Reduce Fine Organic Industries Ltd For Target Rs. 4,225 By JM Financial Services

Volume growth possible only from FY28E

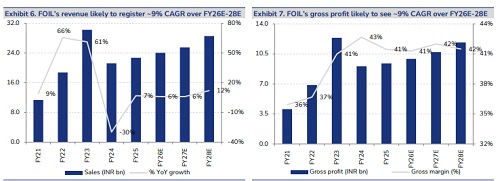

Fine Organic’s (FOIL) 2QFY26 earnings print was unexciting, as the company experienced a dip in volumes amidst tariffs. A sharp rise in raw material prices is likely to have resulted in inventory gains and trading benefits in its subsidiaries. The company currently does not have any headroom for volume growth until 2HFY28, when its new facilities (SEZ unit at JNPA and expansion in the US) are expected to be commissioned. Moreover, depreciation from these large capex projects will begin impacting the P&L from FY27. As a result, the company is likely to see an EPS decline in FY27 and deliver a dismal ~2% EPS CAGR over FY26E–28E, even after building in a ~9% EBITDA CAGR over the same period. We roll forward to Dec’27E earnings and upgrade the stock to REDUCE (from SELL earlier), with a Dec’26 target price of INR 4,225 (based on 30x Dec’27E EPS), as we now expect the stock to experience time correction rather than price correction from here on until volume growth resumes.

* EBITDA beat on JMFe due to higher-than-expected sales and gross margin expansion: FOIL’s 2QFY26 consol gross profit was ~8% above JMFe at ~INR 2.5bn (up 4% QoQ, down 3% YoY) as sales were ~6% above JMFe while in line with consensus, and stood at ~INR 6bn (up 2% QoQ, flat YoY), and gross margin was higher than expected at 41.6% (vs. JMFe of 40.6% and 40.4% in 1QFY26). Other expenses came in at INR 758mn (vs. JMFe of INR 760mn, INR 745mn in 1QFY26). As a result, EBITDA came in ~19%/7% above JMFe/consensus at ~INR 1.4bn (up 9% QoQ, down 10% YoY). Further, PAT was ~3%/1% above JMFe/consensus at ~INR 1.1bn (down 7%/8% QoQ/YoY). The company is likely to have benefitted from sales in overseas subsidiaries. Standalone EBITDA came in flat at INR 1.08bn in 2QFY26 (vs. INR 1.07bn in 1QFY26).

* Fine’s per kg EBITDA higher than historical range: In 2QFY26, based on our calculations, the company is likely to have seen a 6%/4% QoQ/YoY volume decline, with overall volume likely at ~24,745MT during the quarter. However, owing to a sharp jump in the prices of Erucic acid (company’s key raw material) (prices up 19% QoQ), the company’s per kg gross profit was up 11% QoQ and stood at ~INR 100/kg. With only a modest rise in opex/kg, the company’s EBITDA/kg likely stood at ~INR 55/kg (or ~USD 0.62/kg) (up ~17% QoQ). This per kg EBITDA is higher than the company’s historical average of USD 0.45–0.55/kg over FY14–20.

* Estimate 2% EPS CAGR over FY26E-28E; upgrade to REDUCE: While the company has come up with capacity expansion plans for the new SEZ facility at JNPA and the new capacity in the US, we believe meaningful contribution from these facilities will only flow through from FY29. In fact, before the facilities start operational contribution, depreciation will start hitting the bottom line. Hence, we expect an EPS de-growth in FY27E. We generously build in INR 0.9bn EBITDA contribution from new facilities in FY28E in our base case. We now expect a ~9% EBITDA CAGR over FY26E-28E. While factoring in the increase in depreciation, EPS CAGR comes out to only ~2% over FY26E-28E. Factoring in 2QFY26 performance and the elevated raw material price scenario, we raise our FY26E-28E EPS estimates by ~1-6%. We roll forward to Dec’27E earnings and upgrade the stock to REDUCE (from SELL earlier) with a revised Dec’26 TP of INR 4,225 (from Sep’26 TP of INR 4,070 earlier, based on 30x Sep’27E EPS). Key upside risk: With raw material prices going up, there remains a risk of a boost to spreads in the near term.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361