Buy Shakti Pumps Limited for Target Rs. 1,274 by ARETE Securities

Incorporated in 1982, Shakti Pumps (India) is an integrated manufacturer specializing in solar and electricity-operated submersible pumps. It is the only company to produce a diverse range of products in-house, including variable frequency drives, structures, motors, and inverters for solar water pump installations. With over 1,200 product variants, its applications span diverse sectors such as agriculture, building services, oil and gas, power, metals, and mining. We anticipate significant growth in the solar water pump sector driven by the PM-KUSUM Scheme. Over FY24-27, we expect Revenue/EBITDA/PAT to compound annually at 42%/56%/55% CAGR, respectively. Based on the FY27 EPS and a 28.5 median PE, we project a potential 35% upside from current levels.

Investment Rationale:

Significant Market Opportunity for Replacing Pumps:

India's solar pump market presents a massive opportunity, driven by the need to replace 8 million diesel pumps ( 2,000 billion) and address unmet agricultural water demands for 114 million farmers ( 2,400 billion). The total market potential stands at 4,400 billion, with strong growth prospects due to rising diesel prices, low maintenance costs, and eco-friendly operations, supporting sustainable development.

Backward Integration and Strong Order Book :

The company Plans to raise 400 crs through QIP to set up a 1.2 GW solar cell manufacturing plant to mitigate the ongoing supply shortage of DCR cells and has a robust order book of 2070 Cr, driven by strong demand for solar water pumping systems under government initiatives and export projects. The Maharashtra government has launched the "Magel Tyla Saur Krushi Pump Yojana" to promote the use of off-grid solar pumps for irrigation. The scheme aims to install 1 lakh solar pumps every year for the next 5 years. The KUSUM B scheme is another ongoing scheme for off-grid solar pumps.

The company is also actively participating in six ongoing tenders across key states, collectively worth 15,000 crore, positioning it to secure orders of 4,000-5,000 crore while maintaining its market leadership

Relative Price Performance

EV Segment:

The company entered the EV business in 2022, with plans to invest 250 crores over the next 2 years. The 5-year expansion project, expected to begin its first phase by January 2025, focuses on producing motors and controllers for EVs, with initial orders of 3,000 motors supplied to JBM and potential orders from OEMs like JBM and Ward Wizard. The company targets 2-3x asset turns on capex and margins of 16-18%.

Valuation and View:

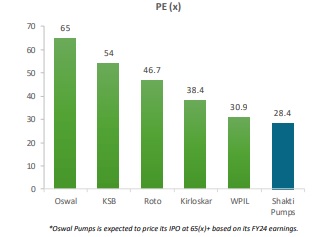

The highly backward-integrated solar water pump business establishes strong business moats, with the replacement demand for electric and diesel-powered water pumps still presenting massive market opportunities. We anticipate significant growth in the solar water pump sector driven by the PM-KUSUM Scheme. Over FY24-27, we expect Revenue/ EBITDA/PAT to compound annually at 42%/56%/55% CAGR, respectively. Based on the FY27 EPS and a 28.5 median PE, we project a potential 35% upside from current levels.

Story in Charts

Despite superior earnings growth, Shakti Pumps is trading at a discounted PE multiples to listed pump manufacturers

Please refer disclaimer at http://www.aretesecurities.com/

SEBI Regn. No.: INM0000127