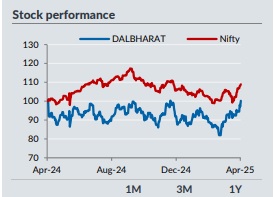

Add Dalmia Bharat Ltd. For Target Rs.9,966 By Yes Securities Ltd

Better Pricing, Strong Volumes, Lower Costs – Upgraded to BUY

DALBHARA reported revenue of Rs40.91bn (–5% YoY, +28.6% QoQ), 16.3% above our est. The strong QoQ growth was driven by higher volume despite muted realizations. Volumes stood at 8.6mt (–2.3% YoY, +28.4% QoQ), while realizations dipped 2.8% YoY but remained flattish QoQ, aided by firmer pricing in Eastern markets. EBITDA in absolute number came in at Rs7.93bn (+21.3% YoY, +55.2% QoQ), and EBITDA/tn at Rs922 (+24.1% YoY, +21% QoQ), supported by decline in Opex/tn (7.6% YoY, 3.8% QoQ). PAT rose to Rs4.35bn (+38.1% YoY, +613% QoQ), significantly above our and street est, aided by better top-line growth coupled with higher other income.

During 4Q FY25, the company has commissioned 2.9mtpa cement capacity (2.4mtpa in Assam + 0.5mtpa in Bihar), with this the total capacity reached to 49.5mtpa. Also, the company has announced a capex of Rs35.2bn to add 3.6mtpa clinker capacity (by FY26E) in North-East and 3.5mtpa/ 3mtpa cement grinding units in Belgaum/ Pune by FY27E.

As per management commentary, the Q4 performance was strong on both operational and profitability fronts, driven by scale and cost control. While the tone on pricing was conservative, despite April price hikes in key markets. However, we believe sustainability of the recent Rs45–50/bag price increase in South India could act as a near-term margin lever. Demand outlook remains healthy, with 7–8% growth expected in FY26E. Eastern and NorthEastern regions continue to offer pricing support due to limited supply additions. DALBHARA's footprint in these regions is a structural advantage. Upcoming clinker capacity in KA by 2Q FY26 will address past supply gaps and support volume growth. Given lowcapacity utilization among acquired southern players, near-term competition is likely to remain moderate. With its balance of strategic expansion, disciplined cost management, and focused regional positioning, we remain constructive on DALBHARA’s medium-term growth and margin trajectory.

Outlook and Valuation:

We see regional benefits in the near term, i.e., stable pricing in DALBHARA’s key markets, especially in the South and East. We expect the industry to witness price discipline in the southern region, led by the entry of larger players. The recently added capacity (4.9 MTPA in FY25) is expected to contribute to volumes from FY26E onwards. A new expansion of 6 MTPA cement and 3.9 MTPA clinker is expected to be commissioned by FY27E, likely catering to domestic as well as neighboring states (i.e., Central and Western India). We project ~66%/67% capacity utilization in FY26E/FY27E, backed by pent-up demand from FY25 and an uptick in govt demand from Q2FY26E. The near-term target to achieve Rs 150–200/tn cost savings has already started reflecting in DALBHARA’s numbers, and we expect the full impact within 1–2 years. We have increased our Revenue/EBITDA/PAT estimates and expect them to grow at a 13%/26%/34% CAGR over FY25–FY27E. At the CMP, the stock is trading at USD 96 EV/ton, which is ~16% discount to its five-year average EV/ton of USD 111, and below that of other regional players. We are valuing the stock at 13x FY27E EBITDA/ton to arrive at a target price of Rs 2,491 (earlier Rs 2,129) and have upgraded the rating to BUY from ADD.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632