headwinds

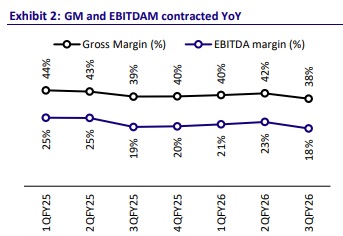

* Fine Organic Industries (FINEORG) reported muted operating performance, with an EBITDA growth of 2% YoY, primarily due to gross margin contraction of 140bp YoY to 38%.

* FINEORG has been expanding its global reach by entering new geographies and strengthening its strategic partnerships. The company incorporated a wholly-owned subsidiary in Jebel Ali Free Zone, Dubai, UAE, to establish a local presence in GCC countries and improve supply chain efficiencies.

* We broadly maintain our earnings estimates for FY26/FY27/FY28 and estimate a revenue/EBITDA/Adj. PAT CAGR of 9%/6%/7% for FY25-FY28. FINEORG currently trades at ~29x FY28E EPS and ~22x FY28E EV/EBITDA. We value the stock at 26x FY27E EPS to arrive at our TP of INR3,920. Reiterate Sell.

Margin pressure despite stable demand

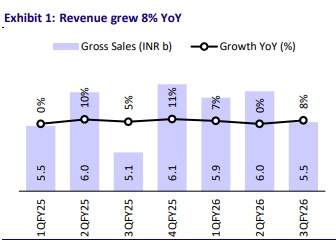

* FINEORG reported revenue of INR5.6b in 1QFY26, rising 8% YoY. Overall demand remained stable during the quarter.

* Exports revenue grew 2% YoY to INR2.9b, while domestic revenue grew 15% YoY to INR2.6b, driven by improved domestic demand. ? Gross margin stood at 38% (down 140p YoY), while EBITDA margin contracted 100bp YoY to 18.3% in 3QFY26, primarily due to higher raw material costs in 3QFY26.

* EBITDA stood at INR1b, up 2% YoY, and Adj. PAT dipped 4% YoY to INR792m in 3QFY26 (est INR869m).

* In 9MFY26, revenue grew 5% YoY to INR17.4b, while EBITDA/Adj. PAT declined 7%/4% to INR3.6b/INR3b.

Highlights from the management presentation

* Freight costs have stabilized during the year and reduced further in 3Q, mainly due to a reduction in global sea freight rates.

* During the quarter, the company infused equity of about INR61.7m in its joint venture company, Fine Organic Industries (Thailand) Co. Ltd., for business growth purposes.

* FINEORG has incorporated a wholly-owned subsidiary, Fine Organics FZE, in Dubai, UAE. The subsidiary aims to establish a local presence in GCC countries and enhance supply chain efficiency.

Valuation and view

* The company remains focused on strengthening its global presence through investments in overseas subsidiaries, expanding US capacity for future growth, enhancing manufacturing capabilities, and incorporating a wholly-owned subsidiary in Dubai to establish a local presence in GCC countries and improve supply chain efficiency

* The long-term prospects for FINEORG remain healthy, as the company operates within the oleochemicals industry and has consistently driven growth through R&D innovations over the years. However, we anticipate that its performance may be adversely affected in the near-to-medium term by the following factors: 1) longer-than-expected delays in the commissioning of new capacities for expansion, and 2) existing plants operating at close to optimum utilization, with no potential for debottlenecking.

* We broadly maintain our earnings estimates for FY26/FY27/FY28 and project a revenue/EBITDA/Adj. PAT CAGR of 9%/7%/8% for FY25-FY28. FINEORG currently trades at ~29x FY28E EPS and ~22x FY28E EV/EBITDA. We value the stock at 26x FY27E EPS to arrive at our TP of INR4,100. Reiterate Sell.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412