Buy Kotak Mahindra Bank Ltd for the Target Rs. 2,400 by Motilal Oswal Financial Services Ltd

Business growth healthy; RoA remains superior at over 2%

Pace of NIM moderation to ease in 2QFY26

* Kotak Mahindra Bank (KMB) has aligned its loan trajectory with a disciplined target of 1.5-2.0x, while consciously improving business granularity by focusing on the retail and SME segments.

* SA repricing and ActivMoney sweep are expected to ease funding costs and limit margin contraction following the sharp decline in 1Q. We estimate NII to clock a 19% CAGR over FY26-28, with NIMs stabilizing and beginning to recover from 3QFY26 onwards.

* We estimate provisioning expenses to subside compared to 1Q and improve further in 2HFY26. Full-year credit costs are likely to sustain at ~70bp (93bp in 1QFY26).

* KMB’s leadership continues to strengthen digital capabilities, enhance segmentation, and maintain cost discipline. With 150-200 branches being added annually without increasing headcount, the bank remains focused on strengthening its retail business, diversifying fees, and sustaining RoA at above 2% during FY26-28E.

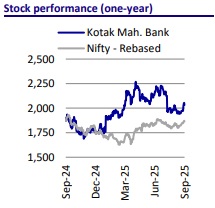

* We have upgraded KMB after being Neutral on the stock for almost five years in Jan’25 at INR1,759. While we estimate current year performance to remain modest we nevertheless estimate the bank to deliver 20% earnings cagr over FY26-28E. This in context to reasonable valuations will aid stock performance.

* We thus estimate KMB to deliver robust return ratios, with RoA/RoE at 2%/12.8% by FY27E. Retain BUY with TP of INR2,400 (2.4x FY27E).

Credit growth to remain healthy; estimated to sustain at 16% CAGR

KMB has aligned its loan trajectory with a disciplined target of 1.5-2.0x of nominal GDP growth at 13-18%. During 1QFY26, the bank delivered 14% YoY growth in net advances, broadly in line with guidance, despite muted privatesector capex and softer demand in select consumption-driven sectors. The focus remains on granular lending, with retail, SME, and mid-market segments forming the core of incremental credit, although growth in 1QFY26 was primarily driven by the corporate sector. The bank is well-positioned to sustain double-digit credit growth, projected at a 16% CAGR over FY25-28.

Retail, MSME, and CVs to anchor next cycle of growth

* Retail lending, including mortgages and LAP, is expected to drive advances growth over FY25-27, supported by urban housing demand and increasing credit penetration among the self-employed. SME lending, which grew 18% YoY in 1Q, is expected to maintain a healthy momentum, with ~96% of the bank’s SME book secured. Credit cards are witnessing a rebuild after issuance commenced in Apr-25 after lifting of RBI ban with gradual market share recovery anticipated over the coming years. Tractor financing remains resilient, while CV volumes are expected to recover, supported by the recent GST rate cuts.

* KMB’s cautious stance in retail CVs ensures that losses are contained, allowing the portfolio to rebound with cyclical recovery. Together, these segments are expected to account for majority of the incremental loan growth and enable long-term market share gains.

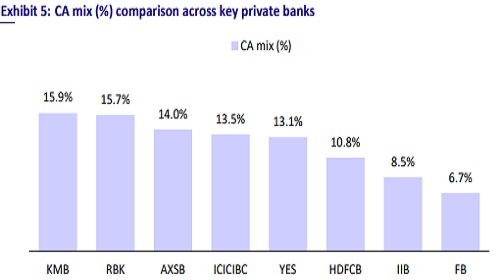

Stable CASA franchisee and sweep product to ease funding costs

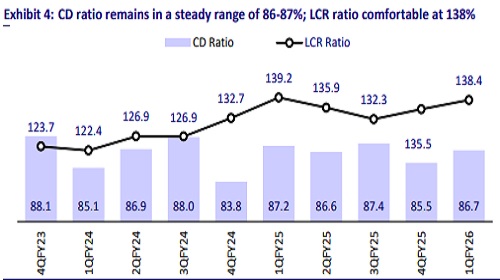

KMB’s liability franchise is expected to remain a key competitive advantage, with deposits projected to clock ~14.5% CAGR over FY25-28 and CASA ratio sustaining in the 42-43% range. The realignment of savings account rates to 2.5% is expected to materially reduce funding costs, with the average SA cost already declining to 3.3% in 1QFY26 from 4.1% a year ago. The ActivMoney sweep product, which grew 23% YoY in 1QFY26, is likely to expand further, enabling balance-sheet liquidity while preserving customer stickiness. TD grew 20% YoY, reflecting strong deposit mobilization despite declining rates. As the repricing benefit of lower SA rates flows through from 2QFY26 onwards, the bank expects a visible reduction in the cost of deposits, enabling resilience in the margin outlook, compared to the sharp 32bp margin decline to 4.65% seen in 1QFY26

Bank remains focused on enhancing digital prowess and deepening business granularity

Under the new leadership structure, the bank has placed strong emphasis on building and scaling up digital platforms, customer segmentation, and effective cost control. Operating leverage is improving, with branch expansion continuing at 150- 200 outlets annually without headcount growth, highlighting efficiency gains from increased digital adoption. Over FY26-28E, the bank will remain focused on scaling retail lending, increasing the share of fee income, and deepening liability granularity. This leadership-driven pivot positions KMB well to enhance returns structurally while sustaining prudence, reinforcing its medium-term aspiration of industryleading profitability with RoA consistently above 2%.

Acquisitions strengthen franchise; future to be driven by integration

KMB has strengthened its franchise through a series of selective acquisitions, each designed to add strategic depth rather than scale, positioning the bank for further growth, particularly as the operating environment improves in the coming quarters.

* The acquisition of ING Vysya Bank in FY16 was transformational, doubling the bank’s balance sheet and significantly expanding its branch network across southern India, thus laying the foundation for nationwide presence.

* The acquisition of BSS Microfinance in FY17 provided the bank with a platform to expand into microfinance, generating cumulative gains of ~INR30b over eight years despite recent stress from the credit cycle.

* The purchase of Standard Chartered’s personal loan and credit card portfolio has further strengthened the bank’s retail business and given access to highyielding unsecured customers.

Looking ahead, KMB’s strong capital position (CET-1 at 21.8%) provides the flexibility to keep pursuing inorganic expansion. However, the focus will remain on extracting synergies and improving profitability from acquired subsidiaries.

Asset quality to remain resilient as MFI stress subsides

Asset quality remains under control, with GNPA at 1.48% and NNPA at 0.34% as of Jun’25. Slippages stood elevated amid stress in MFI and retail CVs. However, the bank guided that MFI-related stress peaked in 1QFY26. Incremental vintages are exhibiting improved CE, and tighter underwriting standards in MFIs are expected to limit fresh stress. The SME portfolio is largely secured (96%), limiting downside risk, while retail credit card and personal loan delinquencies have stabilized after peaking in FY25. The bank continues to clean up legacy 811 accounts and is also working on introducing secured cards for 811 customers. With a healthy PCR of 77%, credit losses are expected to be cushioned. Looking ahead, asset quality metrics are expected to remain resilient, with GNPA maintained below 1.5% and credit costs trending down to 0.7% post-FY26, underpinning confidence in sustainable riskadjusted growth.

RoA well-positioned to sustain at above ~2%

KMB delivered RoA of ~2% and RoE of ~11% in 1QFY26, despite witnessing a sharp NIM contraction and elevated credit costs. Return ratios are expected to strengthen further as credit costs normalize and margins recover in 2H after a more modest decline in 2QFY26. Management’s medium-term aspiration remains to consistently maintain RoA above 2%. Key drivers include lower funding costs from SA repricing, fee income diversification from subsidiaries, and cost efficiencies from digital investments. As credit costs decline to ~50-70bp in FY27, RoE is expected to expand to mid-teens. The bank’s strong capital position provides ample capacity to fund growth without diluting returns. Its ability to combine retail-led growth, liability strength, and efficiency gains places it well to deliver industry-leading return ratios over the coming years.

Subsidiary remains a key contributor to overall franchise

KMB’s subsidiaries are evolving into a structural growth engine, expected to account for more than 30% of consolidated PAT by FY28 vs ~26% currently.

* Kotak AMC is well placed to capitalize on India’s financialization trend, with industry equity AAUM projected to clock a 15-18% CAGR.

* Kotak Securities, holding ~13% market share, benefits from record retail participation and rising derivative volumes, ensuring mid-teen earnings growth.

* Kotak Life Insurance is positioned for long-term compounding as insurance penetration (currently <4% of GDP) moves toward global averages, with protection and annuity products driving margins.

* Kotak Prime is expected to track vehicle and secured retail finance growth at a 12-14% CAGR.

Together, these subsidiaries provide annuity-style, fee-driven income and strengthen KMB’s positioning and premium valuations.

Valuation and view

* KMB reported a sharp 32bp QoQ contraction in NIM and elevated credit costs (93bp) in 1QFY26. However, we expect operating performance to recover in the coming quarters as SA/TD repricing takes effect and credit costs subside with a reduction in unsecured segment slippages.

* The bank is selectively rebuilding its credit card and PL portfolios, while retail, SME, and tractor portfolios continue to witness healthy growth, supporting a balanced mix. CASA remains healthy at ~41%, and sweep products are cushioning deposit cost pressures.

* Subsidiaries are emerging as a core strength, contributing 26% to PAT in 1Q, with the mix projected to increase to 30% by FY28, driven by growth in the AMC, Prime, and Insurance subsidiaries.

* We have upgraded KMB after being Neutral on the stock for almost five years in Jan’25 at INR1,759. While we estimate current year performance to remain modest we nevertheless estimate the bank to deliver 20% earnings cagr over FY26-28E. This in context to reasonable valuations will aid stock performance.

* We thus estimate KMB to deliver robust return ratios, with RoA/RoE at 2%/12.8% by FY27E. Retain BUY with TP of INR2,400 (2.4x FY27E ABV, including an SoTP of INR764 for subs).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412