Buy ACME Solar Holdings Ltd for the Target Rs. 347 by Motilal Oswal Financial Services Ltd

Strong execution and EBITDA upgrade drive positive view

* Multiple projects being commissioned contribute to building a strong execution track record: ACME Solar Holdings (Acme)’s operational capacity currently stands at 2.9GW vs. only 1.3GW at the time of IPO. Commissioning of the 1.6GW capacity over the past few quarters has demonstrated strong project management skills, boosted earnings and cash flow visibility, and eased investor concerns related to the execution of a robust 4GW project pipeline, in our opinion. Further, based on our estimates, the annualized EBITDA from the entire pipeline of 6.9GW will amount to ~INR81b postcommissioning. We are currently modeling 0.45GW/1.9GW/0.83GW of capacity to be commissioned in FY26/FY27/FY28. Overall, Acme has a total operational + under construction + pipeline of 6.9GW, which we expect to be commissioned by the end of FY29.

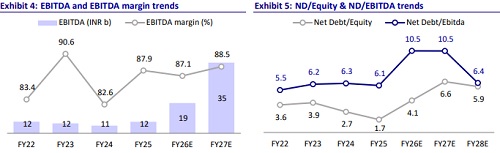

* Raise FY28E EBITDA by 7%; net debt estimate reduces amid lower capex: We cut our FY26E EPS by 8.5%, mainly as we adjust the commissioning timeline for the 350MW (300MW Sikar Solar project and 50MW Pokhran wind project) projects from 4QFY25 to late 1QFY26. However, our FY28 EBITDA estimates now increase by 7%, as we prepone commissioning of Sikar Solar (capacity: 300MW) to FY28 (FY29 earlier). We also reduce our overall capex estimates across the project pipeline following lower battery and solar module prices. This results in a downward revision of our FY27 net debt estimates to INR367b (vs. INR404b). Consequently, our ND/EBITDA estimate dips to 6.4x by FY28 (vs.

* 7.8x). Catalysts include the commissioning of new capacity and lower borrowing costs: Acme will commission 1.9GW capacity in FY27, which will be a key catalyst for the stock. Of the 450MW capacity to be commissioned in FY26, 78% is already commissioned. Further, with 70% of its gross debt on floating interest rates, we estimate a 25bp reduction in average interest cost adds 4% to our FY26E PAT (FY25 gross debt: INR104b). Commissioning of slated projects, lower borrowing costs, and new project wins remain key catalysts for the stock.

* Reasonable valuations and strong execution offer a margin of safety: We continue to value Acme at 10x FY28E EBITDA (discounted by one year) to arrive at our TP of INR347, implying 40% potential upside. In the last three months, Acme’s share price has outperformed its close competitor NTPC Green by 24%. While Acme has demonstrated commissioning of 1.6GW since IPO, NTPC Green has missed capacity addition targets, commissioning only 1.9GW (including a 50% share in Ayana acquisition of 2.1GW) vs. the guided commissioning target of 3GW in FY25. Acme is currently trading at 8.9x FY28 EV/EBITDA, which we believe offers a reasonable margin of safety given the aggressive PPA-backed capacity ramp-up and strong execution track record.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)