Buy Britannia Industries Ltd for the Target Rs. 7,150 by Motilal Oswal Financial Services Ltd

Big guard change; leadership transition in focus

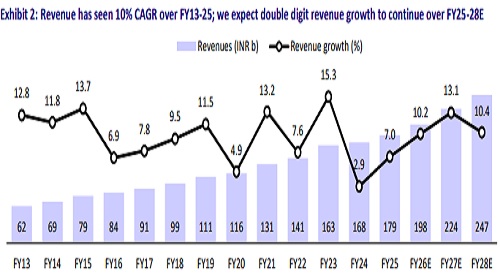

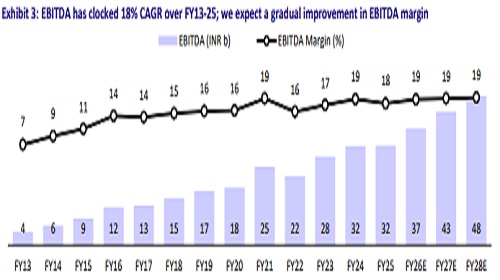

* Mr. Varun Berry, Vice Chairman, Managing Director & CEO, has tendered his resignation after a 13-year stint with the company. The board has accepted his resignation and waived his notice period and relieved with immediate effect. Britannia (BRIT) has been one of India’s best turnaround stories, with massive success in execution, growth, share gain, cost efficiencies, and supply chain. Under his leadership, BRIT focused on five strategic planks: distribution, marketing, innovation, cost efficiencies and developing adjacent businesses. The business at times (before his tenure) was considered a commodity business with a weak operating margin profile. The same changed significantly: EBITDA margins jumped from 7% in FY13 to 18% in FY25 (peak of 19% in FY21) and PAT margins leapfrogged from 4% in FY13 to 12% in FY25 (peak of 14% in FY21). During his tenure, the revenue, EBITDA, PAT and market-cap have seen a CAGR of 10%, 18%, 20% and 25% during FY13-FY25.

* Therefore, it will be a big shoe to fill by the recently appointed CEO, Mr. Rakshit Hargave, who will join on 15th Dec’25. In the interim, Mr. N. Venkataraman, currently ED and CFO, will hold the additional charge of CEO of the company. Mr. Venkataraman has been associated with BRIT for almost two decades. Mr. Hargave has around three decades of work experience in several consumer companies, including Birla Opus, Beiersdorf, HUL, Jubilant Foodworks, and Nestle India.

* In the near term, there can be pressure on the stock considering Mr. Berry’s long and successful stint and his quick exit (without notice period) despite the time gap before the new CEO joins. With this change, the focus on the new CEO and his strategic layout will be crucial, but growth recovery will be a key monitorable in the near term. The interesting part is that overall consumption macros are improving, and we hope Mr. Hargave can bring in fresh energy to BRIT.

* We recently upgraded our rating on BRIT from Neutral to BUY with a TP of INR7,150.

Key achievements of Mr. Berry at Britannia

* When Mr. Berry took over the baton of BRIT in 2013, the mandate was to put the company on the growth trajectory. Under his leadership, BRIT focused on five strategic planks: distribution, marketing, innovation, cost efficiencies and developing adjacent businesses.

* BRIT’s profitability improved drastically. EBITDA margins jumped from 6.8% in FY13 to 17.8% in FY25, reached peak of 19.1% in FY21. PAT margins surged from 4.2% in FY13 to 12.3% in FY25 (peak of 14.1% in FY21).

* From just 7k RPDs (rural distributors) in FY15, Mr. Berry took the figure to 31k in FY25, along with going deeper into the hinterland, targeting four key states in the Hindi belt. Mr. Berry deployed a slew of initiatives: direct tele-sales, SMS blasts, digital campaigns, etc. The direct reach to retailers was increased from ~1.3m in FY16 to ~2.9m in FY25

* He also ensured that distributors follow a 'zero-day' inventory model and discontinued most of the third-party resources in sales and manufacturing.

* Mr. Berry ensured to drive cost efficiencies across line items. He relentlessly focused on saving costs, as BRIT largely operates in a low-margin category. He was able to systematically cut BRIT’s fixed and variable costs and saved 2% of sales annually. He reduced the distance to market between products and consumers and the distance travelled by supplies to factories.

* He invested in the R&D center, increased in-house manufacturing capacities, focused on premiumisation, scaled up distribution, tried to understand consumer preference, and started venturing into new categories such as rusks, croissants, dairy, salty snacks and wafers.

Brief overview about Mr. Hargave

* Mr. Hargave joined Birla Opus Paints in Nov’21 and served as its CEO for four years until his resignation, effective 5th Dec’25. Under his leadership, Birla Opus successfully established itself as a credible challenger in the decorative paints category, focusing on premiumization and experiential retail formats.

* Mr. Hargave is a seasoned business leader with almost three decades of experience across leading consumer companies.

* Before joining Birla Opus, he held senior roles at Beiersdorf (NIVEA), where he led operations across India, Africa, ASEAN, and ANZ regions.

* At HUVR, he worked as Sales and Marketing Director, followed by senior positions at Kimberly Clark Lever and Lakme Lever, where he served as COO. He also held a leadership position with Jubilant Foodworks where he was instrumental in launching innovative consumer propositions (such as Domino’s Pizza’s 30 minute delivery model).

* Academically, Mr. Hargave holds a B. Tech in Electrical Engineering from IIT (BHU), Varanasi, and an MBA from the Faculty of Management Studies (FMS), Delhi.

Mr. Hargave’s key accomplishments at Birla Opus

* Orchestrated the rapid buildout of Birla Opus, managing a capex of ~INR100b to establish six integrated manufacturing plants in strategic locations across India.

* Expanded the distribution network to over 10,000 towns (vs. earlier guidance of 8,500) and 50,000 dealers, with growing depth in Tier-2/3 towns. The product portfolio has grown to 191 products with over 1,750 SKUs across six decorative paint categories.

* Invested aggressively in marketing, with high-impact campaigns and IPL sponsorships that built brand recall and consumer interest, while initiating experiential store formats for differentiated customer engagement.

* Drove outreach strategies targeting painters, contractors, and influencers to break the industry dominance of incumbents, especially Asian Paints.

* Built and led high-performing teams, guiding Birla Opus through its start-up, disruption, and scale phases in a challenging macro environment for the paint industry.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)