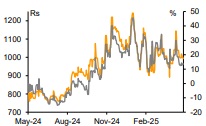

Buy Vijaya Diagnostic Ltd For Target Rs. 1,150 By Emkay Global Financial Services Ltd

On track execution; growth trajectory looks promising

Vijaya’s Q4FY25 results were a slight miss on our estimates (2%/3% on sales/EBITDA) due to industry-level headwinds (extended festivities in South India), capacity constraints in Pune centers, and gross margin contraction. However, the outlook for the next 2-3 years looks promising on the back of timely commissioning of new hubs in non-core geographies and management guidance of +15% sales CAGR over FY25-28. We expect EBITDA margin to be flat over the next two years, as operating leverage offsets initial losses owing to multiple hub additions in FY26. Factoring in the Q4 miss, we cut our FY27 sales/EBITDA estimates by 2%/4%, respectively. We maintain BUY with unchanged Mar-26E TP of Rs1,150 (DCF-based), implying FY27E PER of 53x. Sustained growth momentum (18% sales CAGR), robust balance sheet, and cash-flow generation provide comfort on valuations.

A muted quarter; network execution remains on track

For Q4FY25, Vijaya Diagnostic reported consol revenue of Rs1.73bn (+12% YoY) with overall patient and sample volume growing 7% and 13% YoY, respectively. Ex-PH, growth in patient and test volume stood at 9% and 12%, respectively. The Wellness segment contributed to 15% of the topline (+20% YoY, including PH). Contribution from the B2C segment stood at 93%, while the radiology mix was at 38%. Gross margins contracted by 70bps YoY and employee costs grew 16% YoY leading to EBITDAM contracting by 90bps YoY. Per the management, increase in wellness contribution and the higher input costs (for reagents) have caused a contraction in gross margin. PBT adjusted for oneoffs related to restructuring costs is likely to have been Rs384mn (+10% YoY) while reported PAT was up 4% YoY. Net cash balance stood at Rs2.8bn as of Mar-25. The company has declared a final dividend of Rs2/share.

Outlook and risks

With the commissioning of six new hubs (all in non-core geographies), Vijaya is on track to diversify beyond its core region and transition into a pan-India integrated operator. Management guidance of +15% revenue CAGR over the next three years lends comfort on scalability of the business model, despite the asset heavy nature of the business. While dip in margins is imminent owing to multiple hub adds in FY26, we expect them to recover to 40.5% by FY28 on the back of operating leverage and management target of achieving breakeven within 12 months for any newly commissioned hub. We, thus, remain constructive on Vijaya’s ability to replicate its set template of delivering profitable growth, even in non-core geographies. A strong balance sheet (net cash position of Rs2.8bn as of Mar-25), sustained growth momentum, and robust cash generation (OCFto-EBITDA at 82% in FYFY25) lend comfort on valuations, as we anticipate revenue/PAT CAGR of 18/25%, respectively, over FY25-28E. Key risks: Increased competition in the organized market (non-core markets), shortage of manpower, adverse regulatory ruling around pricing for healthcare services.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)