Neutral Exide Ltd for the Target Rs. 368 by Motilal Oswal Financial Services Ltd

Weak 2Q due to channel destocking

Demand likely to normalize in 2H

* EXID's 2QFY26 PAT of INR2.2b came in well below our estimate of INR3.2b on account of lower-than-expected revenue. Revenue was mainly affected by channel destocking in segments like auto replacement, UPS and solar and weak demand in home UPS due to extended monsoon. Management expects the bulk of this demand to revive in 2H as the channel would look to restock and OEM demand is picking up.

* Given the weak 2Q performance, we cut our FY26/FY27 EPS estimates by 9%/3%. While the market appears to be upbeat on EXID’s lithium-ion foray, we remain cautious about the long-term returns from the business. Besides, the stock trading at 27.3x/23.5x FY26E/FY27E EPS appears fairly valued. Reiterate Neutral with an SoTP-based TP of INR368.

Weak performance amid deferred purchases and cost under-recovery

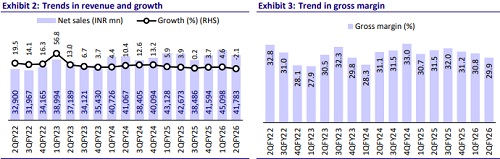

* Standalone revenue declined 2% YoY to INR41.8b (6% below our estimate), due to production cuts in Aug and Sep on the back of channel destocking done by distributors after the GST 2.0 announcement in mid-Aug.

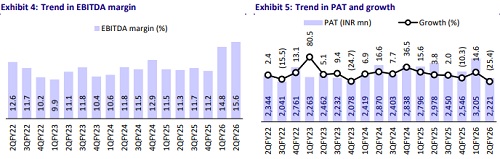

* Gross margin declined 160bp YoY (down 90bp QoQ) to 29.9% (100bp lower than our estimate) due to the inability to pass on rising lead costs.

* Overall, EBITDA margin declined 180bp YoY to 9.5% (vs. est. 11.5%) due to higher input costs and lower revenue.

* EBITDA fell 18% YoY to INR3.9b (sharply below our estimate of INR 5.4b).

* Adj. PAT at INR2.2b came in 32% below our estimate of INR3.2b.

* EXID invested INR5.8b in 1H and additional INR650mn in Oct’25 in Exide Energy Solutions. Total equity investment till date stands at INR39.5b.

Highlights from management call

* EXID sees a positive outlook for lead-acid batteries, supported by a visible uptick in auto OEM production in 3Q.

* Given that demand for auto aftermarket, UPS and solar was deferred due to channel destocking, EXID expects this demand to bounce back in 3Q.

* About 50% of 2W capacity has been moved to Punchgrid technology, unlocking multiple cost levers like lower material and labor costs.

* EXID now plans to move 4W battery to continuous casting technology, which is expected to drive cost savings and more consistent quality.

* The company invested about INR5.8b in 1H and INR650m in Oct, with total equity investment of ~INR39.5b in the business (Exide Energy).

* The initial ramp-up will start with a 2W line on NCM chemistry. EXID is in discussions with a couple of large 2W OEMs for this program. Subsequently, a prismatic LFP line will be introduced for stationary applications. By Year 1, it expects Line 1 to ramp up to about 25% utilization and expects to commence Line 3 (for LFP).

Valuation and view

* Considering the weak 2Q performance, we cut our FY26/FY27 EPS estimates by 9%/3%. Given the significant imminent risk to its core business, EXID has forayed into the manufacturing of lithium-ion cells in partnership with S-Volt at a total investment of INR60b in two phases. While the market appears to be upbeat on EXID’s lithium-ion foray, we remain cautious about the long-term returns from the business. Besides, the stock trading at ~27.3x/23.5x FY26E/FY27E EPS appears fairly valued. Reiterate Neutral with an SoTP-based TP of INR368. We value the core (lead acid) business at 15x Sep’27E EPS (in line with Amara). We add INR59 per share value for the EV business (based on book) and INR55 per share for its stake in HDFC Life.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)