Buy Britannia Industries Ltd for the Target Rs.6,972 by PL Capital

Quick Pointers:

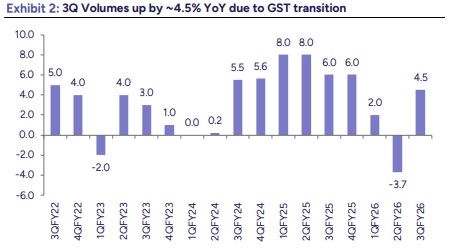

§ Volume growth came at ~4.5%, while Nov/Dec witnessed ~6% volume growth

§ RM prices likely to remain benign with GM to be sustained at healthy levels

BRIT has indicated higher growth in coming quarters as Nov/ Dec has shown double digit sales growth of 12% and GST transition impact (competitors cutting prices rather than grammage increase) will wane off by end of March. We see new management focus on 1) B2C and future platforms 2) market interventions and innovations to gain market share form regional and local players 3) Increased pace of innovations and launches 4) focus on Ecom/ Quick commerce which are growing much faster in non-biscuit segment for BRIT so far 5) dairy products like cheese. We expect BRIT to sustain gross margins above 40% given good sowing of wheat and benign prices of sugar, packaging and likely reduction in import duty on cashews and nuts.

We remain positive on BRIT given 1) expected uptick in volume growth post GST transition 2) success of new launches and 3) possibility of entry into new categories with new B2C platforms. We estimate double digit sales and 17.0% EPS CAGR over FY26-28 and value the stock at 50x Dec’27EPS and assign a target price of Rs6972 (Rs6761 earlier). Retain BUY.

Consolidated Financials: volumes increased ~4.5% on GST transition

§ Consolidated Revenues grew by 8.2% YoY to Rs49.7bn (PLe: Rs50.6bn), 35% decline in other operating had impact of 1% on sales and margins

§ Gross margins expanded by 454bps YoY to 43.3% (Ple: 42.0%), driven by stable commodity environment.

§ EBITDA grew by 19.7% YoY to Rs9.8bn (PLe:Rs9.4bn); Margins expanded by 130bps YoY to 19.7% (PLe:18.6%) despite 120bps higher other expenses and staff cost as base quarter had a write back of SAR (stock appreciation rights).

§ PBT grew by 18% YoY to Rs 9.22bn(PLe: Rs 9.0bn). Adjusted PAT grew by 17.2% YoY to Rs6.88bn (PLe:Rs6.7bn)

§ Standalone sales increased by 8.1%, EBIDTA by 15.3% to 9.34bn and PAT by 23.5% to 6.88bn. Volumes grew 4.5% in 3Q.

§ Nov/Dec 25 had 12% sales growth with value and volume contributing to 50% each of the total sales.

Key Concall Highlights: 1) The sales growth of 9.5% (gross) was split equally between volume growth and GST benefits. 2) October month was impacted by GST transition in the system, November and December witnessed a strong recovery with double digit sales growth, the GST transition impact is now over 3) BRIT is currently facing competition from unlisted players and plans to increase investments to fight regional players and drive top line growth 4) Key commodities like sugar, wheat (good sowing) have largely stabile ,thus RM is likely to remain steady in near term. 5) BRIT anticipates E commerce revenue to reach early teens from high single digits by FY27. 6) BRIT’s competitors had cut prices of Rs5/10 packs to Rs4.5/9 while BRIT had increased grammage, this confusion led to loss of revenues but now industry is likely to fully migrate to Rs5/10 packs with higher grammage. 7) BRIT focuses more on E-comm and Q-comm channel as it believes it has immense opportunity, particularly for indulgence and impulse categories.

Above views are of the author and not of the website kindly read disclaimer