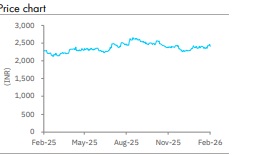

Accumulate Hindustan Unilever Ltd for Target Rs 2,635 by Elara Capitals

Focus remains on volume growth

Hindustan Unilever (HUVR IN) posted revenue growth at 6% YoY and 4% underlying volume growth (UVG) in Q3FY26. Growth was broad-based and competitive amid signs of demand recovery, led by easing food inflation, improved consumer sentiments, GST stabilization and policy tailwinds. Management has made strategic changes to make it more agile as it aims to focus on volume growth. We reiterate Accumulate with a lower TP of INR 2,635 on 50x FY28E P/E to factor in slow growth and challenges to reach double-digit EPS growth.

Improved Q3 growth with GST transition behind us: HUVR reported a 5.3% YoY increase in consolidated revenue to INR 16.4bn in Q3 with UVG of 4%, the highest recorded in the past 12 quarters. The home care segment remains a drag with 3% revenue growth while rest of the segments reported 6% revenue growth. Double-digit growth was witnessed in the Winter portfolio, and hair, premium skin & oral care. Growth was supported by premiumization, successful new launches, and channel initiatives especially in quick commerce. Minimalist posted strong double-digit performance during the quarter. Management expects H2FY26 to be better than H1 and FY27 growth to be stronger than FY26, aided by improving macros and internal strategic actions.

Strategic reset under new leadership: focus on volume-led growth: HUVR is focused on competitive, volume-led revenue growth through a four-pillar strategy centred on radical consumer segmentation, modernizing core brands, future-proofing marketing & sales, and doubling down on high-growth spaces. On the sales front, it has set up a dedicated qCommerce organization with category partnerships (Blinkit, Instamart, Zepto) and significantly improved supply chain capabilities. The company is scaling masstige & D2C (Minimalist & OZiva ~INR 11bn average run rate (ARR), bodywash (~3x turnover in the past three years), new TRESemmé Hydra Matrix range to better appeal to the youth and laundry premiumization through the new INR 99 Surf Excel Easy Wash accessible pack. Organizational changes under the “Unified India” strategy (direct business unit reporting to CEO, dedicated CMO, single India R&D) aim to bolster agility and India-centric innovation. The company has approved the acquisition of the remaining 49% in OZiva and divestment of 19.8% stake in Nutritionalab.

Retains EBITDA margin guidance: EBITDA margin stood at 22.7%, lower than our estimates due to higher-than-estimated employee expenses (+21.9%, one-off at INR 1.13bn). Adjusted for employee cost, EBITDA margin at 23.4% was 30bp better than our estimates. Gross margin improved +5bp YoY to 51.2%. Management remains committed to investing in growth and retains near-term EBITDA margin guidance of ~22-23%, and additional ~50-60bp benefits from the ice-cream demerger.

Reiterate Accumulate with a lower TP of INR 2,635: We cut our EPS by 0.4% for FY26E, 3.5% for FY27E and 2.9% for FY28E to factor in lower revenue and profitability. We reiterate Accumulate with a lower TP of INR 2,635 from INR 2,780 on 50x (from 55x) FY28E P/E as we roll forward.

Please refer disclaimer at Report

SEBI Registration number is INH000000933.

.jpg)