Buy Britannia Industries Ltd for the Target Rs. 6,761 By Prabhudas Liladhar Capital Ltd

A perfect Bake

Quick Pointers:

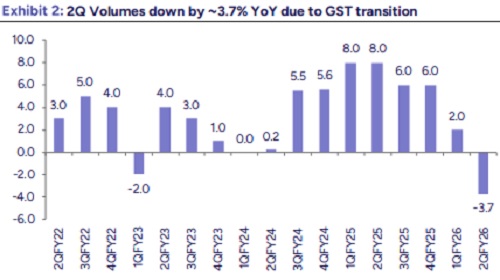

* ~GST transition impacts 2Q sales by 2-2.5%, expect 2H26 volumes to grow in high single/ low double digits, stable RM to sustain margins

* Organised players like to gain share from big GST re-set, however, expect some hit for PLI/GST refunds for capex incurred

We increase FY27/FY28 EPS estimates by 4.3% factoring in 1) expected volume gains from higher grammage (65% of sales) and price cuts 2) steady margins outlook with focus on volume-led growth 3) benefits of sustained innovations and cost control and 4) lower PLI and GST refunds under various Govt capex schemes. BRIT delivered ~3.7% revenue growth as GST led transition impacted sales by 2-2.5% while GM was up by 16bps/138bps YoY/QoQ on relatively stable commodity prices.

We remain positive on BRIT given 1) Sustained leadership in Biscuits and Bakery 2) likely share gains from local and regional players given sharp reduction in GST rates (18% to 5% on 85% of portfolio) 3) rising scalability & improved profitability in adjacencies and 4) strong innovation pipeline with focus on region/ channel specific products & premiumization. We expect double digit volume growth in 2H26 and FY27 led by benefits of GST cut, favorable macro environment, new launches, and benign inputs. We estimate 16.5% EPS CAGR over FY26-28 and value the stock at 50x Sep’27EPS and assign a target price of Rs6761 (Rs6484 earlier). Retain BUY.

* Consolidated Financials: volumes decline ~3.7% on GST transition

* Revenues grew by 3.7% YoY (~3.7% volume decline) to Rs48.4bn (PLe: Rs50.4bn) as GST transition impacted sales by 2-2.5%. Sales were led by double-digit growth in Rusk, Wafers, and Croissants with strong momentum in E-com.

* Gross margins expanded by 16bps YoY to 41.7% (Ple: 40.5%) driven by relatively stable commodity prices and sustained efforts to optimize costs across value chain.

* EBITDA grew by 21.8% YoY to Rs9.5bn (PLe: Rs8.3bn); Margins expanded by 294bps YoY to 19.7% (PLe:16.5%). Employee Cost down 22% YoY as base quarter had Rs500mn provision for SAR (Phantom stock options). QoQ employee cost declined as 1Q26 had Rs520mn provision for SAR while QoQ stock price is up by less than 2%. Other expenses declined due to decline in volumes during the quarter.

* PBT grew by 23.4% YoY to Rs 8.9bn (PLe: Rs 7.8bn). Adjusted PAT grew by 23% YoY to Rs6.6bn (PLe: Rs5.8bn). Excluding the impact of SAR in 2Q25, EBIDTA and profits would have grown by ~15% each.

* Standalone sales increased by 3.8%, EBIDTA by 22.5% and PAT by 34% (23% ex of SAR) as other income increased by 112% due to dividend from subs.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271