Buy Mphasis Ltd For Target Rs.3,310 by Prabhudas Liladhar Capital Ltd

Re-rating on the card

Quick Pointers:

* Well-positioned for sustained revenue growth driven by strong deal wins

* Improving fixed price project (FPP) revenue mix to help maintain margins, despite continued investments

We are upgrading MPHL to ‘BUY’ led by steady and consistent performance, attributed to an elevated deal TCV and robust conversion. Despite the fact the deal funnel seems to be encouraging for both BFS (+45% YoY) and non-BFS (+139% YoY) in Q2FY26. More importantly, the pain within Logistics & Transportation (L&T) has subsided, the vertical performance should see a progressive turnaround through H2FY26 and FY27, driven by focused investment in potential accounts. Ex-L&T, USD revenue grew by 15.7% YoY in H1FY26, during which L&T saw ~55% YoY decline. Ex-L&T, USD revenue reported a CQGR of 3.5% and 2.5% over the past 4 and 8 quarters, respectively, which is encouraging considering the current volatile environment.

(1) Investments in scaling TAM (beyond BFS), (2) onboarding of senior leaders (in Q2FY25) for securing large strategic deals, and (3) focus on products and accelerators to augment new-age offerings, have supported MPHL win strategic accounts and demonstrate value proposition. Additionally, we believe that any further cuts in US interest rates would be an incremental trigger for volume uptick in the Mortgage business for MPHL. With that, we are revising our revenue estimates upward by ~100bps/~200bps for FY27E/FY28E, while keeping our margin estimates unchanged, which translates to an EPS upgrade of 1%/3%. Given its relative outperformance and 15% earnings CAGR over FY26-28E, we are upgrading PE multiple to 27x (25x earlier) with TP of Rs. 3,310. Upgrade to ‘BUY’ (‘Accumulate’ earlier).

From dialogs to demonstrations:

Beyond boardroom dialogs or narratives, it requires actual demonstrations of productivity gains, reducing effort and accelerating revenue growth. Early investments in product accelerators and platform-led service architecture are helping MPHL demonstrate better value propositions to enterprise clients. Despite the current budget constraints and conservative nature of enterprise clients, MPHL is able to convert long-term strategic projects to FPP from T&M setup earlier. With that, the company gets to play on an additional budget that is derived through cost-savings and effort reduction, thereby self-funding and increasing the original budget allocated. The shift is evident from FPP revenue mix improving to ~43% in H1FY26 from ~32% in FY24.

Large deal orchestration: Large deal wins stood at 10 in H1FY26 itself vs. 13 for the full year FY25 and 15 in FY24. The acceleration in large deals has helped improve NN large deal TCV to USD 2.0bn (TTM, up 115% YoY). Additionally, elevated deal TCV over the last 4 quarters indicates a large deal pipeline (2x) with a high AI-led concentration mix (~70%) within the pipeline, demonstrating revenue visibility for the medium term. Strategic wins can be attributed to the senior leadership team, established in Q2FY25 to chase must-have potential accounts that are scalable and strategic in nature. Existing advanced AI capabilities have also helped find incremental leads and early breakthroughs.

Improving unit economics:

Decoupling of revenue growth and headcount growth has accelerated of late, leading to better talent utilization and revenue per employee. Revenue per billable employee increased to ~USD67.0k in H1FY26 (annualized) vs. ~USD64k/~USD59k in FY25/FY24, which is largely a function of limited new headcount addition; H1FY26 saw a reduction in headcount of 600+. With that, we believe there is limited scope for sweating assets with utilization reaching its peak at ~86% in H1FY26. Despite the strong unit economics, margin improvement was limited due to incremental investments in driving future growth and structurally realigning pockets that are weak.

Valuations and outlook:

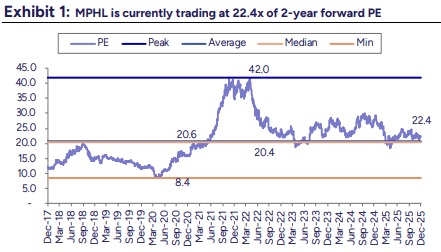

We estimate USD revenue CAGR of 9.8% and INR earnings CAGR of 15.2% for FY26-28E. The stock is currently trading at 25x and 21x to its FY27E and FY28E earnings, respectively. We assign PE multiple of 27x to Sep’27E earnings to arrive at TP of Rs3,310 and upgrade to ‘BUY’.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271