Buy JK Cement Ltd For Target Rs. 7,200 By Choice Broking Ltd

Correction an Opportunity

Strong Capacity Addition in the Near Term

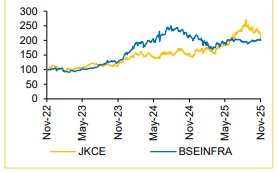

JK Cement Ltd. (JKCE) corrected by 32% from recent highs, although fundamentals remain intact. Hence, we upgrade our rating to BUY (from ADD earlier), while our target price remains unchanged at INR 7,200. Key pillars of our investment thesis are: 1) Cement sector tailwinds like better demand and healthy pricing, 2) On track capacity expansion plan with a potential to reach 32Mnt by FY26 end, 3) Commitment to cost efficiency through increasing adoption of green power, 4) Disciplined leverage strategy, with net debt to EBITDA well below 2x, and 5) RoCE expansion of ~500 bps over FY25-28E under reasonable operational assumptions. We employ a robust EV to CE (Enterprise Value to Capital Employed) based valuation framework which allows us a rational basis to assign a valuation multiple that captures improving fundamentals.

We forecast JKCE EBITDA to grow at a CAGR of 20.1% over FY25-28E, supported by our assumptions of volume growth at 8.0%/10.0%/10.0% and realisation growth of 4.0%/1.0%/0.0% in FY26E/FY27E/FY28E, respectively.

We arrive at a 1 year forward TP of INR 7,200/share for JKCE. We assign an EV/CE multiple of 3.7x/3.7x for FY27E/FY28E, which we believe is conservative, given expansion in ROCE from 11.2% in FY25 to 16.1% in FY28E. We did a sanity check of our EV/CE TP using implied EV/EBITDA, P/BV, and P/E multiples. On our TP of INR 7,200 FY27E implied EVEBITDA/PB/PE multiple is 18.3x/5.9x/34.8x.

Q2FY26: Strong Volume and Realisation Offset by Cost Spike

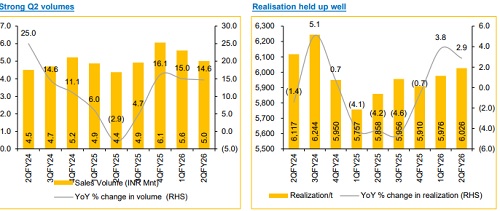

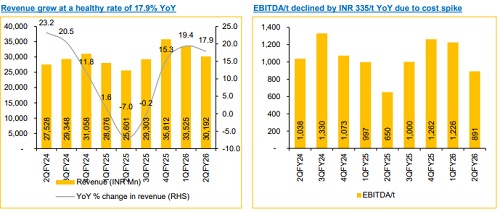

JKCE reported Q2FY26 consol Revenue/EBITDA of INR 30,192Mn (+17.9% YoY, -9.9% QoQ)/INR 4,465Mn (+57.3% YoY, -35.1% QoQ) vs CIE estimates of INR 26,616Mn and INR 4,549Mn, respectively. Volume came in at 5.0Mnt (+14.6% YoY, -10.7% QoQ).(CIE est. 4.5Mnt),

Realization/t came in at INR 6,026/t (+2.9% YoY and +0.8% QoQ), which is higher than CIE Est of INR 5,856/t. Total cost/t came at INR 5,135/t (-1.4% YoY and +8.1% QoQ). High other expenses in Q2 were attributed to major maintenance work undertaken on three kilns and cement mills, as well as significant branding activities (annual dealer conferences and foreign tours) during the lean period. As a result, EBITDA/t came in at INR 891/t, declining by ~INR 335/t QoQ.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131