Hold Berger Paints India Ltd For Target Rs. 580 By InCred Equities

Weak quarter; gradual recovery expected

* Consolidated/standalone 2Q sales grew by 1.9%/1.1% yoy led by an 8.8% volume growth. Growth was impacted by extended monsoons & downtrading.

* Inferior mix led to gross margin contraction of 10bp yoy, while EBITDA margin contracted 320bp yoy to 12.5% led by operating deleverage and higher costs.

* We expect the recovery to be gradual as competitive intensity is expected to revive post-monsoon. Maintain HOLD rating with a lower target price of Rs580.

Subdued quarter impacted by extended monsoons and a weak mix

Consolidated sales of Berger Paints India (Berger) in 2QFY26 grew by 1.9% yoy to Rs28.3bn (2% below our estimate). Standalone sales grew by 1.1% yoy, with an 8.8% volume growth. Growth was impacted by extended monsoons and higher competitive intensity impacting key markets like Andhra Pradesh, Kerala, West Bengal, North-East region, Gujarat & Maharashtra. Categories like tile adhesives, admix and putty led volume growth while high-value products like exterior and roof coatings were muted, which led to an inferior mix and high volume/value gap. A marginal shift in mix took place from premium/luxury to economy emulsion segments in both exterior and interior segments. Sales momentum revived towards the end of Sep 2025, as weather conditions stabilized.

International subsidiaries posted a mixed performance

Bolix Poland saw healthy topline growth; however, pricing pressure impacted profitability. BJN Nepal reported strong revenue growth with muted profitability due to seasonal impact. SBL Speciality Coatings reported muted sales growth, and STP was impacted by a temporary plant shutdown in Jamshedpur. Berger Becker Coatings JV posted healthy growth in topline and profitability. Berger Nippon Paint Automotive Coatings Pvt Ltd continued its momentum driven by the four-wheeler segment, with healthy growth.

Margins dragged by inferior mix and downtrading

Gross margin contracted by 10bp yoy to 41.6% led by a weak mix. Employee costs were higher by 11% yoy led by feet-on-street expansion in urban markets, where projects business will be a focus area. Advertising and promotional spending remained elevated. EBITDA margin contracted by 320bp yoy to 12.5%. Management maintained its 15-17% EBITDA margin guidance for the medium term and expects 2HFY26F to see a 1.5% improvement in gross margin owing to an improvement in product mix. We expect margins to remain rangebound in the medium term owing to elevated competitive pressure.

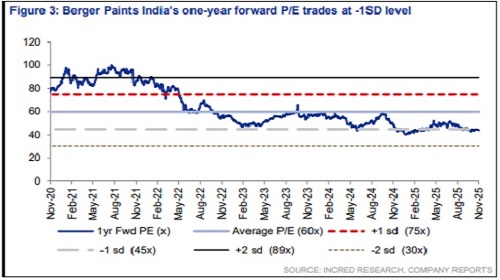

Maintain HOLD rating with a lower target price of Rs580

Management expects 3QFY26F to see mid-single digit growth followed by double-digit growth in 4QFY26F, as the competitive intensity has stabilized; however, we expect a new entrant to step up its media spending to drive demand. We cut our FY26F/27F EPS estimates by 1%/2%, respectively, and maintain our HOLD rating with a lower target price of Rs580 (48x Sep 2027F EPS), from Rs620 earlier. Upside/downside risks: Faster/slower than expected sales growth..

Above views are of the author and not of the website kindly read disclaimer