Buy Radico Khaitan Ltd for the Target Rs. 3,340 by Choice Institutional Equities

Business Overview:

RDCK is one of India’s oldest and largest Indian-made Foreign Liquor (IMFL) manufacturer. It is a distiller, which entered the branded space in 1998 with 8PM Whisky. Its flagship – Magic Moments Vodka – commands 80% share in India and ranks 6th globally. Morpheus XO leads premium Brandy with over 60% share. With over 15 launches in as many years, 13 in the premium segment, RDCK’s Prestige & Above category grew 21.1% YoY in FY25, contributing nearly 41% of IMFL volumes. Recent premium launches include Rampur Indian Single Malt, Jaisalmer Gin and Royal Ranthambore Whisky, supported by celebrity partnerships and strong digital campaigns.

Could RDCK balance high-margin P&A growth without compromising traction in Popular segment?

RDCK is successfully executing a dual-growth strategy. P&A expansion has made it the primary revenue driver (48.2%), while Popular volumes are regaining traction, owing to policy reforms. With 5 of 8 Millionaire brands in P&A and a supportive regulatory backdrop, both segments are poised for strong FY25–28E CAGRs of 23.3% (P&A) and 22.6% (Popular), respectively.

Could RDCK’s distribution and bottling strength act as a sustainable moat?

RDCK’s extensive distribution and bottling infrastructure acts as a sustainable moat by creating high barriers to entry. With over 1,00,000 retail outlets, 10,000 on-premise accounts, a strong CSD presence and key brands capturing up to 16% market share, the company ensures unmatched market penetration. Supported by 43 bottling units, over 300 sales executives and operations in over 100 countries, this scale secures brand visibility, deep market access and operational efficiency.

How is RDCK leveraging backward integration to strengthen margins?

RDCK is leveraging backward integration by expanding its ENA capacity to 321Mn litres through new grain-based and dual-feed distilleries, ensuring supply security, cost stability and consistent quality. RDCK will save cost, owing to lighter packaging and local sourcing. With major capex behind, this integrated setup is expected to drive ~320 bps margin expansion over FY25–28E through improved mix, lower leverage and stronger free cash flow.

Why invest in RDCK?

Investing in RDCK offers exposure to India’s growing Premium and Popular spirits market. It has built a strong brand portfolio, with several Prestige & Above brands leading revenue contribution, supported by a wide distribution network across retail, on-premise and international markets. Additionally, its backward-integrated operations ensure supply security, cost-efficiency and margin support. With proven execution, a diversified portfolio and operational scale, RDCK presents a compelling investment opportunity.

Valuation:

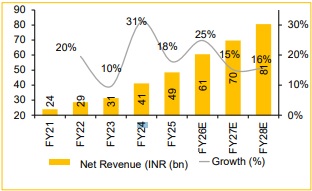

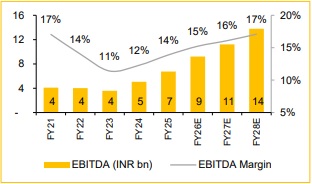

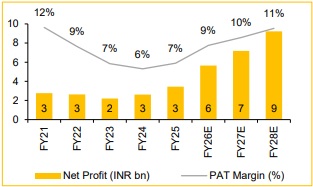

* RDCK is poised for FY25–28E Revenue / EBITDA / PAT CAGR of 18.5% / 26.9% / 39%, respectively, driven by premiumization, distribution scale-up and cost synergies. We have a ‘BUY’ rating with a target price of INR 3,340 based on DCF methodology. Our valuation implies a ~62.2x / 48.4x PE on FY27E / FY28E EPS.

Key Risks:

* RDCK faces risks from rising competition in Vodka, Brandy and the premium segment, which could pressure margin and possibly affect market share.

* Additionally, advertising restrictions and state-level regulatory changes governing pricing and branding may limit marketing flexibility and create volatility in volumes and growth.

Revenue projected to expand by CAGR of 18.5% from FY25 to FY28E

Driving the margin up by 320 bps by FY28E

We expect PAT to grow by 435bps over FY25-28E

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)