Buy Grasim Industries Ltd for the Target Rs. 3,410 by Motilal Oswal Financial Services Ltd

Chemical-led beat on EBITDA; exit of Paints’ CEO an overhang

Strong momentum in the Paints business in Sep-Oct’25

* GRASIM’s 2QFY26 EBITDA was above our estimate, fueled by outperformance in the chemical business, while the VSF performance was in line. EBITDA increased ~13% YoY to INR3.7b (~14% beat). OPM contracted 50bp YoY to 3.8% (est. 3.5%). Adj. PAT grew ~6% YoY to INR8.0b (in line). However, Mr. Rakshit Hargave, CEO of the Paints business, who had joined GRASIM in Nov’21, has tendered his resignation after ~20 months of the launch of its paints brand “Birla Opus”. This will be an overhang on the stock in the near term.

* GRASIM has also outperformed UTCEM in the last two months, and its HoldCo discount has been reduced to 39% vs. an average of 41% in 2QFY26. Revenue traction of the Paints segment and its losses would be the key monitorables for the next few quarters. Though we maintain our positive view on Grasim, considering the near-term headwinds for the Paints business, we raise our HoldCo discount to 40% from 35% earlier.

* Management highlighted that Birla Opus continues to grow its market share. Birla Opus hit its highest-ever monthly sale in Sep’25, and the brand saw an equally strong Oct’25. Management expects sequential growth in the Paints business to be in double digits in 3QFY26 and significantly higher on a YoY basis. GRASIM maintained its revenue guidance of INR100b and EBITDA break-even by FY28.

* We retain our EBITDA estimates for FY26-28. We reiterate our BUY rating with a revised TP of INR3,410 (earlier INR3,540) based on an SoTP valuation

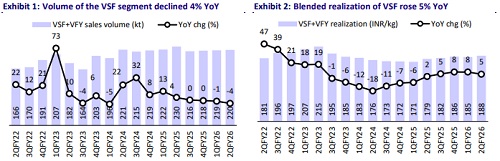

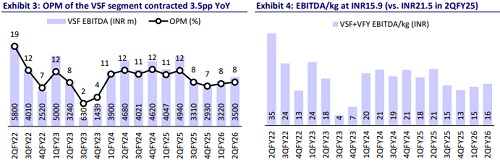

VSF margin dips 3.5pp YoY; chemical margin expands 1.9pp YoY

* GRASIM’s standalone revenue/EBITDA/Adj. PAT was at INR96.1b/INR3.7b/ INR8.1b (+26%/+13%/+6% YoY and +4%/+14%/+4% vs. our estimates) in 2QFY26. VSF segment: sales volume declined ~4% YoY, whereas realization rose ~5%. EBITDA declined ~29% YoY (up 9% QoQ) to INR3.5b. OPM dipped 3.5pp YoY (up 50bp QoQ) to ~8%. EBITDA/kg was at INR16 vs. INR21/INR15 in 2QFY25/1QFY26. Chemical segment: volume remained flat YoY, whereas realization rose ~17% YoY. EBITDA increased ~34% YoY to INR3.7b. OPM expanded 1.9pp YoY to ~15%. The paints and B2B e-commerce revenue (combined) grew ~8% YoY to INR26.5b. Loss in new high-growth businesses stood at INR3.2b vs. INR3.7b/INR3.0b in 2QFY25/1QFY26.

* In 1HFY26, revenue/EBITDA/Adj PAT stood at INR188.3b/INR7.5b/INR6.9b (+30%/+15%/-3% YoY). OPM dipped 50bp YoY to ~4%. OCF stood at INR10.7b vs. INR2.6b in 1HFY25. Capex stood at INR10.5b vs. INR20.1b. Net cash inflow stood at INR219m vs. net cash outflow at INR18.4b in 1HFY25.

Highlights from the management commentary

* Birla Opus continues to gain market share in the Indian decorative paints segment despite an overall industry slowdown, driven by rapid expansion of its distribution network, stronger secondary sales, enhanced brand visibility, and sustained product quality differentiation.

* With the commissioning of its sixth paint plant at Kharagpur, West Bengal, Birla Opus' total installed capacity now stands at 1,332mlpa, making it India’s secondlargest decorative paint company with 24% industry capacity share.

* Phase 1 of the 55K TPA Lyocell project at Harihar, Karnataka, is progressing well and is targeted for commissioning by mid-2027. Long-lead items have been ordered, basic engineering has been completed, and other orders and contracts are currently in process.

Valuation and view

* GRASIM’s 2Q profitability was above our estimates, led by better-than-expected performance in the chemical segment. The CEO of the Paints business has resigned, which may weigh on the stock performance in the near term. While we remain positive on the company, we raise the HoldCo discount to 40% from 35% amid short-term headwinds in the Paints segment. We will also closely monitor its revenue traction and losses.

* We reiterate our BUY rating with a TP of INR3,410 as we value its: 1) holding in listed subsidiaries by assigning a discount of 40% on our TP for coverage companies, 2) standalone business at 6x Sep’27E EV/EBITDA, 3) paint business at 2x of investments, 4) B2B e-commerce at 1.5x of Sep’27E (TTM) revenue, and 5) renewable business at 10x EV/EBITDA

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412