Buy R R Kabel Ltd For Target Rs. 146 By Yes Securities Ltd

Cables capacity expansion to drive volume growth & margin improvement; reiterate BUY

Result Synopsis

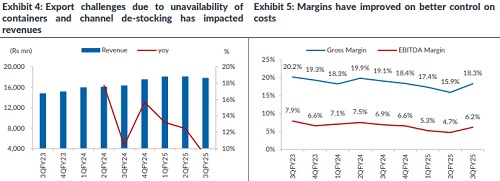

RRKABEL performance has been muted with revenue growing at 9.1% yoy (6.1% lower than estimates), Wires and Cables revenue grew at 7.6%, which is lower than peers as the company is facing challenges in exports as availability of shipping containers has become difficult and on the domestic front there has been channel de-stocking on back of volatility in the copper prices. Margins in Wires and Cables stood at 7.0% contracting 104bps on yoy basis, while on sequential basis it has improved 189bps. Margin contraction is attributed to huge volatility in commodity prices and negative operating leverage resulting on back of slower growth. On the FMEG front revenue grew by 20% yoy driven by strong performance of Fans, Appliances and Switches, losses in FMEG have come off and it is lowest quarterly loss. Reduction in FMEG loss has been on account of superior product mix and healthy volume growth. Management is confident of strong performance continuing in FMEG and breaking even in Q1FY26. On the wires and cables side management has guided 15% volume growth in Q4, guidance is based on demand recovery that has been observed in month of December and in January there has been dealer stocking as copper prices has started to firm up. As far as exports is concerned challenges regarding the container availability is easing and capacity of cables is also coming on stream. Management endeavor is to reach double digit margin by improving mix towards cables which has higher margin. The company has planned capex of Rs12bn in next 3 years most of it will be going towards increasing cables capacity. Considering change in mix we expect margin to start inching up in wires and cables segment and increased capacity to drive volume growth. We reiterate our BUY with revised PT of Rs1,612. We now value the stock at 30x which is at discount to its peers as it must demonstrate volume growth and margin improvement in line with peers.

We estimate the company to now deliver FY24-27E revenue of 18%. We have trimmed down the margin expectation given the change in business mix, increased competition. We value the company at 30x FY27 EPS and our revised PT stands at Rs1,612. We believe the company should do well given the real-estate continues to do well and company’s has distribution network in place to tap the opportunity.

Result Highlights

* Quarter summary – RR Kabel’s has missed estimates with topline growing by 9.1% yoy (6.1% lower than estimates). EBITDA margin stood at 6.2% (136 bps lower than estimates).

* Wires & cables – Wires and cables revenue grew 7.6% yoy, lower than estimates as the company is facing challenges in exports and volatility in copper prices has resulted in de-stocking in wires impacting revenue.

* FMEG –FMEG business revenue grew by 20% YoY. Strong growth in FMEG has been attributed to higher demand for fans, appliances, and Switches. Losses has reduced owing to better product mix and various cost saving initiatives

* Working Capital – Net working capital has largely remained flat with NWC days in 9MFY25 being 65 days which has been commendable.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632