Buy Ellenbarrie Industrial Gases Ltd For Target Rs. 550 By JM Financial Services Ltd

Earnings beat on faster ramp-up in Kurnool merchant ASU; reiterate BUY

Ellenbarrie Industrial Gases’ (EIGL) standalone revenue was 3.6% higher than JMFe at INR 892mn in 2QFY26 (up 6.6% QoQ, but down 5.8% YoY on a high base as 2QFY25 revenue had one-off revenue of ~INR 150mn in the project engineering segment) led by higher gas revenue due to faster-than-expected ramp-up of its Kurnool merchant plant capacity utilisation and slight improvement in argon prices. Hence, EBITDA was also 4.8% higher than JMFe at INR 335mn while PAT was much higher than expected at INR 367mn, aided by higher other income (mostly due to interest on unused IPO proceeds) and lower taxes. The management said that Uluberia-2 ASU and East onsite plants are on track for Nov'25 and Mar'26 commissioning respectively while North India ASU completion has been delayed to 2HFY27 (vs. 2QFY27 earlier). We reiterate our BUY rating (unchanged TP of INR 550/share) based on 40x FY28E P/E as we expect EIGL to deliver a CAGR of ~30%/34%/32% in revenue/EBITDA/PAT over FY25-28, driven by 29% CAGR in merchant volume on account of strong capacity expansion and EBITDA margin improvement to 38% in FY28 (from 35% in FY25%) due to rise in proportion of revenue from high-margin argon.

* Revenue 3.6% higher than JMFe at INR 892mn, led by higher gas revenue though it was partly offset by lower project engineering segment revenue: Standalone revenue was 3.6% higher than JMFe at INR 892mn in 2QFY26 (up 6.6% QoQ, but down 5.8% YoY on a high base as 2QFY25 revenue had one-off revenue of ~INR 150mn in project engineering segment) led by higher gas revenue due to faster-than-expected ramp-up of its Kurnool merchant plant capacity utilisation (from 65% in 1QFY26 to 75-80% in 2QFY26) and slight improvement in argon prices. Gas revenue was 5.5% higher than JMFe at INR 879mn (up 8.7% QoQ and up 10.3% YoY), though it was slightly offset by lower project engineering segment revenue at INR 12mn (down 54.5% QoQ and down 91.7% YoY on a high base as there was one-off revenue of ~INR 150mn in 2QFY25).

* EBITDA also 4.8% higher than JMFe at INR 335mn while PAT much higher than expected at INR 367mn, aided by higher other income and lower taxes: Power expenses were also slightly higher at INR 184mn (up 4.5% QoQ but down 3.2% YoY) being 20.7% of revenue (vs. 21% of revenue in 1QFY26) and other expenses were higher at INR 224mn (up 13.7% QoQ and up 12.2% YoY). Hence, reported EBITDA was 4.8% higher than JMFe at INR 335mn (up 9.1% QoQ, but down 7.6% YoY on a high base as 2QFY25 EBITDA had one-off revenue of INR 150mn in the project engineering segment), leading to 84bps QoQ improvement in EBITDA margin to 37.5% in 2QFY26 (vs. 36.7% in 1QFY26). Further, PAT was significantly higher than JMFe at INR 367mn aided by higher other income (at INR 126mn vs JMFe of INR 70mn - mostly due to interest on unused IPO proceeds) and lower tax expense (at INR 32mn vs. JMFe of INR 74mn).

* Repaid debt of INR 2.1bn using net IPO proceeds and kept unutilised IPO proceeds of INR 1.2bn in FDs; hence, net cash stood at INR 3.2bn at end-2QFY26: The company has utilised net IPO proceeds received from fresh issue of INR 3.7bn: a) repaid debt of INR 2.1bn (as proposed in prospectus); b) utilised INR 0.2bn on setting up of 220TPD Uluberia-Il merchant ASU (vs. INR 1bn proposed in prospectus; leaving INR 0.8bn unutilised at end-2QFY26); and c) utilised INR 0.15bn for general corporate purposes (vs. INR 0.55bn proposed in prospectus; leaving INR 0.4bn unutilised at end-2QFY26). Further, unutilised portion of IPO net proceeds of INR 1.2bn has been primarily held as fixed deposit and classified under Cash and cash equivalents. Hence, its gross debt declined to INR 1.1bn at end-2QFY26 (vs. INR 2.5bn at end FY25) while there was net cash (after reducing investment and Loans & Advances) of INR 3.2bn at end-2QFY26 (vs. net debt of INR 0.5bn at end-FY25). Further, cash capex was INR 542mn in 1HFY26 (vs. INR 489mn in 1HFY25).

* Uluberia-2 ASU and East onsite plant on track for Nov'25 and Mar'26 commissioning respectively; North India ASU completion delayed to 2HFY27 (vs. 2QFY27 earlier): The management reiterated that: a) Uluberia 2 (220TPD merchant plant in West Bengal) project will be operational by end-Nov’25 (expects full capacity utilisation in the next 18-24 months) and b) East onsite plant (320TPD onsite plant under construction) will be operational by Mar’26. Hence, it expects 2HFY26 to be better than 1HFY26. However, 220TPD merchant plant in North India, is now expected to be completed by 2HFY27 (earlier expected to be completed in 2QFY27). Hence, the management reiterated that its total plant capacity was 1,370TPD at endFY25, and expects plant capacity to grow to 1,910TPD by end-FY26 and 2,130TPD by endFY27 (excluding any new projects that could be announced later). Separately, the company is looking to build merchant capacity in West India and may come up with some related announcement soon.

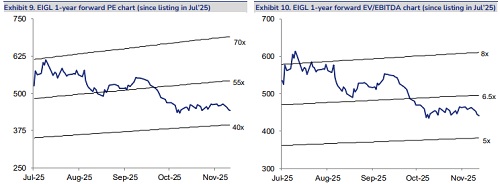

* Reiterate BUY rating on EIGL with unchanged TP of INR 550: We reiterate BUY with unchanged TP of INR 550/share based on 40x FY28E P/E as we expect EIGL to deliver a CAGR of ~30%/34%/32% in revenue/EBITDA/PAT over FY25-28, driven by: a) 29% CAGR in merchant volume on account of strong capacity expansion; and b) EBITDA margin improvement to 38% in FY28 (from 35% in FY25% and 24% in FY24) due to rise in proportion of revenue from highmargin argon. At CMP, EIGL is trading at ~32x FY28 P/E and 23.8x FY28 EV/EBITDA. (vs. Linde India trading at valuation of ~54x FY28 P/E and 28.2x FY28 EV/EBITDA despite its EBITDA/PAT CAGR expectation being lower than EIGL with a similar RoE profile). Key risks: a) decline in price/volume of argon; b) lower volume growth due to delay in start of new capacity and/or slower ramp-up; c) high customer, industry and region concentration.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)