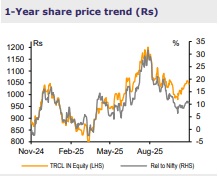

Add The Ramco Cements Ltd for the Target Rs.1,080 By Emkay Global Financial Services Ltd

Steady quarter; fresh price hikes required to induce momentum.

The Ramco Cements (TRCL) reported standalone EBITDA of ~Rs3.9bn (up 24% YoY and broadly flat QoQ), which is in line with our estimate. In Q2FY26, TRCL improved its growth rate, which was flat YoY (though down ~7% QoQ). However, the growth rate was below the industry average due to early monsoons/excess rainfall and a run-up to GST rate rationalization. Cement realization moderated by ~2% QoQ (in line with the industry), likely due to higher contribution of OPC and more non-trade dispatches. The ~Rs400mn (Rs160/t) levy of mineral bearing land tax was offset by a sharp rise in green power consumption to 48% (of total power consumed) in Q2 vs 39%/31% YoY/QoQ, respectively. Other expenses rose 15% YoY (and were 11% above estimate) on higher brand promotion expenses for the construction chemical business (Hardworker’). Consequently, EBITDA/t stood at Rs850 (Emkay estimate: Rs915) vs Rs700 YoY and Rs965 QoQ.

View: Based on our latest checks (Minor correction in cement prices with likely hike in Q4), we see subdued demand in South India, owing to the extended monsoons and flood-like situation in various parts of AP/TG in Oct-25. Also, cement prices tapered off by ~Rs7/bag in the South. This will impact profitability in the short term. Hence, factoring in the above, we cut our FY26E/27E/28E EBITDA by 7-10%. Buoyancy in the construction chemical business (~4% of H1FY26 revenue) is noted and will remain a key monitorable, given the steep revenue guidance by CY29/30. We hold on to our 13x EV/EBITDA multiple and roll forward our EBITDA to Q2FY28E, arriving at a revised TP of Rs1,080 (earlier Rs1,150). We retain ADD on the stock.

Steady quarter

TRCL reported standalone EBITDA of Rs3.9bn, in line with our estimate. Unseasonal rainfall and soft demand till the run-up to the lower GST rate led to flat YoY cement volumes. Cement realization moderated by ~2% QoQ (in line with that of the industry) likely due to higher a) contribution of OPC (35% in Q2 vs 31% QoQ) and b) non-trade dispatches (31% in Q2 vs 30% QoQ). Inflation in raw material costs was offset by higher green power consumption and lower fuel prices, resulting in unit (RM+P&F) cost increasing by a meagre ~1%. Absolute fixed costs increased 12%/6% YoY/QoQ due to overhead cost-built up in the construction chemical segment. TRCL reported EBITDA/t of Rs850, up 22% YoY. PAT stood at Rs743mn, viz ~3x YoY.

30mtpa capacity by FY26; peak net debt by Mar-26E

TRCL is steadfast in achieving 30mtpa capacity by FY26-end, with the commissioning of Kurnool line-2 and debottlenecking activities. The company guided for capex of Rs12bn in FY26; we estimate ~Rs5bn capex in FY27E, as no major expansion projects are lined up for the next fiscal year. Hence, we see net debt peaking in FY26E, with net debt/EBITDA at 2.8x/1.8x/1.3x in FY26E/27E/28E, respectively.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354