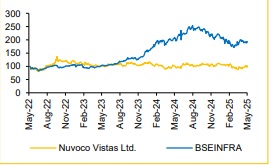

Buy Nuvoco Vistas Corp Ltd . For Target Rs. 441 - Choice Broking Ltd

Vadraj asset would be value accretive

We upgrade NUVOCO from HOLD to BUY as 1)We revise our Realisation / EBITDA per ton and EBITDA assumptions higher (Exhibit 2) mostly due to sector tailwinds and also due to company specific reasons like the ongoing cost saving and premiumisation initiatives, 2) We factor in incremental positive value (INR 21bn, ~15% of current market cap) from the Vadraj acquisition, 3) The RoCE expands by 670 bps from 3.9% in FY25 to 10.6% in FY28E on the back of higher operational assumptions as described in 1) above, and 4) We incorporate a robust EV to CE (Enterprise Value to Capital Employed) based valuation frame work (Exhibit 3) which allows us a rational basis to assign right valuation multiples basis improving fundamentals

We forecast NUVOCO’s EBITDA to grow at a CAGR of 20% over FY25- 28E based on our volume growth assumptions of 2%/2%/2%, and realisation growth of 2%/1%/1% coupled with per ton total cost saving of 30%/16%/14% in FY26E/27E/28E, respectively. We like NUVOCO’s premiumization and cost saving initiatives like adding railway sidings, improving AFR rate, optimising freight costs and other de-bottlenecking measures.

We arrive at a 1-year forward TP of INR 441/share for NUVOCO. We now value NUVOCO on our EV/CE framework – we assign an EV/CE multiple of 1.36x/1.36x for FY27E/28E, which we believe is conservative given the near tripling of ROCE from 3.9% in FY25 to 10.6% in FY28E under reasonable operational assumptions. This valuation framework gives us the flexibility to assign a commensurate valuation multiple basis an objective assessment of the quantifiable forecast financial performance of the company. We do a sanity check of our EV/CE TP using implied EV/EBITDA multiple. On our TP of INR 441, FY28E implied EVEBITDA multiple is 6.3x which makes NUVOCO amongst the cheapest mid to large sized cement companies in our coverage. Regulatory uncertainty around potential higher state levies on limestone, soft patches of government spending on infrastructure / construction, sudden large spike in petcoke prices as a result of various global dynamics and any regulatory/legal hurdles around Vadraj acquisition are potential risks to be mindful of.

Q4FY25 Results: Strong beat at EBITDA level

NUVOCO reported Q4FY25 consolidated Revenue and EBITDA of INR30,423 Mn (+3.7% YoY, 26.3% QoQ) and INR5,516 Mn (+12.4% YoY, +113.6% QoQ) vs CEBPL estimates of INR30,361 Mn and INR4,436 Mn, respectively. In our view market expectation of Q4FY25 EBITDA was in the range of INR 4,600-5,300 Mn, so the reported numbers are well ahead of street expectations. Total volume for Q4 stood at 5.7 Mnt (vs CEBPL est. 5.8 Mnt), up 7.5% YoY and 21.3% QoQ, which is better than most of the peers.

Realization/t came in at INR5,337/t (-3.6% YoY and +4.1% QoQ), which is better then CEBPL est of INR5,203/t. Total cost/t came in at INR4,370/t (- 5.2% YoY and -4.5% QoQ). As a result, EBITDA/t came in at INR 968/t, which is an expansion of ~INR418/t QoQ, which is a well ahead of market expectation of ~INR 750-800/t, and ahead of CEBPL estimate of INR 760/t.

Pricing Tailwinds:

Pricing increases that have been announced between Dec’24 to Apr/Mar’25 continue to hold and cumulatively add up about INR20 per ton (INR 1,000 per ton), which is quite impressive.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131