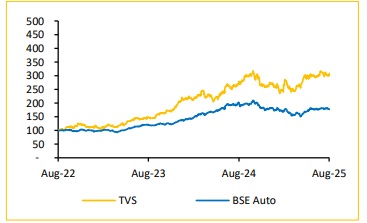

Add TVS Motor Company Ltd For Target Rs. 3,100 By Choice Broking Ltd

Market Outperformance Across Key Segments:

The company consistently grew above industry averages, indicating strong market share gains. In Q1FY26, domestic two-wheeler ICE sales grew by 8%, while the industry experienced a 3% decline. International two-wheeler sales excelled with 40% growth against an industry growth of 23%. Furthermore, TVS iQube maintains its market leadership in EV two-wheelers, with sales increasing by 35% to 70,000 units, and the recently launched TVS King EV Max (three-wheeler) is also performing extremely well. We believe this diversified growth across domestic, international, ICE, and EV segments highlights TVSL’s strong competitive position and sets it for a strong future growth.

View and Valuation We revise our FY26/FY27 EPS estimates downwards by 0.7%/0.1%, and arrive at our target price of INR 3,100, valuing the company at 34x (unchanged) on the average FY27/28E EPS while introducing FY28E estimates and assigning a value of INR 101 to TVS Credit. Accordingly, we maintain our rating to ‘ADD’.

TVSL delivers strong performance, in line with expectations

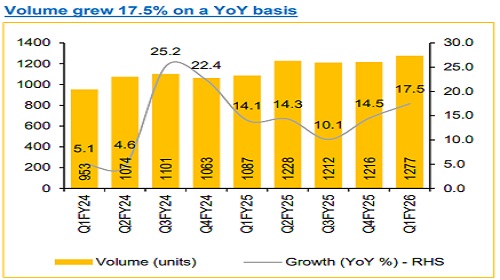

* Revenue was up 20.4% YoY and up 5.6% QoQ to INR 1,00,810Mn (vs consensus est. at INR 99,730Mn) led by 17.5% YoY growth in volume and 2.5% YoY growth in ASP.

* EBITDA was up 31.5% YoY and down 5.2% QoQ to INR 12,630Mn (vs consensus est. at INR 12,389Mn). EBITDA margin was up 106bps YoY and down 142bps QoQ to 12.5% (vs consensus est. at 12.4%).

* PAT was up 34.9% YoY and down 8.6% QoQ to INR 7,786Mn (vs consensus est. at INR 7,596Mn).

Strategic Investments in Premium and Electric Mobility:

TVSL is making substantial long-term investments in future growth drivers with approximately 40% of its non-current investments being allocated to Norton, with multiple new superbike models slated for launch in H2FY26, available in Europe and India. The company plans continued annual investments of around INR 20,000Mn for FY26, focused on new products, marketing, and global brand building for Norton, as well as developing new two-wheeler and three-wheeler EV products. We believe these strategic investments position TVS for future leadership in premium and electric segments.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131