Add Asian Paints Ltd For Target Rs. 2,450 by Centrum Broking Ltd

Muted demand; expect single digit growth in FY26E

APNT’s Q4FY25 print was below our estimates; consol. revenue/EBITDA/PAT declined by 4.3%/15.1%/32.0% (5-year value/volume CAGR at 13%/16%). Management cited weak performance (volume grew 1.8%) due to (1) muted consumer sentiments especially in urban market , (2) lower construction & renovation activities, (3) lower B2B sales, and (4) competitive pressure resulting in consumer down trading. Industrial decorative business performed relatively better (volume: 2.1% while muted value growth) led by Builder project. Industrial JVs PPG-AP grew 6% driven by Auto OEMs whereas AP-PPG up by 4%. International business down by 1.5% due to weak Africa performance while ME & Asia offset the downside. Gross margin improved to 43.9% (+20bps) whilst EBITDA margin down to 17.2% (-220bps). Management expects gradual demand recovery in urban with single digit value growth in FY26E on the back of healthy monsoon and elevated government spending. Further, APNT aspires to retain margins ~18-20%. Considering weak FY25, we cut our earnings and maintained ADD, with a P/E-based TP of Rs2,450 (P/E 48.0x on 27E EPS).

Weak urban demand and slowdown on construction affected volume/value growth in Q4

APNT’s Q4FY25 consol. revenues at Rs83.6bn declined by 4.3% YoY while volume grew by 1.8% due to (1) muted consumer sentiments especially in urban market , (2) lower construction & renovation activities, (3) lower B2B sales, and (4) competitive pressure resulting in consumer down trading. Industrial decorative business performed relatively better (volume: 2.1% while muted value growth) led by Builder project. Industrial JVs PPG-AP grew 6% driven by Auto OEMs whereas AP-PPG up by 4%. International business down by 1.5% due to weak Africa performance while ME & Asia offset the downside. Distribution reach now expanded to 169k with a target to add 7-8k in FY26. Management expects gradual demand recovery in urban with single digit value growth in FY26E on the back of healthy monsoon and elevated government spending.

Consumer down trading impacted EBITDA margin; maintained 18-20% margin in FY26

Gross margin improved to 43.9% (+20bps) on account of benign raw material cost and sourcing/formulation efficiencies. While EBITDA margin down to 17.2% (-219bps) due to higher Employee cost/Other expenses by 2.8%/6.2%. Adjusted PAT cut by 30.7% to Rs8.8bn. APNT retained margin guidance at ~18-20% given lower RM prices.

Challenging environment would continue; expect mid-single digit value growth in FY26

We expect APNT to emerge as strong player, moving from share of surface to share of space inside home in line with its core strategy: (1) upgrade volumes using innovations in economy/luxury emulsions, (2) grow project/institutional business, (3) expand waterproofing business, (4) grow rural reach, and (5) gain volume market share, yet balance margins. We expect with revamp in packaging, innovative regional packs, strengthening ‘Advanced Range’ and exclusive range for Architectural and Interior application would help APNT to lift revenue momentum and profitability. Despite challenging demand conditions, APNT expects to deliver mid-single digit volume growth in domestic decorative segment led by bounce back on urban demand along with NPD (~12% of sales). Further, it expects to maintain operating margins ~18-20% band. Considering weak FY25 and higher competition intensity in the sector, we cut earnings for FY26E by 6.6% and up by 0.1% in FY27 and retained ADD, with a P/E -based TP of Rs2,450 (P/E- 48.0x FY27E EPS). Key risks to our call include weak demand conditions, rise in crude oil prices & rising competition.

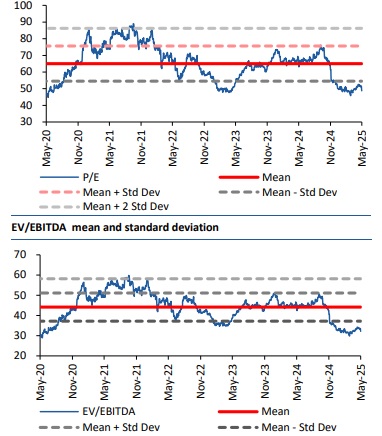

Valuations

We expect APNT to emerge as strong player, moving from share of surface to share of space inside home in line with its core strategy: (1) upgrade volumes using innovations in economy/luxury emulsions, (2) grow project/institutional business, (3) expand waterproofing business, (4) grow rural reach, and (5) gain volume market share, yet balance margins. We expect with revamp in packaging, innovative regional packs, strengthening ‘Advanced Range’ and exclusive range for Architectural and Interior application would help APNT to lift revenue momentum and profitability. Despite challenging demand conditions, APNT expects to deliver mid-single digit volume growth in domestic decorative segment led by bounce back on urban demand along with NPD (~12% of sales). Further, it expects to maintain operating margins ~18-20% band. Considering weak FY25 and higher competition intensity in the sector, we cut earnings for FY26E by 6.6% and up by 0.1% in FY27 and retained ADD, with a P/E -based TP of Rs2,450 (P/E- 48.0x FY27E EPS). Key risks to our call include weak demand conditions, rise in crude oil prices & rising competition

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331