F & O Rollover Report 31th December 2025 by Axis Securities

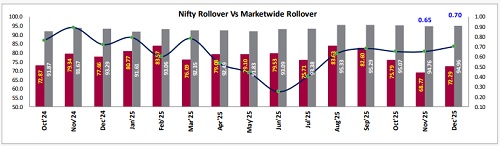

Nifty Rollover: The Nifty December series concluded with a rollover rate of 72.3%, marking a moderate improvement over the previous month's 68.8% but remaining notably below the three-month and six-month benchmarks of 78.0% and 78.8%, respectively. This deceleration relative to historical norms suggests a degree of caution among large-scale traders, as a lower-than-average rollover often indicates a reduction in aggressive long-term positioning.

Bank Nifty Rollover Analysis: Bank Nifty exhibited robust momentum with a rollover of 77.5%, significantly outperforming both the prior expiry’s 70.4% and its six-month average of 63.8%. This surge in participation, which also eclipsed the three-month average of 75.8%, signals a bullish rotation toward the banking sector and a renewed conviction among institutional participants.

Market-Wide Rollover Trends: Broad market participation remains resilient, with the December market wide rollover reaching 94.96%, marginally surpassing the previous cycle’s 94.76%. While this figure aligns closely with the three-month average of 95.0% and slightly exceeds the six-month mean of 94.5%, it reflects a stable underlying environment where investors are consistently shifting their positions into the new series rather than exiting the market.

Open Interest and Price Action: Nifty Futures have entered the January series with an Open Interest (OI) of 15.1 million shares, an expansion of 0.55 million shares over the previous series. Combined with a modest price appreciation of 0.2% and a rise in rollover costs to 0.70% (up from 0.65%), the data points toward a constructive but measured "long-buildup" sentiment as the new year begins. While the banking index transitioned into January with an OI of 1.24 million shares, a contraction of approximately 0.18 million shares from the prior series. However, the accompanying 0.6% price gain and a sharp spike in rollover costs climbing to 0.72% from 0.56% suggest that the reduction in OI may be driven by short-covering, indicating a healthier technical backdrop for the sector.

Stocks with Increased Interest: BIOCON, LTF, DABUR, BSE, and PIIND experienced heightened rollover activity compared to the previous expiry, reflecting increased investor appetite, while the most significant rollover volumes for the day were concentrated in HDFCBANK, MARICO, TVSMOTOR, APLAPOLLO, and GRASIM, marking these as high-conviction areas.

Stocks with Decreased Interest: Conversely, SUPREMEIND, TECHM, MOTHERSON, TCS, and SIEMENS saw a dip in rollover velocity, with CHOLAFIN, MUTHOOTFIN, and DIXON joining the list of stocks showing the lowest rollover interest this cycle.

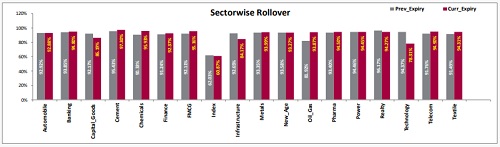

Sectoral Rollover: Oil & Gas, Chemicals, Telecom, FMCG, and Textiles witnessed a healthy uptick in rollovers, suggesting these defensive and commodity-linked plays are attracting fresh capital. Market participants displayed a more reserved stance toward Technology, Infrastructure, Capital Goods, and Realty, all of which saw lower rollover figures compared to the previous month, indicating a potential tactical pause in these high-growth segments.

NIFTY HIGHLIGHTS

Nifty December rollovers rollover of 72.3% (vs. 68.8% last expiry) is below the 3-month (78.0%) and 6-month (78.8%) averages, signaling a cautious "wait-and-watch" approach despite a month-on-month uptick. The data points to a cautious start for the December series as traders lighten overall exposure. Bank Nifty rollovers rollover of 77.5% (vs. 70.4% last expiry) stands above the 3-month (75.8%) and 6-month (63.8%) averages, indicating strong conviction and aggressive carry-forward of banking positions. Nifty Futures began the January series with 151.1 lakh shares (up from 145.5 lakh) adding 5.6 lakh shares with a 0.2% price gain to confirm a mild Long Build-up, while Bank Nifty started with 12.5 lakh shares (down from 14.3 lakh) reducing 1.9 lakh shares with a 0.6% price gain to reflect a move driven primarily by Short Covering. Rollover costs rose to 0.70% for Nifty (vs. 0.65%) and 0.72% for Bank Nifty (vs. 0.56%), showing that bulls are paying a higher premium to hold positions, which signals optimism for January. Market wide rollover of 94.96% (vs. 94.76% last expiry) is slightly below the 3-month average (95.0%) but above the 6- month average (94.5%), suggesting that while index interest is mixed, broad stock-specific participation remains resilient. The January series options data shows concentrated Call OI at 27,000 and 26,500 against substantial Put OI at 25,000 and 25,500, defining an expected expiry range of 25,500–26,500 with the 26,000- strike serving as the critical pivot due to its high dual-side OI concentration.

Nifty Rollover Vs Market-wide Rollover

Fii’s , Stock & Sector Highlights

* BIOCON, LTF, DABUR, BSE and PIIND saw higher rollover on Tuesday compared to same day of previous expiry.

* SUPREMEIND, TECHM, MOTHERSON, TCS and SIEMENS saw lower rollover on Tuesday compared to same day of previous expiry.

* Fii’s Futures Index Long ratio for the current expiry is 9%, down from 15% in the previous expiry, indicating a cautious outlook.

* FIIS have initiated their positions in the current series with 15,462 contracts on the Future Index Long, a decrease from 4,958 contracts in the previous expiry. In contrast, the Future Index Short begins with 1,59,524 contracts, an increase of 44,415 from 1,15,109 contracts at the last expiry.

Sector wise Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

More News

Perspective on Markets 22nd Sept 2025 by Mr. Vikram Kasat, Head - Advisory, PL Capital