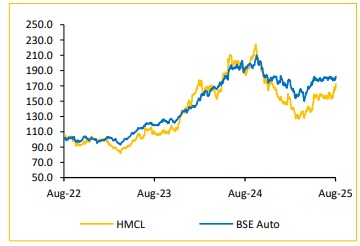

Add Hero MotoCorp Ltd for the Target Rs. 5,100 by Choice Broking Ltd

Accelerating EV Momentum and Global Ambitions:

HMCL is strategically accelerating growth through its EV business, VIDA, and an ambitious global market expansion. VIDA has shown remarkable progress, achieving its highestever quarterly market share of 7%, which more than doubled year-on-year, and further increased to over 10% in July. A key innovation is the pioneering Batteryas-a-Service (BaaS) model launched with the VIDA VX2, which significantly reduces upfront ownership costs, fostering broader EV adoption. In its global business, HMCL recorded 27% year-on-year dispatch growth and target’s to achieve 10% of total revenue and volumes from international operations.

Combined with a favorable macroeconomic environment and strong festive season expectations, HMCL is well-positioned for strong sales in both its core and emerging growth segments

View and Valuation: We revise our FY26/27 EPS estimates down by 5.4%/5.0% and maintain our target price of INR 5,100. We value the company at 17x (maintained) on the average FY27/28E EPS, while we introduce FY28 estimates. Consequently, we change our rating to ‘ADD’ (previously ‘BUY’).

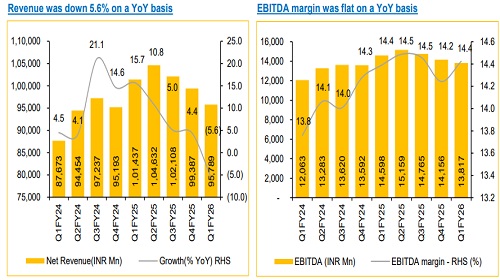

Revenue and EBITDA in line, EBITDA margin better than expectations:

* Revenue was down 5.6% YoY and down 3.6% QoQ to INR 95,789Mn (vs consensus est. at INR 97,970Mn) led by 10.9% YoY de-growth in volume and 6.0% YoY growth in ASP.

* EBITDA was down 5.3% YoY and down 2.4% QoQ to INR 13,817Mn (vs consensus est. at INR 13,731Mn). EBITDA margin was flat YoY and up 18bps QoQ to 14.4% (vs consensus est. at 14.0%).

* PAT was flat YoY and up 4.1% QoQ to INR 11,257Mn (vs consensus est. at INR 10,629Mn).

Aggressive product portfolio expansion:

HMCL is taking steps to grow its market share with a strong and diverse product strategy. In the important 125cc motorcycle segment, the company plans two new products in Q2FY26 with the launch of an all-new model and a refreshed sporty variant. In scooters, HMCL reached its highest-ever market share in June at 9.7%, owing to the success of the new Destini 125 and Xoom 125. The upcoming launch of the Xoom 160 will address gaps in the portfolio and further strengthen its position. Additionally, HMCL’s partnership with Harley-Davidson is set to deliver new premium models starting in Q2FY26, supporting its entry into higher-end segments.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131