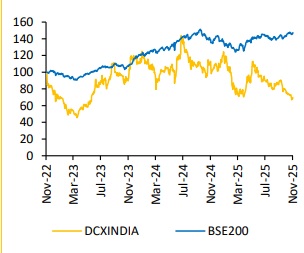

Reduce DCX Systems Ltd for the Target Rs. 225 By Choice Broking

Execution Slippages Cloud Near-term Outlook

DCX Systems delivered a disappointing quarter, with performance missing expectation on key financial parameters. The company witnessed pressure on both, revenue and profitability, resulting in a negative operating outcome. DCX’s overall performance raises nearterm concern with regards to the company’s ability to sustain margin and efficiently execute its robust order pipeline.

Despite the weak quarterly print, DCX’s long-term fundamentals remain intact. The company continues to benefit from a strong order book (~2.5x its FY25 revenue), alongside a well-established manufacturing footprint and deep partnerships with reputed global OEMs. However, the persistent execution tardiness and rising operational caution remain key points of concern. These factors warrant close monitoring, particularly as management works to stabilise profitability & strengthen leadership with the appointment of a new CFO

From a strategic standpoint, DCX’s positioning in the defence manufacturing ecosystem, coupled with its growing export traction, supports a positive long-term outlook. However, in the near term, we prefer a measured stance until there is visible evidence of (a) margin recovery and (b) management stability. Accordingly, we maintain our REDUCE rating, with a revised target price downwards to INR 225 (earlier INR 275), valuing the stock at 30x the average FY27–28E EPS. We recommend selective accumulation on any newsled weakness while awaiting execution improvement and margin clarity

Disappointing Quarter; Sharp Margin Erosion

Revenue for Q2FY26 down 1.4% YoY & down 13.2% QoQ at INR 1,929 Mn (vs CIE est. INR 2,302 Mn).

* EBIDTA for Q2FY26 came in at INR -128 Mn (vs CIE est. INR 11 Mn). EBITDA margin stood at -6.6%, contracted by 470bps YoY (vs CIE est. 0.5%).

* PAT for Q2FY26 came in at INR -90 Mn (vs CIE est. INR 62 Mn). PAT margin contracted by 735bps YoY, reaching -4.7% (vs CIE est. 2.7%).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131