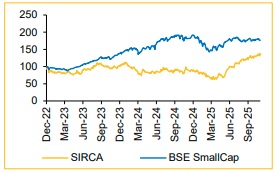

Buy Sirca Paints India Ltd For Target Rs. 625 By Choice Broking Ltd

A Compounding Story

Well-positioned to capitalise on structural growth opportunity

We believe, Sirca Paints Limited (SIRCA), with its exclusive collaboration with Europe’s wood coating stalwart SIRCA S.P.A, is well-positioned to capitalise on the long runway for growth of premium Wood Coatings market in India. As of FY25, this market is pegged at INR 100Bn and would expand at a CAGR of 10%+ over the next 5–10 years in our view.

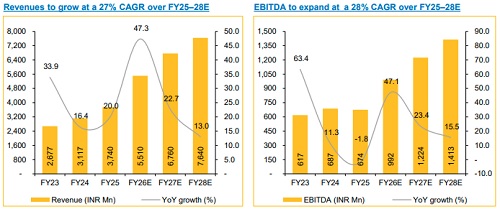

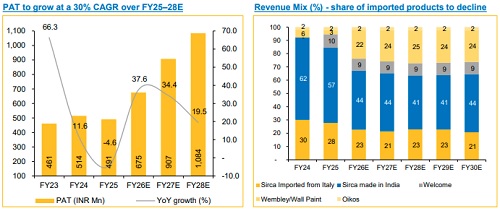

We forecast FY25-28E Revenue/EBITDA/PAT CAGR of 27/28/30% for SIRCA. It trades at attractive multiples of ~18x/26x FY28E EV/EBITDA/P/E. Given the growth runway, we believe these metrics are reasonable, on an absolute as well as relative basis.

The 3 key pillars of our constructive Investment Thesis on SIRCA are:

I) Structural growth story of premium wood coatings in India: We believe, following are the main drivers of growth of the premium coating products and high-quality finishes:

a) Overall growth (FY25–30E CAGR of ~9%) of Paints industry which, in turn, is broadly driven by India’s GDP growth, given construction, housing, real estate are significant drivers of India’s economic growth.

b) Domestic furniture manufacturing industry growth and rapid capacity expansion (30+% over next 3 years) by MDF/HDHMR players.

II) Melamine replacement would accelerate PU demand: We believe there is a structural shift in India’s Wood Coatings market, from formaldehyde based Melamine (INR 30–35Bn market size as of FY25) which is carcinogenic to PU based products which are considered much safer. Transition to PU is also backed by increasing adoption of MDF in the furniture industry as Melamine struggles with adhesion on engineered materials. Additionally, once architect-driven, PU coatings, are increasingly becoming mainstream retail products. While we expect overall Wood Coatings demand to increase at a 10% CAGR over FY25– 30E, we expect PU-based segment to grow at a faster rate of 25% due to these dynamics. SIRCA by virtue of its strong presence in high-quality PU-based wood coatings, would be a key beneficiary of this shift away from Melamine.

III) Strategic acquisitions would expand product portfolio breadth and deepen market reach: SIRCA’s recent strategic acquisitions (Welcome, Wembley) expand its product portfolio breadth and customer base. Welcome and Wembley acquisitions broad-base SIRCA’s presence in the wood coatings value chain into thinners, sanding sealers, enamels etc.

Valuation: We use a DCF-based approach to value SIRCA. Our base case scenario TP is INR 625/sh and upside scenario (20–25% probability event) fair value is INR 800/sh. Whereas, our downside scenario (15–20% probability event) fair value is INR 360/sh.

Risks to our BUY rating: Possible significant slowdown of Indian economy and probable predatory pricing could affect SIRCA’s business.

Q2FY26: Core EBITDA above Expectations

Q2FY26 Revenue grew by 24.3/14.8% YoY/QoQ to INR 1,312Mn (vs CIE estimates at INR 1,234Mn).

EBITDA grew by 44.5/21.5% YoY/QoQ to INR 274Mn. EBITDA margin expanded by 292bps YoY to 20.9%. (vs CIE estimates at 19.7%) owing to lower solvent cost and higher contribution from better margin products like Acrylics.

RPAT is up 36.3/27.4% YoY/QoQ to INR 181Mn. (vs CIE estimates at INR 158Mn).

Management Call - Highlights

* Q2 Margin Performance: SIRCA reported strong Q2 EBITDA margin of 21%, even after integrating Welcome and Wembley, which are relatively lower-margin businesses.

* Drivers of Margin Expansion: The high margin was primarily supported by lower solvent prices during the quarter and a favourable product mix, with a higher contribution from acrylic coatings, which are more premium.

* Growth Outlook: Management guided for 30–40% annual revenue growth over the next 3–4 years, reflecting confidence in both, organic and inorganic expansion opportunities.

* Industry Landscape: India’s wood coatings market, including NC, melamine, PU (both, normal and premium), is estimated at INR 95–100Bn.

* High-quality PU Segment: Within this, the high-quality PU (polyurethane) coatings segment alone accounts for INR 35–40Bn, representing a key value and growth driver for SIRCA’s product portfolio.

* Revenue Share: Retail 70% and OEM 30%

* Client Base: SIRCA has 900+ OEM clientele

* Strengthening Brand Portfolio: The launch of the ‘Wembley–Valentino’ range marks a significant step in Sirca’s strategy to diversify across price points, targeting both, premium and mass-premium, customer segments with differentiated design and performance attributes.

* Technology and Product Leadership: Leveraging its technical know-how from Sirca Italy, SIRCA continues to produce and market top 10 PU products in India, ensuring sustained leadership in premium polyurethane finishes.

* Focus on High-value Segments: Continued emphasis on PU, metallic and acrylic finishes underscores Sirca’s strategy to drive mix improvement and margin enhancement by catering to the evolving aesthetic preferences of urban and institutional customers.

* Engagement with Design Ecosystem: Sirca is deepening its engagement with architects, interior designers and project consultants through curated presentations and collaborations, aimed at enhancing brand recall, specification-led demand and professional advocacy within the design. community

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131