Buy Tata Consultancy Services Ltd For Target Rs. 3,565 by Axis Securities

TCS’s management hosted an investor and analyst day where the CEO & Managing Director, Mr K Krithivasan, and his management team presented business progress and medium to long-term priorities. The company highlighted its aim to become the world's largest AI-led Technology Services company. The management views the transition from a digital to an AI enterprise as a huge opportunity for growth. It has identified specific areas, such as the Salesforce services market, Revenue verticals, Workforce and India Data Centre, as pockets of high growth. TCS aspires to maintain its EBIT margins between 26-28%, led by strategic initiatives and productivity gains.

Key Takeaways:

* Strategically Evolving from Infrastructure to Intelligence: TCS is transitioning from a Digital Enterprise model, i.e., focused on automation and data reporting, to an AI Enterprise, driven by reasoning, autonomy, and intelligence. Therefore, to achieve this, the company is deploying an Infrastructure to Intelligence architecture that spans the entire technology stack. This includes foundational layers like the TCS Sovereign Cloud and AI-ready data center, moving up to domain-tuned models, AI platforms like TCS AI Wisdom Next, and finally to Intelligence in Action through physical robotics and digital agents. This strategy is anchored around its five key transformation pillars: internal transformation, redefining all services, building a future-ready talent model, making AI real for clients through industryspecific solutions, and expanding the AI ecosystem.

* Implementation of Human + AI framework: TCS's plans to complete a redesign of its service delivery through a Human + AI autonomy framework. This model progresses through five distinct levels of maturity, i.e., starting at Level 1, where humans use general purpose AI tools; advancing to Level 2 with specialized AI assistants; Level 3 involving supervised agents which can handle parts of the work; Level 4 where AI agents work autonomously with human goal-setting; and in Level 5, the Agentic Enterprise, where selflearning AI systems manage full value chains. Currently, this approach has already been operationalised in application development, allowing developers to move from simple coding assistants to overseeing autonomous agents that build and deploy apps. Therefore, to support this, the company has established a massive AI Foundry to democratize access to AI infrastructure for its employees and launched the TCS AI Fridays initiative to foster innovation and problem-solving.

* Building AI-first Workforce and Ecosystem: The company, in its meet reports, has over 580,000 AI-aware associates and more than 180,000 employees with higher-order AI skills, backed by a "Future-ready Talent Model" that treats AI as a teammate. On the partnership front, TCS is engaging in "360-degree collaboration" with major hyperscalers (AWS, Google, Microsoft), AI innovators (Anthropic, NVIDIA, OpenAI), and enterprise solution providers. Moreover, this ecosystem play is further strengthened by strategic acquisitions, such as "ListEngage" and "Coastal Cloud", which enable TCS as a top global Salesforce advisory firm and enhance its capabilities in high-growth areas like marketing and data. Moreover, it also announced a subsidiary to build a sovereign AI data center of up to 1GW capacity (150 megawatts would be around $1 Bn), phased over 5–7 years at an estimated $6-7 Bn investment, in collaboration with technology and finance partners.

* Robust Financial Performance and Internal Targets: TCS is focusing on strong momentum and discipline. The specific portfolio continues to focus on "Redesigning services through AI" and has reached approximately $11 Bn in annualised revenue, while the dedicated AI Services segment alone is generating ~$1.5 Bn annualised, reflecting a robust 16.3% QoQ growth. The company maintains industry-leading profitability with a reported EBIT margin of 25.2%, and has set a medium-term target to expand this to 26- 28% through operational excellence and outcome-based pricing models. TCS continues to deliver exceptional shareholder value, a RoE of 51.2% for FY25, significantly higher than the peers. Its cash generation remains robust, with free cash flow consistently exceeding 100% of net profit, supporting a history of returning capital to shareholders through dividends and buybacks, totalling over Rs 3.7 Lc Cr since the date of listing.

Valuation & Recommendation

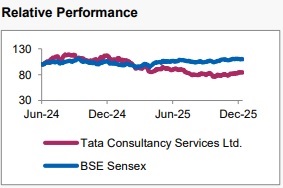

For FY26, management expects its international growth to exceed FY25’s 0.7% constant currency growth, driven by strong deal momentum and AI-led modernisation. We believe TCS’s revenue and EBIT to grow at a CAGR of 5% and 9% over FY25-27E on the back of continued deal wins despite a stable macro-environment, driven by mining of large clients across end-user industries and greater ability to bag larger deals. The company is currently at a 23x/21x P/E multiple for FY26E/FY27E. We recommend a BUY on the stock and value the company at 23x multiple to its FY27E earnings to arrive at a TP of Rs 3,565/share, implying an upside of 11% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633