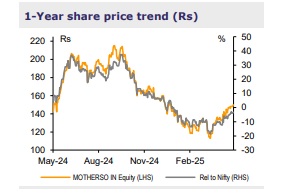

Buy Samvardhana Motherson Limited For Target Rs. 180 By Emkay Global Financial Services Ltd

SAMIL logged 8% revenue growth, while its EBITDA performance was impacted by difficult macros and on-going expansion activities across divisions. Underpinned by its innate engineering and manufacturing capabilities, SAMIL targets a major ramp-up in consumer electronics manufacturing, supported by strong vertical and backward integration initiatives (in mobile phone components, PCBA, silicon wafer components) over the next 5 years. The management offered a glimpse of its next 5-year plan, per which it eyes USD108bn group revenue by FY30 (vs USD25.7bn in FY25 on gross basis). We believe that with the worst-behind for core business, major foray into consumer electronics amid the bold vision for FY30 grants SAMIL a strong footing. We raise our SoTP-based TP by 20% to Rs180 (from Rs150 earlier) to reflect improving outlook; maintain BUY.

Modest revenue growth; margin impacted by macros and ongoing expansion Revenue grew 8.3% YoY to Rs 293.2 (above Consensus estimate) led by Modules & Polymers (up 12%) and Emerging businesses (up 41%). EBITDA declined 10% YoY to Rs26.4bn, with EBITDA margin down by 70bps QoQ to 9% owing to gross-margin contraction and higher other expenses. Adj PAT stood at Rs10.5bn (down 23% YoY), largely on account of higher depreciation. SAMIL’s net debt-to-EBITDA stood at 0.9x.

Earnings Call KTAs 1) The management highlighted continued outperformance vs the underlying industry, against the backdrop of muted global production; SAMIL’s revenue grew ~8% vs 1% degrowth in global light vehicles. PV volume de-growth in the developed markets of Europe and North America was largely offset by growth in the emerging markets of China and India. CV volume declined 5% YoY; sustained premiumization trends and growing share of SUVs/Hybrids would support the secular content growth. 2) While most global macros are largely stable, there was some uncertainty owing to the evolving trade dynamics. 3) The first consumer electronics plant commenced production in Q3FY25, and is ramping up sharply with 15-17mn units production expected in FY26. Two significantly larger plants would come on-stream in Q2FY26/Q3FY27 and are seen supporting SAMIL’s vertical integration efforts. 4) While such greenfields would manufacture mobile phone components (cover glass) to begin with, they have capability to branch out into other products as well. SAMIL aims to move beyond assembly, into full-scale consumer electronics manufacturing, backed by strong backward integration initiatives. 7) A new PCBA plant is being set-up to cater to internal needs as well as for external sales to customers; another greenfield is being set up to supply components used in the manufacture of silicon wafers, to support players in the semi-con industry. 8) With most pressures now behind for the Modules and Polymers division, margin should improve for the segment, contingent on OEM volume recovery. 9) In the Vision Systems division, SAMIL has made a breakthrough in camera monitoring systems for CV applications. 10) FY26 capex guidance stands at Rs60bn, of which 50% would be growth-oriented (mainly toward non-auto businesses).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354