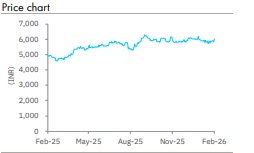

Accumulate Britannia Industries Ltd for Target Rs 6,975 by Elara Capitals

Growth rebuilds post GST transition

Britannia Industries (BRIT IN) reported Q3 net sales at INR 49.7bn, up 8.2% YoY amid stable commodities, driven by high single-digit growth in biscuits and double-digit adjacency expansion. In November and December, biscuits grew 12%. The management is confident of driving volume-led growth supported by brand investments, innovation and focused competitive interventions. We broadly maintain our earnings estimates for FY26E-28E to factor in better EBITDA margins. We reiterate Accumulate with a TP of INR 6,975 (unchanged) on 55x (unchanged) December 2027E P/E.

Healthy recovery post GST transition: BRIT reported consolidated revenue growth of 8.2% YoY to INR 49.7bn in Q3 (in-line with our estimates), fuelled by strong performance in biscuits (~12% growth in November-December post-GST stabilization) and adjacencies, alongside benign commodity costs. Underlying growth, adjusted for transitional factors, was healthy, with price realization at ~7%. The company reversed prior price cuts in smaller packs by enhancing grammage and restoring MRPs to INR 5/10, aiding recovery. Adjacency bakery segments such as cake, rusk, croissant, and wafers all posted double-digit growth (e-commerce contribution is ~3x that of biscuits), supported by relaunches such as vegetarian cake variants and new capacities. Dairy saw marginal cheese growth but faster expansion in ghee, milk drinks, and whitener, entering peak season. Management eyes double-digit topline momentum, backed by improving consumer demand and gains from regional players.

Strategic priorities to bolster market leadership: BRIT is focusing on strategic priorities: sales, distribution and supply chain efficiencies, elevated brand investments, innovation in adjacencies and future platforms, and targeted interventions against regional competitors. e-commerce and quick commerce traction is stronger in non-biscuit categories, presenting upside to close the gap via ramped execution. A centralized CMO structure has been implemented to create stronger brand synergies across core and adjacent businesses. Management highlighted an omnichannel focus and higher media investments to sustain adjacency growth.

Brand investment to increase going ahead: EBITDA grew 16% YoY to INR 9.8bn (in-line with estimates), with margins up 132bps to 19.7%, driven by lower raw material costs and operating efficiencies. Commodity trends remained largely stable in Q3, with moderation in refined palm oil and cocoa prices, marginal softening in flour and steady milk prices. While the margin environment remains supportive, management indicated that the approach is on incremental brand investments and combating competitive intensity to attempt a balance approach on margins going ahead.

Reiterate Accumulate with an unchanged TP of INR 6,975: We maintain our earnings estimates and expect double-digit sales growth in the near-to-medium term. We reiterate Accumulate and maintain our TP at INR 6,975 (unchanged) on 55x December 2027E P/E (unchanged).

Please refer disclaimer at Report

SEBI Registration number is INH000000933.