Buy JK Lakshmi Cement Ltd For Target Rs. 1,175 By Choice Institutional Equities

Recent Stock Price Correction - An Opportunity

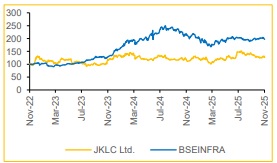

We maintain our BUY rating on JK Lakshmi Cement Ltd (JKLC) with a TP of INR 1,175, implying an upside of 39%, post 15% correction in the stock price after Q1 results. On our TP, JKLC’s implied FY28E EV/EBITDA is 9.7x, which is reasonable. The amalgamation of Udaipur Cement Works Ltd. (UCWL) and other subsidiaries into JKLC clears the overhang of a complicated corporate structure. Now that the overhang is behind us, our focus is back on JKLC’s amalgamated entity business merits, such as: 1) Capacity addition of 4.4 MTPA by FY28E, 2) Volume growth of 6.0%/5.0%/10.0% in FY26E/27E/28E driven by asset sweating and 3) Cost saving of INR 120/t is expected over a period of the next 2 years. We adopt a robust EV to CE (Enterprise Value to Capital Employed)- based valuation framework, which allows us a rational basis to assign a valuation multiple that captures fundamentals (ROCE expansion over FY25–28E).

We forecast JKLC’s EBITDA to expand at a CAGR of 28.8% over FY25– 28E, supported by our assumption of volume growth of 6.0/5.0/10.0% and realisation growth of 1.5/1.0/1.0% in FY26E/FY27E/FY28E, respectively.

We value JKLC on our EV/CE framework, where we assign an EV/CE multiple of 1.9x/ 1.9x for FY27E/28E. This framework gives us the flexibility to assign a commensurate valuation multiple basis an objective assessment of the quantifiable forecast financial performance of the company. We did a sanity check of our EV/CE TP using implied EV/EBITDA and P/E multiples. On our TP of INR 1,175, implied FY28E EV/EBITDA / PE multiple translates to 9.7x/14.7x, which is reasonable in our view.

Q2FY26 Results: Better-than-expected numbers

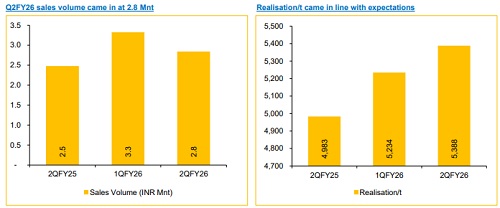

JKLC reported Q2FY26 revenue and EBITDA of INR 15,318 Mn (+24.1% YoY, -12.0% QoQ) and INR 2,081 Mn (+133.9% YoY, -33.1% QoQ). Total volume for Q2 stood at 2.8 Mnt, up 14.8% YoY and down 14.5% QoQ.

Realisation/t came in at INR 5,388/t (+8.1% YoY and +2.9% QoQ). Total cost/t came in at INR 4,656/t (+0.7% YoY and +8.3% QoQ). As a result, EBITDA/t came in at INR 732/t, which is an increase of ~INR 373/t YoY.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131