Buy JSW Infrastructure Ltd For Target Rs.330 by Motilal Oswal Financial Services Ltd

Scouting for organic and inorganic expansions

JSWINFRA, incorporated in 2006, is a part of the JSW Group and is engaged in the business of developing infrastructure and operations for ports across India. As of Dec’24, JSWINFRA has a total operational capacity of around 174 MMTPA. It has also entered into an agreement with the Port of Fujairah for the operation and maintenance of the bulk handling system for cargo at two berths in the Fujairah Port. In Oct’23, JSWINFRA completed its IPO of INR28b

* Geographically diversified port locations: JSWINFRA has two minor ports (Jaigarh and Dharamtar) on the western coast, while it has seven operational terminals on major ports. Among seven port terminals, four are located on the eastern coast and three on the western coast, leading to a geographically diverse presence for JSWINFRA. The ports are located in the vicinity of JSW Group companies.

* Volume growth to remain robust: Cargo volumes grew 15% YoY in FY24 to 106.5MMT from 93MMT in FY23 (three-year CAGR of 33% over FY21-24). With capacity ramp-up at existing ports, along with a higher share of volumes from third-party customers, we expect the growth momentum to continue.

* Scouting for organic and inorganic expansions: JSWINFRA has been actively scouting for growth opportunities (organic/inorganic) as the management aims to maintain a ~15% CAGR in volume over the long term. In FY24, JSWINFRA signed a concession agreement with the Karnataka Maritime Board to develop a 30 MTPA greenfield port in Keni, Karnataka. Additionally, it emerged as the winning bidder for a 7MTPA dry bulk terminal in Tuticorin through a PPP model. Furthermore, JSWINFRA signed a concession agreement with JNPA for two liquid berths with a capacity of 4.5MTPA.

* To enhance capacity to 400MMT by 2030 through capex: In line with its long-term growth outlook, the management has guided a capex of INR300b over FY24-30E, which will increase overall capacity by 85MMT in the next three years, and to 400MMT by 2030 (current capacity is 174MMT).

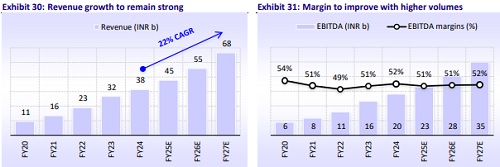

* On track to deliver robust performance; reiterate BUY: Considering stable growth levers at its existing ports and terminals, a higher share of third-party customers, sticky cargo volume from JSW Group companies, and an expanding portfolio, we expect JSWINFRA to strengthen its market dominance, leading to a 14% volume CAGR over FY24-27. This should drive a 22% CAGR in revenue and a 21% CAGR in EBITDA. We reiterate our BUY rating with a revised TP of INR330 (premised on 22x Sep’26 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412