Neutral KEC International Ltd for the Target Rs. 940 by Motilal Oswal Financial Services Ltd

Margin trajectory now improving

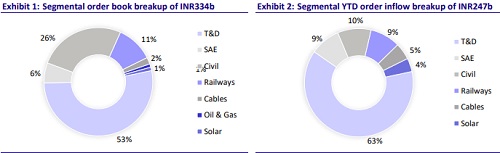

KEC International (KEC)’s 4QFY25 performance was broadly in line on the revenue and EBITDA fronts, while PAT was above our estimate. Strong execution, especially in the T&D and cables segments (which reported higher revenue and profitability), propelled KEC’s revenue and EBITDA. KEC’s margin surprised and reached 7.8% in 4QFY25. Its FY25 order inflows jumped 36% YoY to INR247b, taking the total order book to INR334b, up 9% YoY (particularly driven by T&D). Looking ahead, T&D is expected to remain the key growth engine, supported by a strong order book and expanding global pipeline, while the non-T&D segment is expected to have a turnaround and start improving beyond FY26 through high-margin industrial, semiconductor, and exportfocused opportunities. We raise our estimates by 1%/3% for FY26/27 to factor in KEC’s FY25 performance. We reiterate our NEUTRAL rating on the stock with a revised TP of INR940, premised on 21x Mar’27 estimates.

In-line revenue and EBITDA; beat on PAT

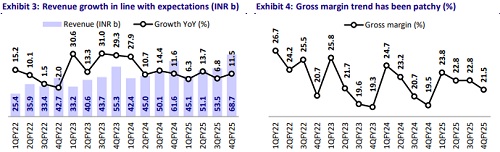

KEC’s 4QFY25 performance was broadly in line on the revenue and EBITDA fronts, while PAT was above our estimate due to a lower-than-expected tax rate. KEC’s revenue grew 12% YoY to INR68.7b vs. our estimate of INR68.4b. EBITDA rose 39% YoY to INR5.4b vs. our estimate of 5.6b, while its margin, at 7.8%, improved 150bp YoY/80bp QoQ. The sharp beat on our other income estimate was largely offset by higher-than-expected interest expenses. Its PAT surged 77% YoY to INR2.7b, beating our estimate by 11%, mainly driven by a lower-than-expected tax rate of 22% vs. our estimate of 30%. Order inflows declined 51% YoY to INR26b in 4QFY25, taking the closing order book (OB) to INR334b (+13% YoY). The T&D:non-T&D mix stood at 59%:41%. OB + L1 position stood at INR400b. For FY25, KEC’s revenue/EBITDA/PAT grew 10%/24%/65% to INR218.5b/INR15b/INR5.7b, while inflows stood at INR247b, rising 36% YoY.

Revenue growth led by improvement in the T&D and cable businesses

KEC’s 4QFY25 revenue growth was primarily fueled by strong YoY growth of 28% in the T&D segment, resulting in revenue of INR43.3b, aided by strong execution of its order book. Civil segment execution was constrained by moderated execution in water-related projects due to client payment delays and site-level labor shortages. Railways revenues declined 26% YoY; however, the segment has now bottomed out and is expected to stabilize in FY26 and be profitable from FY27 onwards. The cable division delivered revenue of INR5.9b (+29% YoY) with healthy margins, which would improve further as the company is doubling conductor capacity and is setting up new lines for elastomeric and E-beam cables, both margin-accretive categories.

T&D witnessing strong traction across geographies

Order inflows for the T&D segment stood at INR180b, with India’s contribution being around INR72b, led by strong tendering from Power Grid Corporation and private developers. Internationally, the business secured its largest-ever order in the UAE and posted more than double the previous year’s intake across the Middle East, the Americas, and South Africa. Management expressed its confidence in the outlook for the T&D segment, citing a highly encouraging sector backdrop driven by increased tendering activity in both domestic and international markets. In India, the government's push towards achieving 600GW of non-fossil fuel capacity by 2032 is fueling consistent investments in transmission lines and substations. Internationally, markets like the Middle East, Africa, CIS, and the Americas are witnessing significant traction, particularly with regional interconnections and renewable-linked transmission expansion in countries like Saudi Arabia and the UAE. Having a strong order book and L1 position exceeding INR245b in T&D, combined with a growing tender pipeline and enhanced capabilities such as HVDC and digital substations, KEC is well positioned for sustained high growth in the T&D business. Out of the TAM of INR1.8t, KEC foresees 50% to come from the T&D business.

Margin trajectory now improving

FY25 marked a clear indication of margin recovery for the company. EBITDA grew 26% YoY with margins reaching 6.9%, while 4Q margins improved to 7.8%. PBT/PAT for the year grew 71%/65% YoY, aided by lower interest and depreciation costs. The key drivers included the winding down of loss-making legacy projects, strong operational performance in T&D and cables, and improved order selection across verticals. Looking ahead, EBITDA margins are guided to reach 8-8.5% in FY26 and exceed 9% in FY27. T&D margins have already crossed the 10% threshold, and cables are on track for 8% by FY27. Civil margins are projected to return to the 7-8% range as Metro projects wind down and better-margin industrial orders ramp up. By prioritizing highquality orders and enforcing stricter cash flow and hurdle rate thresholds, the company is strategically shaping a more resilient and profitable order book.

Selective non-T&D bidding to strengthen the order book

In FY25, KEC adopted a calibrated approach towards non-T&D order intake, prioritizing margin and cash flow visibility over volume. The civil business secured over INR24b in new orders, including a significant win in the semiconductor space and repeat orders in metals and mining. Execution in Metro projects progressed well, with key viaduct handovers in Delhi and Chennai, while water projects resumed activity following client payments, supported by an INR20b backlog. In transportation, the company pivoted toward less block-dependent work, securing INR22b in new orders, including tunnel ventilation and gauge conversion projects. With over ~INR100b in the combined order book and L1 across non-T&D segments, the company is positioned for steady growth, supported by selective bidding and operational realignment.

Working capital moderation on track for FY26

NWC saw a substantial improvement, reducing to 122 days in Mar’25 from 134 in Dec’24. This improvement was driven by better collections, particularly from delayed water projects in Odisha and MP, and disciplined execution in T&D orders. The India T&D business now operates with a near-zero NWC profile (~10 days), providing a natural hedge against working capital-intensive segments. The company expects further improvements in FY26, targeting a reduction to 100 days NWC by year-end. Resolution of outstanding receivables (INR8b in water), claim settlements in railways, and a greater share of capital-light projects will support this goal. As NWC improves, management expects interest costs to also decline further (already down to 2.5% of revenue in 4QFY25) and aid in its deleveraging efforts.

Financial outlook

Financial outlook We raise our FY26/27 estimates by 1%/3% to factor in KEC’s FY25 performance. Accordingly, we expect a revenue/EBITDA/PAT CAGR of 17%/27%/44% over FY25- 27. This will be driven by 1) order inflow growth of 24% over the same period, led by a strong prospect pipeline; 2) a recovery in EBITDA margin to 8.1% by FY26/FY27; and 3) a gradual reduction in NWC. With the expected improvement in execution and margins, we expect its RoE and RoCE to improve to 21% and 17.8%, respectively, by FY27.

Valuation and recommendation

KEC is currently trading at 24.6x/19.4x on FY26E/27E earnings. Our estimates bake in a revenue CAGR of ~17% and an EBITDA margin of 8.1% for FY26E/27E. We reiterate our Neutral rating with a revised TP of INR940 based on 21x Mar’27 EPS.

Key risks and concerns

A slowdown in order inflows, higher commodity prices, an increase in receivables and working capital, and heightened competition are some of the key risks that could potentially affect our estimates.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412