Fundamental Stock Pick : Ambuja Cements Ltd For Target Rs. 704 By Nirmal Bang Ltd

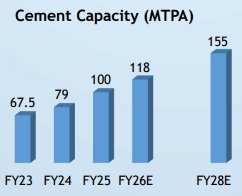

Ambuja Cements, part of the Adani Group, is one of India’s largest and fastest-growing cement companies, operating a 107 MTPA capacity base that is set to scale up to 155 MTPA by FY28. With an extensive nationwide footprint of integrated plants, clinker units, grinding stations, ports and 29,000+ dealers, the company has built a highly efficient, low-cost operating model. Its industry-leading fuel efficiency, rising renewable power mix, strong logistics backbone and ongoing debottlenecking efforts keep Ambuja firmly positioned among the lowest-cost producers. Recent acquisitions Sanghi, Penna and Orient along with a strong pipeline of greenfield and brownfield expansions, are transforming Ambuja into a true pan-India cement powerhouse. Importantly, the company remains debt-free and AAA-rated, enabling it to pursue aggressive growth while maintaining exceptional balance-sheet strength.

* Strong Volume Growth Visibility: Ambuja is executing one of the largest industry expansions, targeting cement capacity of 140 MTPA, further rising to 155 MTPA through 15 MTPA of debottlenecking already identified and Clinker capacity will ramp to 96 MTPA FY28 which is currently 73 MTPA towards a materially higher level.Expansion is backed by reliability upgrades of acquired assets (Sanghi, Penna, etc.) and strong logistics/digital investments enabling higher utilization and operating leverage.

* Premiumisation & Brand Leadership: Company is rapidly scaling premium cement now 35% of trade sales with 28% YoY growth driven by strong customer pull, digital and on-ground engagement, and premium brands like Kawach, materially boosting realizations and margins. Thirteen new blenders will be commissioned over the coming year, enabling better product mix efficiency and significantly increasing premium cement contribution, supporting higher margins.

* Industry-Leading Cost Reduction Roadmap: Ambuja is executing a clear multi-year cost optimization program, targeting Rs 4,000/ton by Mar’26 and Rs 3,650/ton by FY28, supported by synergy benefits and efficiency gains. Key levers include lowest-in-industry kiln fuel costs, higher AFR usage, aggressive logistics optimization (Rs 80–100/ton savings), and 40%+ green power share (Rs 70–90/ton savings) to cut energy costs structurally. Debottlenecking across clinker and grinding, digital/AI-driven process controls, and improved utilization of acquired assets will drive sustained cost reductions and margin expansion.

* Favorable Industry Tailwinds: Strong multi-year demand visibility driven by sustained momentum in housing, infrastructure build-out and a revival in rural construction activity. Structural boost from GST cut (28% → 18%), improving affordability and accelerating bagged cement demand across markets.

* Valuation:

* Cement sector outlook remains long-term positive, supporting higher utilization, pricing stability and strong volume growth for leading players like Ambuja. Demand is expected to grow by 7-8% for FY26E driven by higher investments in both private and public sectors.

* Ambuja accelerated its scale-up through strategic acquisitions, adding Sanghi Industries in FY23 and completing the purchases of Orient Cement and Penna Cement in FY25.These deals expanded its total capacity to >100 MTPA, strengthened its footprint across South, West and Central India, and unlocked large limestone reserves. Operational turnaround of Sanghi, Penna, and Orient Cement assets can significantly lift ROE and EBITDA, with markets not fully pricing in the synergy benefits yet.

* FY26 performance for H1 was impacted by softer cement prices in key markets, which compressed realizations despite strong volume growth. Monsoon impacted plant efficiency and led to higher lead distances and evacuation costs. The company has increased its market share to 16.6% and targets to increase it to 20-22% by FY28.

* EBITDA/tn for the previous quarter came at Rs 1061 and aims to achieve Rs 1500 by FY28. Ambuja is likely to deliver higher volume growth than the industry supported by the capacity additions. They are also set to gain meaningfully from the integration of Penna and Sanghi, as both acquired businesses continue improving operations and move steadily toward achieving 4-digit EBITDA per ton.

* Capacity utilization currently stands at 65–67%, indicating meaningful headroom for higher output as demand strengthens.

* We estimate Revenue/EBITDA/PAT to grow at 15%/41%/9% CAGR between FY25-27E respectively. Key drivers of Ambuja’s growth include rapid capacity expansion, strong premiumisation, and sustained cost reductions supported by rising housing and infrastructure demand. The stock is currently trading at 11.5x to FY27E EV/EBITDA which is believed to be at discount when compared to its historic average valuation. We have valued stock at 14.5x FY27E EV/EBITDA to arrive at a target price of Rs 704 and recommend to BUY the stock.

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176