Neutral Zee Entertainment Ltd for the Target Rs.135 by Motilal Oswal Financial Services Ltd

Weak 1Q; ad revenue recovery remains key

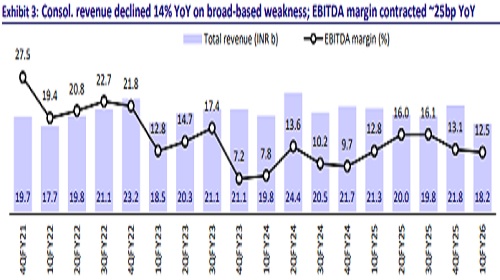

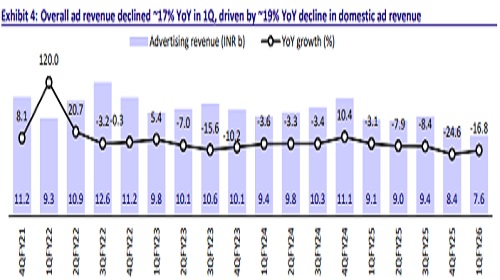

* Zee Entertainment (Zee) reported a weak 1QFY26, with revenue declining 14% YoY (~7% miss), primarily due to continued weakness in domestic ad revenue (-19% YoY) and weak subscription revenue (-1% YoY).

* Zee maintained robust cost controls, with further reduction in Zee5 losses (down to ~INR660m from INR1.8b YoY). However, due to operating deleverage, consol EBITDA declined ~16% YoY (9% miss).

* Zee continues to aim for: 1) 8-10% revenue growth through its re-entry into Free-to-Air (FTA), expansion into new genres, and increased focus on regional languages; 2) Zee5 breakeven by FY26-end; and 3) EBITDA margins of 18-20% in FY26E.

* We cut our FY26E EBITDA/PAT by 7-8% and FY27E EBITDA/PAT by 3-4%, driven by persistent weakness in ad revenue.

* We build in a CAGR of 4%/11%/14% in revenue/EBITDA/PAT over FY25- 28E. However, we see downside risks to our estimates due to the structural shift in ad revenue to digital medium (Zee’s ad revenue has declined 30% since FY19).

* Zee’s valuations remain attractive (13x FY27E EPS). However, a sustained recovery in domestic advertisement revenue and a favorable outcome in ongoing litigation for ICC rights with Star remain key for rerating. We reiterate our Neutral rating with a TP of INR135 (earlier INR150).

Weak 1Q as ad revenue decline continues

* 1QFY26 consolidated revenue declined ~14% YoY (-17% QoQ) to INR18.2b (~7% miss) due to a broad-based weakness across key revenue streams.

* Advertisement revenue declined 17% YoY to INR8.3b (-25% YoY in 4Q), as domestic ad revenue dipped ~19% YoY (vs. ~27% YoY decline in 4Q), impacted by a slowdown in FMCG spending and an extended sports calendar (IPL).

* Subscription revenue declined ~1% YoY to INR9.8b (-1% QoQ), with a modest ~1% YoY growth in domestic subscription revenue (vs 4.5% YoY in 4Q) as higher digital subscriptions was offset by a decline in linear subscriptions.

* Revenue from other sales and services tumbled 64% YoY to INR0.8b (-77% QoQ), due to a decline in movie and syndication revenue.

* Zee maintained robust cost controls, with total operating expenses declining ~14% YoY to INR16b (-16% QoQ), coming in 6% below our estimates due to lower movie production and content costs.

* Selling and other expenses declined 11% YoY, while operational costs declined ~18% YoY (10% below).

* EBITDA declined 16% YoY to INR2.3b (-20%QoQ, 9% miss), as margin contracted ~25bp YoY to 12.5% (-55bp QoQ and 30bp miss).

* Adj. PAT declined 7% YoY to INR1.4b (-24% QoQ, 11% miss), as lower EBITDA and other income were partly offset by lower D&A and finance charges.

Zee5: 30% revenue growth leads to lower operating losses

* Zee5’s revenue grew 30% YoY to INR2.9b (~6% QoQ), driven by healthy trends in usage and engagement metrics.

* Operating losses reduced further to INR658m (vs. ~INR750m loss QoQ and ~INR1.8b loss YoY).

* Adjusted for Zee5, linear TV business revenue declined 19.5% YoY, while EBITDA declined ~35% YoY to INR2.9b as margins contracted ~450bp YoY to 19.1%.

Key highlights from the management commentary

* Ad revenue trends and outlook: Domestic advertising revenue was impacted by continued macroeconomic headwinds, extended sports calendar (IPL), and lower ad spending by FMCG companies. However, management remains cautiously optimistic about an ad revenue recovery in the coming quarters, citing early signs of recovery supported by a healthy monsoon and the onset of the festive season. The company maintained its guidance of 8% ad revenue growth, driven by Zee’s re-entry in the FTA segment, rising viewership share, launch of new genres, and a focus on regional languages.

* Subscription trends and outlook: Digital subscription growth was supported by the introduction of language packs in Zee5. However, this was offset by a decline in linear subscriptions due to a drop in Pay TV subscribers. Management indicated that the company remains in negotiations with DPOs and expects subscription revenue to grow in line with inflation.

* Guidance and outlook: Management reiterated its commitment to: 1) accelerating growth (8-10% annually); 2) improving margins (18-20%); and 3) driving Zee5 to breakeven by FY26-end. Management highlighted that all new investments are already factored into the margin guidance (18-20%), and there is no change in plans despite shareholders not approving the recent promoter infusion.

Valuation and view

* Zee aspires to deliver a revenue CAGR of 8-10% with its current portfolio and improve EBITDA margins to an industry-leading range of 18-20% by FY26. We believe that a sustainable recovery in ad revenue remains the key to achieving these aspirations and driving a potential re-rating of multiples.

* We cut our FY26E EBITDA/PAT by 7-8% and FY27E EBITDA/PAT by 3-4%, driven by persistent weakness in ad revenue.

* Despite the continued decline in ad revenue (~30% decline from FY19 levels), we have built in ~4% CAGR in ad revenue over FY25-28. However, there could be downside risks from the structural shift in advertising spends toward the digital.

* We build in a CAGR of 4%/11%/14% in revenue/EBITDA/PAT over FY25-28E.

* Zee’s valuations remain attractive (13x FY27E EPS). However, a sustained recovery in domestic advertisement revenue and a favorable outcome in ongoing litigation for ICC rights with Star remain key for rerating. We reiterate our Neutral rating with a TP of INR135 (earlier INR150), premised on ~12x Sep’27 P/E.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412