Neutral Cipla Ltd For Target Rs.1,530 by Motilal Oswal Financial Services Ltd

3Q results beat estimates; yet to scale up Lanreotide supply

USFDA clarity on niche products is key monitorable over medium term

* CIPLA delivered better-than-expected 3QFY25 earnings. While revenue was in line, EBITDA/adj. PAT beat our estimates, aided by a better product mix and lower R&D spending. Among the segments, CIPLA continued to improve chronic share in prescription (Rx) business and scale up trade generics (Gx) business. US sales were flat YoY/QoQ due to certain product-specific issues.

* We raise our FY25 EPS estimate by 14% to factor in healthy traction in the domestic formulation (DF) business and controlled opex. We largely maintain our estimates for FY26/FY27. We value CIPLA at 23x 12M forward earnings to arrive at a TP of INR1,530.

* We expect CIPLA to deliver 18% YoY earnings growth in FY25 after posting strong 39% YoY growth in FY24. However, considering the delay in niche approvals/launches, we expect earnings growth to moderate to 5% over FY25-27. We maintain Neutral, given limited upside from current levels.

Segmental mix/lower R&D spend boost profitability

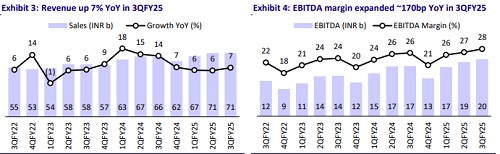

* 3QFY25 revenue increased by 7.1% YoY to INR70.7b (est. INR69.7b). DF sales (44% of sales) grew 10% YoY to INR31.5b. EM sales (12% of sales) rose 22% YoY to INR8.2b. SAGA sales (14% of sales) grew 19.6% YoY to INR9.8b. API sales (2% of sales) were up 16.7% YoY at INR1.3b. US sales (27% of sales) declined by 1% YoY to INR19b (USD226m, down 1.7% in CC terms).

* Gross margin expanded 160bp YoY to 68% (est. 66.6%), aided by lower raw material costs.

* EBITDA margins expanded 170bp YoY to 28.1% (est. 25.5%) thanks to a better gross profit. R&D expenses decreased by 100bp YoY as a percentage of sales, while employee costs/other expenses increased by 80bp/20bp YoY.

* EBITDA increased by 13.8% YoY to INR19.9b (est. INR17.8b).

* Adjusting for one-off gains of INR670m and tax write-backs of INR1.6b, PAT grew 14% to INR13.6b (est. INR11.9b).

* In 9MFY25, revenue/EBITDA/PAT grew 6.2%/12.4%/14.2% YoY to INR208b/INR55.9b/INR38.4b.

Highlights from the management commentary

* CIPLA aims to end FY25 with higher-than-guided EBITDA margin of 24.5%- 25.5%.

* It has filed g-Advair from its US facility and expects a launch in 1HFY26, subject to USFDA inspection and approval. The company expects to launch g-Abraxane in 2HFY26, indicating some delay.

* Despite facing competition in g-Revlimid, CIPLA expects growth in FY26.

NA: Work-in-progress to offset revlimid impact and sustain growth

* In 9MFY25, US sales grew 6.3% YoY (USD713m; up 4.7% in CC terms) to INR59.8b, supported by market share gains in Albuterol and base business and traction in key products, offset by supply chain issue in Lanreotide.

* CIPLA anticipates solving the supply chain issue for Lanreotide product and normalization from Mar’25 onward.

* While CIPLA has received regulatory clearance for the Goa facility, the launch of g-abraxane has been delayed to 2HFY26 considering the chance of re-inspection and subsequent approval.

* The genericisation of revlimid will affect revenue in FY26-27. CIPLA is gearing up to offset the impact with the launch of g-abraxane, g-advair, partnered inhalation assets and few peptides over the next 12-15 months.

* To enhance its capabilities in the US market, the company is looking for inlicensing of niche products and acquiring a sterile/injectable facility.

* Based on the above factors, we expect the company to deliver a 4.9% CAGR in US sales to USD1b over FY25-27.

India: Recovery in trade generic/in-licensing of innovative brands to drive growth

* During 9MFY25, CIPLA posted 6.4% sales growth, led by growth in key brands in Rx business, recovery in trade generics and sustained momentum in consumer business, offset by seasonality in acute therapies.

* During 3QFY25, CIPLA outperformed IPM in respiratory/anti-infective/urology by 550bp/190bp/210bp.

* In the branded specialty in-licensing business, the top brands Dytor/Budecort delivered strong growth of 13.8%/24.4% YoY in 3QFY25. Further, the company is focusing on launching innovative brands in India through in-licensing.

* CIPLA’s consumer health business grew 9.5% YoY due to strong growth in anchor brands like Nicotex, Omnigel and Cipladine and the contribution from Astaberry acquisition.

* Accordingly, we expect CIPLA to deliver a 10% sales CAGR in DF to reach INR140b over FY25-27.

One Africa: Brand building to drive growth/margin expansion

* In 9MFY25, CIPLA’s One Africa business grew 7.1% YoY to INR27.4b. The growth was propelled by an uptick in key therapies, new launches and significant growth in OTC portfolio.

* In 3QFY25, SA private market/ SA tender market grew 14%/85% YoY in CC terms to USD67m/ USD24m.

* CIPLA is focusing on margin expansion in Africa business, which is currently below 25%.

* It is building a strong brand franchise in private as well as OTC markets, along with new launches.

* We expect sales growth of 6% in One Africa business to INR41b over FY25-27.

Valuation and view

* We raise our FY25 EPS estimate by 14% to factor in healthy traction in DF business and controlled opex. We largely maintain our estimates for FY26/FY27. We value Cipla at 23x 12M forward earnings to arrive at a TP of INR1,530.

* We expect Cipla to deliver 18% YoY earnings growth in FY25 after posting strong 39% YoY growth in FY24. However, considering the delay in niche approvals/launches, we expect earnings growth to moderate to 5% over FY25- 27. We maintain Neutral, given limited upside from current levels.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)