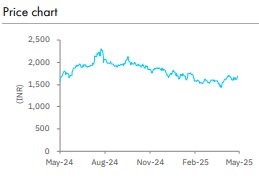

Buy Vinati Organics Ltd for Target Rs. 2,128 by Elara Capitals

Capacity expansion to drive growth

Vinati Organics’ (VO IN) stock price (up 8%) slightly underperformed the NSE Small-Cap Index (up 11%) in the past three months due to a drop in crude oil prices, which may have hit demand for 2-Acrylamido 2-Methylpropane Sulfonic acid (ATBS). ATBS is mostly used by the onshore crude oil exploration & production (E&P) industry in the US. Per industry data, demand for major products such as ATBS, iso-butyl-benzene (IBB), n-propyl-benzene (NPB) and meta-isobutyl-toluene (MIBT) is normalizing, with combined demand recovering 34% QoQ and prices recouping 3-8% QoQ. However, prices of IBB and MIBT are still down ~6% YoY.

Going forward, VO is set to benefit from 50% capacity expansion in ATBS, higher capacity utilization at its anti-oxidant (AO) plant and ramp-up at Veeral Organics’ plant, which would support 16% revenue CAGR through FY25-28E. Based on FY25 earning and a few quarters of delay in capacity ramp-up, we trim FY26E EPS estimates by 5%. We introduce FY28E EPS at INR 64, ascribing 21% YoY growth. We reiterate BUY with TP unchanged at INR 2,128.

ATBS-driven recovery continues: Q4 EBITDA/PAT at INR 1.8bn/1.2bn rose 20%/18% YoY, as estimated, driven by a recovery in ATBS demand, which contributed ~35% to total revenue in FY25 and is a high-EBITDA margin product. QoQ, EBITDA/PAT grew 27%/31%. Revenue was up 18/24% YoY/QoQ to INR 6.5bn, with ATBS and N-propyl benzene posting YoY volume growth (further supported by ~7% price recovery, per our analysis).

ATBS, AO and butyl phenols (BP) contributed to growth: Per Ministry of Commerce data and US trade data as also our analysis, ATBS volume was a key driver, with likely volume growth of 25-30% YoY in Q4. NPB and para-tertiary butyl phenol (PTBP) also contributed to growth. Prices of major products recovered 3-8% YoY, but were trending lower than the peak two years ago. VO has guided that capacity expansion in ATBS will ensue in two phases and full utilization of expanded capacity will be achieved in three years. Guidance for revenue CAGR is 20% in the next three years.

Growth volume-led: We expect a 16% revenue CAGR in FY25-28E, led by: 1) a 50% capacity expansion in ATBS to 60,000 tonnes (in two phases by Q1FY27), 2) expected 30% jump in revenue from AO & BP in FY25-27E to INR 8bn, and 3) ramp-up at Veeral Organics’ plant in FY26, including 3,000tonnes of mono methyl ether hydroquinone (MEHQ) and Guaiacol.

Reiterate BUY; TP retained at INR 2,128: We recommend Buy led by capacity expansion in ATBS, supportive policies for E&P in the US, higher capacity utilization of AO and BP plants and ramp-up at Veeral Organics’ plant. Expect these to support FY25-28E revenue CAGR to 16% and EBITDA CAGR to 19%.

We cut FY26E EPS estimates by 5% assuming a slower ramp-up and maintain FY27E EPS estimates. We maintain our TP at INR 2,128. We value VO on DCF, assuming a 5% (unchanged) terminal growth rate and a 10.7% (unchanged) cost of capital, with long-term EBITDA margin at 26.7% (from 27.5%) from FY29E.

Please refer disclaimer at Report

SEBI Registration number is INH000000933